Managing the Christmas supply chain

Oct 13, 2014 • 14 min

In the United States the day after Thanksgiving is known as Black Friday. Originally it earned its name because of the disruption caused by the post holiday crowds. Lately, however, Black Friday earns its moniker because it’s the day when U.S. retailers supposedly hit profitability for the year. Falling as it does in late November it’s become the busiest shopping day in the American calendar.

Managing seasons and public holidays is a never-ending task for retailers. If there isn’t a public holiday then there will be a new season starting, or another one wrapping up with a sale.

Of all these special events, Christmas is undoubtedly the most important, and puts enormous pressure on supply chain managers to ensure products are available and that everything moves smoothly through the season. After all, it is the weeks just before Christmas that, in many retail sectors, determine a business’s financial health; John Lewis, for instance, reportedly generates 80% of its annual profits during Christmas period.

The challenges that retailers face during Christmas naturally vary according on the sector and from company to company. For many specialty retailers, having to cope with long lead times, Christmas challenges centre around estimating the season’s demand both well in advance and accurately; not an easy task. For grocers the problem is less about lead times and longterm forecasting but more the sheer volume of everything, which requires careful capacity planning and good execution. Lastly there are those retailers for whom Christmas is a nonevent – in fact, one that might even cause sales to drop as customers spend their pennies elsewhere.

Yet while plenty has been written about the Christmas retail season and pages are devoted to analysing Christmas successes and failures, there’s very little been published about the underlying supply chain challenges. So, to address this deficit, here is an overview of the Christmas-related hurdles that supply chains face, with some suggestions on how to tackle them.

Managing the Christmas Supply Chain

Supply chain problems are generally most readily solved one at a time, by continuous improvement of the process, and not by trying to fix everything at once.

Indeed, from a retailer’s point-of-view, Christmas is not so much an event but rather a process: as soon as New Year celebrations are over, it is time to start planning for the next Christmas: What to sell, where to source it, and how much and when to buy. These questions need to be answered long before Christmas; how long depends on the lead times of the products in question. Just before the season supply chain managers must ensure that products end up in shelves in time and in correct quantities. The actual length of the season again varies for different products and categories – many fresh food products will sell just a few days before Christmas, whereas other seasonal lines might have already peaked in early December. Toys, electronics, books, clothes, and other gifts are bought during the whole period, the highest demand probably registering about a week before Christmas.

The last task, where it can still all go wrong, is to ensure a successful Christmas ramp-down. In order to learn from both successes and problems it’s really useful for carry out a performance analysis after Christmas.

Before Christmas

Long-term Forecasting and Initial Purchases

In many specialty retail sectors – clothing and electronics for instance – goods are often sourced from the Far East with long lead times. This means that they need to be ordered way before there’s any actual Christmas sales data. There are even long-lead-time products in grocery; for example turkeys. Other products generally have rather short lead times – chocolate for instance – but as Christmas causes such an exceptional peak in demand, preorders made well in advance enable suppliers to plan their production. Sometimes there might be an opportunity to place some extra orders closer to or during the season.

Where products have a sales history and there are figures from previous Christmas seasons, it should be fairly straightforward to come up with reasonably accurate forecasts. In an efficient process these baseline forecasts are automatically calculated, and after that, specialists can adjust the forecasts based on their expertise and factors that are not present in the sales history – if adjustment is needed. Even where there are inaccuracies in store-level forecasts, the aggregated total forecast used as a basis for ordering will be much more accurate. Christmas really wouldn’t be that big a challenge if the seasonal product selection was the same every year. But innovation and change are vital aspects of retail – and so product life cycles tend to be short and suppliers introduce new products for every season.

So how does one create meaningful forecasts for new products when there is no sales history at all? One option is to use reference products as a basis for forecasting – a new product’s forecast would then be based on a similar product that has a sales history. This approach can be very effective but, if it is done manually, it takes a lot of time and effort and can only practically applied to the most important new products.

So when you are handling a large numbers of SKUs some automation is needed. For instance, references could be selected automatically based on defined rules, or forecasting could be based on product attributes such as colour, brand, size or genre. It also helps a lot if there is any sales history available prior to the season: That can be then used as a baseline, and the seasonal pattern can be adapted from items in the same product group.

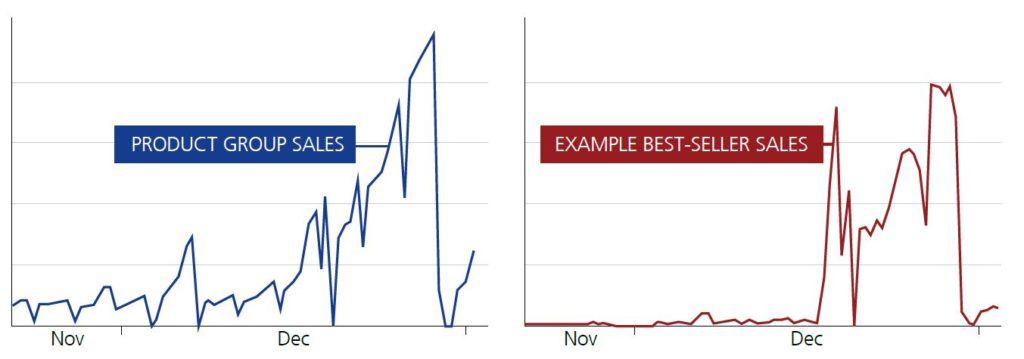

Example

For one of our clients, a book retailer, Christmas is a significant sales driver, accounting for 20% of annual revenue – rising to 50% in some product categories. To complicate things, most of its assortment changes from Christmas to Christmas, so there is no seasonal sales history to provide a forecasting baseline for the new items. The season is short and sales are highest during the days just before Christmas, so there is little latitude to organise replenishment around actual sales. Thus guaranteeing availability while avoiding excess stock after Christmas depends, crucially, on an accurate forecast.

To help our client we designed a special Christmas forecast model for them that predicts the demand for new products using product-group and store level patterns for reference. The model works well even where there is very little sales history, and the quality improves as more sales are recorded during the season. As a result, the retailer was able to improve their on-shelf availability from around 91% to over 98%.

Where purchasing must be done months before Christmas due to long lead times it’s often worth exploring whether there are alternative sources nearby. So where demand is uncertain the purchasing could be split so while the bulk of an order might come from low cost suppliers operating on long lead times, the rest could be held back and sourced locally at short notice, in response to actual demand. Of course the purchase price might well be substantially higher, but on the other hand, with real sales figures in and with forecasts now increasingly accurate, those additional buying costs are offset by being able to meet pre-Christmas demand with a greatly reduced risk of being left with dead stock.

Initial Allocations

Traditionally forecasting and pre-season ordering have been the responsibility of store staff. Usually in this scenario all the pre-ordered goods are delivered to stores before the season kicks off. The up-side is that stores tend to be more committed to selling out their stock as they’ve invested their reputation when they make forecasts and orders. However the quality of store-led orders is generally poor and variations between stores is huge.

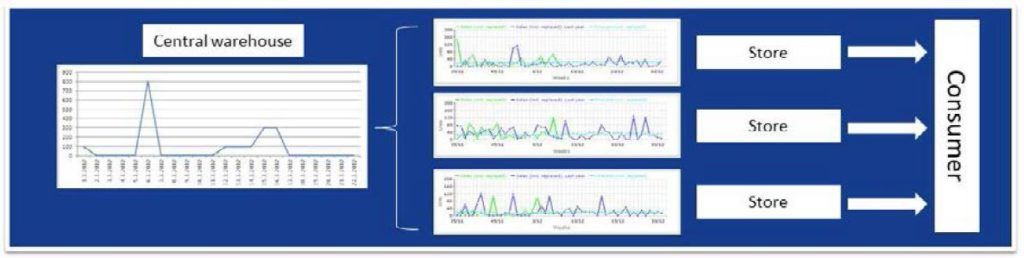

Centralising forecasting and ordering routinely yields far better results with much less effort: the quality of forecasts is better and much more consistent, being based on actual store level data. It also allows stores’ allocations to be done centrally and in a more structured way. For companies with an extended Christmas season, and where there is time to make further deliveries throughout, it makes sense to retain some stock at the distribution centre. Given that lines may sell better than expected at some stores, and less well at others, if you have shipped all your stock to stores before the season starts, reallocation involves moving goods between stores, which is costly and labour-intensive. Instead, by only allocating part of the stock at first (for instance sufficient just to cover the initial rush and to build displays) companies can then replenish stores from their central warehouse in response to actual sales. This allows buyers, planners and store managers to respond flexibly to changing conditions – the weather for example – and to react quickly to unexpected changes in market conditions.

Example

In the case of one RELEX client, their existing system made store staff responsible for pre-ordering Christmas goods several months in advance. We used a pilot implementation to showcase the impact of centralising Christmas pre-ordering based on a statistically calculated forecast. These centrally calculated pre-orders were then held in the distribution centre, and stores made their own replenishment orders, as per their normal routine, 48 hours before delivery. Afterwards we analysed the accuracy of these last-minute replenishment orders and compared them to the order forecasts calculated centrally months earlier. The central, statistically calculated forecast was considerably more accurate, resulting in less waste while maintaining the same or higher on-shelf availability.

During the Christmas Season

Inventory Management Based on Exception Alerts

So, your stock is in the stores and your Christmas season is about to start. What now? Should you, for instance, sit back and relax as Christmas draws ever closer? Well, if you’ve already shipped everything to your stores, and you haven’t established any channels for short-lead replenishment, there may not be much else that you can do. But preparing your supply chain to be reactive, or ideally to be proactive, during the season can make a big difference to the eventual outcome. In most categories, the start of the season should be fairly trouble-free, so even if your forecasts were not spot-on, you still have time to correct the situation. If sales exceed forecast, you can replenish from your DC or from a nearby supplier – and there is still time to put additional marketing in place to drive more sales. For some products and for some businesses offering small discounts early in the season might be a much better choice than a big discount just a couple of days before Christmas.

A successful Christmas sales season calls for a structured exception management process that ensures all important exceptions are picked up as early as possible and acted upon. Not only does this require good system support, but also well-organised process where exceptions are clearly defined, the responses they need are also clearly defined, and the number of exceptions is manageable. The answer is prioritisation. It is best to deal with the most important exceptions well than try to solve your many small problems and, as a result, not giving any of them the attention needed to tackle them properly. Where possible, exceptions that can be automated should be, so your team can focus on tasks where its expertise is really needed.

Capacity Management to Ensure Smooth Flow of Goods

Again, it would be nice and easy simply to replenish stores against forecast – just in time – but to complicate things, in many businesses and especially in urban areas, Christmas increases the total demand so much that it simply becomes impossible to plan store replenishment taking only the sales forecast into account. In high-volume businesses, such as grocery, companies must also take capacity constraints into account, and that means asking questions like:

- If we order and allocate goods according to plan, is there enough warehouse space for peak days or should we phase the orders from suppliers or replenishment deliveries to stores?

- Do we have enough transportation capacity or warehouse staff to match the delivery plan?

- Do we have enough resources in the stores to receive and shelve the delivered goods?

The differences don’t only show up week-to-week – there are also big day-to-day variations during each week. Peak shopping days in December, especially Fridays and Saturdays, are among the busiest days of the year for many retailers, and staff capacity to receive and shelve goods during those days is limited. Better to schedule deliveries for quieter times on quieter days so that staff can use their hours before 10 am, for instance, or on Mondays, for restocking. Ideally shipments would be spaced through the week ensuring adequate stock levels ahead of the busiest days – though other factors such as the short shelf life of some items complicates matters.

To manage this, store-level sales forecasts are not enough – the process needs to be refined further: Combining store-level sales forecasts with store delivery cycles, lead times and current inventory levels, it is possible to derive order and delivery forecasts, which can then be used as a basis for resource planning for both stores and warehouses, and for transportation capacity. Aggregating these store-level order forecasts also results in an accurate sales forecast for the warehouse, one that takes into account not only end-consumer demand but also the current store stock levels. Finally, factoring in order forecasts for the warehouse allows you to produce a storage capacity forecast for your warehouse, based on outgoing and incoming deliveries.

Being able to take these factors into account early, during the planning phase, and to be able to run and compare different what-if scenarios, can make a significant difference and prevent many last-minute problems.

Final Allocations Just Before the End of Season

Great! You’ve had a problem-free season. Well done! Time to wrap the presents, stock up on booze and prepare to put your feet up? Sorry. Before you can treat the Christmas season as done and dusted and prepare to celebrate Christmas yourself, you need to see through a successful ramp-down. A ramp-down is retail’s answer to a tightrope walk. On one side there’s the possibility of running out of stock early and losing sales at the busiest time of year, and on the other there’s excess stock which like a pumpkin at midnight transforms from profit generator to landfill fodder as the clock chimes for Christmas Day.

The first and perhaps the easiest step is to build in the responsiveness that I have set out above: Keeping an extra buffer in your distribution centre, rather than in your stores, allows you to allocate goods to those stores where they are most likely to sell right down to the last moment. On the one hand this avoids losing sales because some stores are out-of stock while on the other it minimises the need for mark-downs in those stores that are unable to sell those items.

It is also vital to understand when to stop replenishing stores. Though the rules of retail tell you that you need 100% on-shelf availability at all times, those rules can be broken common-sensically. As Christmas draws close customers grow increasingly tolerant of out of stocks. They may be cross that an item isn’t there, but by the afternoon of Christmas Eve most will blame themselves for leaving it too late rather than blaming the store for not maintaining high stock levels.

It’s OK to run out of some lines by December 23rd or 24th. Late in the day many customers will simply look for an alternative. By that point Christmas shopping becomes an exercise in buying people something rather than nothing. Likewise shelf displays that are running low with a day or two before Christmas don’t necessarily say ‘disorganised’, they equally say ‘popular; grab one while you can.’ Running out late on the 24th may well beat having a lot of excess after Christmas that is very hard to sell with a reasonable margin. So consider consciously driving down on-shelf availability just before Christmas, but do it carefully and be mindful of the trade-off between excess stock after Christmas and on-shelf availability just before Christmas – the relation of these two dictates the optimal availability target for the last day before Christmas.

Example

In book retailing, as in many other sectors, the season ends very abruptly: The highest-grossing days of the season are often followed by the leanest period of the whole year. Stock left in store to cover one peak day’s sales during Christmas season, might be sufficient to cover sales for the next eleven months or so. Jane Austen might sell as well in 2013 as she did in 1813 but Cheryl Cole’s autobiography will lose its appeal long before she develops wrinkles and retires to be with her cats. So it is crucial to ensure excess stock after Christmas is kept to a minimum. Don’t forget – once Christmas is done if you need more stock it’ll be easy to buy, quite possibly at a discount.

This particular RELEX book retail client has acknowledged this challenge and actively manages it. It continuously lowers safety stock levels during the season, only replenishing crucial items during the last two weeks. The aim is to reduce on-shelf availability to as low as 85% just before Christmas. The reasoning for this is – apart of the high inventory risk after Christmas – that when customers come to buy a book on 23rd of December, they are after a last-minute gift, and if the book they came for is out of stock, there is a good chance they will buy another book instead – after all they don’t actually have to read it themselves – so the likelihood of lost sales is lower than at other times of the year.

Pricing Management

Lastly you will almost inevitably have some excess stock. That raises the question of when and how much to discount. There are algorithms that help you decide the best time to discount and by how much. However, having good real-time visibility on stock levels and sales – and on the estimated supply of stock – will help you make those important decisions in good time. It is often better to offer a small discount early on that will drive up sales for the rest of the season rather than huge discounts at the last minute that will eat up all your margins.

After Christmas

Finally, Christmas is over. So what next? The usual way is to sell out the remaining seasonal stock, put Christmas behind you, and concentrate on the season ahead or other important projects. But when you eventually come to plan for the next Christmas, you risk having forgotten the problems of the previous one. The annual Christmas-overdose means that once the holiday is finished, no-one wants to think about it again until they have to, and the chance of learning important lessons is all too often missed.

Analysing Christmas Performance

The ultimate step in any continuous and successful Christmas process should be the evaluation stage. This means going through all the problems that cropped up, identifying the causes and understanding them, building a solution, documenting it for next Christmas, and most importantly, putting that solution into practice! Nor should you only focus on the big problems. A careful, structured analysis of the overall performance during the Christmas season should be carried out. You should be asking yourself: Were our forecasts accurate enough? Did we have good on-shelf availability throughout the whole period? Did we have to give ad-hoc discounts? Do we have a lot of excess stock? The list goes on. More importantly, the focus shouldn’t just be on overall KPIs but on the differentiators: Why did some stores do better than the others? Are there differences in performance between product groups? Did some suppliers perform better than others? Are there some other explanatory factors that could be taken into account in the future?

In fact, this kind of an analysis should be done after all major events. With good system support it really doesn’t take much time, as long as the questions are carefully defined. Understanding the reasons for problems, and also reasons for success, is key to improving the process in the future. And to be clear: Understanding the problems doesn’t improve anything, but coming up with good solutions and implementing those solutions does.