1. Grocery retail strategies fall flat if not backed by the right supply chains

Food retail is a challenging and turbulent market. The grocery supply chain has always been complex, but the current business transformation is more dramatic than anything we have seen in decades, especially considering the lasting impacts of the COVID-19 pandemic, weather and environmental disruptions, and economic challenges such as inflation. These supply chain issues and many others are in constant flux and significantly impact market trends.

Some of the trends that grocery retailers need to address simultaneously include:

- The ongoing evolution of online ordering and order fulfillment. From online ordering to home delivery and curbside pickup, the speed of omnichannel development has made operational efficiency particularly challenging for food retailers due to their mix of low-value products and high handling costs for fragile, variously sized products that often require temperature control. But while most grocery retailers offer online shopping in some form, many struggle to make the channel profitable.

- The power of operational efficiency and the rise of discounters. The 2008 financial crisis spawned a dramatic growth curve in discounters’ market share. Today, that growth continues, spurred on by inflation and geopolitical uncertainty. This shift to discount proves shoppers appreciate low-cost private-label products and well-curated assortments, even at the expense of abundant choice. Cost control always provides a competitive advantage, especially when consumers hesitate to spend. So, streamlining operations to improve efficiency must be crucial to every grocery retailer’s strategy in the future.

- Increased competition from delivery and meal kit services. Meal delivery services – kits and prepared – and food-to-go apps are capturing an increasing share of consumers’ wallets. As a result, food retailers are developing new approaches to prepared foods, high-value food-to-go, and even meal kits that can be picked up in-store or delivered to improve margins in a demanding environment. With poor execution, though, these initiatives also introduce new opportunities to lose money on costly food waste.

- Continuing challenges in managing fresh and short-shelf life products. Healthy eating trends have discounters like Aldi and Lidl improving their fresh offerings, including organic meats and freshly baked bread. In their pursuit of growth, these former hard discounters are stepping away from their highly efficient comfort zones previously built on simplicity, standardization, and large volumes. The increasing complexity will test their grocery supply chains as they experiment with fresher products, smaller store formats, and localized assortments.

- The growth of consumers’ environmental concerns. As consumers push their personal sustainability efforts, they also expect their grocers to increase their sustainable practices. Many leading retailers have committed to lowering carbon emissions, but sustainability is moving from “positive messaging” to table stakes. Retailers who fail to take meaningful action to reduce grocery store food waste and emissions put their reputations at risk. The good news is that sustainability, efficiency, and profitability often go hand in hand.

While these trends present challenges and opportunities, it’s clear that supply chain management will lie at the heart of the successes and failures we see in grocery retail’s future. Food retailers must make tough choices today about where to place their business bets moving forward. Whichever strategy a retailer chooses, they have a slim chance of success if they don’t develop their grocery supply chain to match it.

Successful food retailers must master both the hard discounters’ lean, highly efficient grocery supply chains and the agile, responsive supply chains required for fresh products. In addition, many will need to manage the complexity of operating multiple store formats while offering several fulfillment options.

To achieve this, retailers need the right planning tools at their disposal. Furthermore, they need to understand how to apply them.

- Fresh products typically have a high risk of markdowns and waste, making it very important to forecast demand accurately and synchronize replenishment. For fresh products, the planning process must be granular enough to capture even the smallest changes in demand, and the supply chain must be agile enough to adapt to variations in demand.

- Center-store and other longer-shelf life products require efficient goods handling and optimization of inventory flow. Though accurate forecasting remains essential, replenishment for long-shelf life products does not need to be precisely in sync with demand at any given moment, allowing the inventory flow through the supply chain to be leveled for the most efficient capacity utilization. Setting up store deliveries to allow for one-touch replenishment or “truck-to-shelf” delivery is essential for increased profitability.

- Omnichannel has grown to a point where retailers can no longer operate it as an add-on service exempt from standard efficiency requirements. Online fulfillment accentuates the need for high quality and freshness because end-consumers can’t evaluate products themselves. Furthermore, with many grocers taking significant losses on online orders, the continued growth of omnichannel highlights the need for substantial improvements to operational efficiency.

This best practice guide will highlight critical approaches for increasing responsiveness and efficiency in grocery supply chains. You will be hard-pressed to find a single retailer employing all these best practices. Instead, we encourage you to prioritize the most feasible and impactful development areas from your own perspective.

2. Harness the power of AI to optimize your grocery supply chain

Today’s grocers collect massive amounts of data on transactions and interactions with consumers online and offline. AI and machine learning capabilities can leverage that data to drive faster, more accurate decisions – making AI-enabled solutions a perfect match for grocery. High levels of speed and accuracy are invaluable in an industry where retailers must control millions of goods flows and accurately match supply to demand at hundreds or even thousands of locations daily.

Technology companies can be eager to position their AI algorithms as “intelligent” by making them as human as possible—even giving them human names like Siri, Alexa, Einstein, or Watson. Keep in mind, though, that AI is not a person. AI is not even a singular “it.”

The world is still far from general artificial intelligence that could creatively solve ill-defined problems. However, companies are making significant progress in the development of specialized AI that solves well-defined problems, such as algorithms for image recognition and text generation, and combinations of several types of specialized AI, as used for self-driving cars.

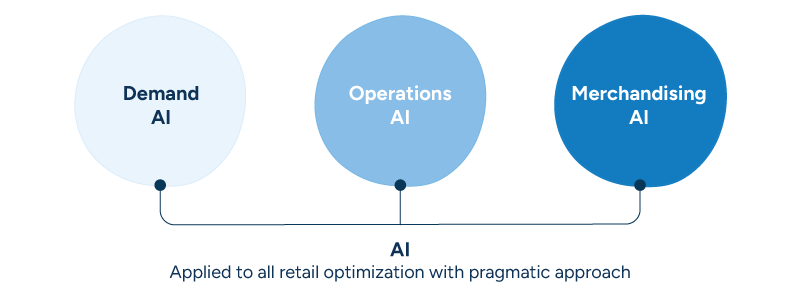

Retailers do not need “AI”—they need to employ several AI algorithms in their analytics toolbox to supplement old-hat technologies like statistical analysis and rules-based heuristics. Machine learning algorithms, for example, consider hundreds of potential demand-influencing factors when forecasting retail sales, something a human demand planner could never achieve.

The application of AI in grocery retail is not limited to demand forecasting. Retailers can reap even more significant benefits by leveraging AI to optimize the full range of their operations – from order optimization to workforce optimization and optimized markdowns.

3. Demand forecasting is the engine running your grocery supply chain

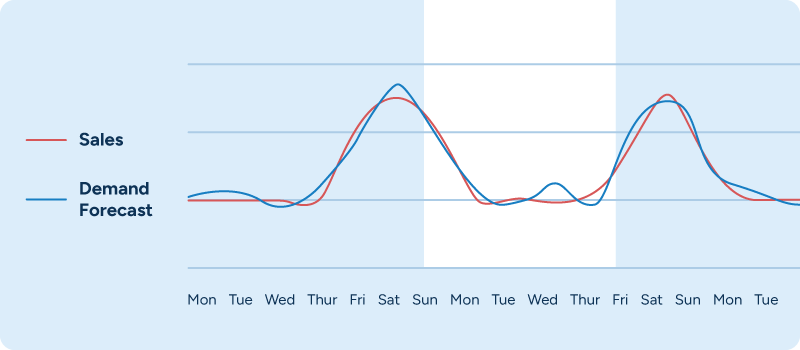

Demand forecasting is the central force driving the grocery supply chain. Yet, despite the technology available, many notable grocery retailers have not truly embarked on their journey of data-driven forecasting.

3.1. Granular forecasting is not just a best practice — it’s a must-have in today’s grocery retail

To meet the speed of the market, grocers need to be able to forecast on the day-SKU-store level (SKU = stock-keeping unit). Further, they must be able to separately forecast online orders picked in their stores, mitigating issues such as out-of-stocks for in-store shoppers and capacity issues while managing multi-channel inventory.

Without detailed forecasts, it’s impossible to correctly position inventory in the supply chain to maximize sales and minimize waste. Granular forecasts are also the planning foundation for resource and capacity management and, thus, should be considered a prerequisite for profitable operations.

3.2. Machine learning delivers high value in grocery demand forecasting

Machine learning enables a forecasting system to learn automatically and improve its predictions using data alone, with no additional programming needed. Because retailers generate enormous amounts of data, machine learning technology quickly proves its value.

Of course, machine learning algorithms are not new—they’ve been around for decades. But never have they been able to access as much data or data-processing power as is available today. Though grocery retailers may have struggled to update their forecasts quickly in the past, large-scale data processing and in-memory technology now enable millions of forecast calculations within the space of a single minute.

However, how machine learning is implemented does make a difference. Although grocery retailers can collect massive amounts of data, their data is often quite limited at the store and SKU levels. Slow-moving products may not provide enough data to study; master data on past promotions and product displays may be lacking; and, as products move in and out of range, data may not be available for the exact SKU the system is attempting to forecast. Machine learning forecasting must be set up correctly to make it less vulnerable to data issues (the “garbage in, garbage out” scenario).

Implemented correctly, machine learning effectively addresses common challenges with retail data to deliver benefits across all facets of grocery demand forecasting.

Machine learning delivers only equivalent or slightly better accuracy than traditional time series-based demand forecasting in simple scenarios like forecasting a predictably recurring demand variation. However, machine learning-based forecasting outperforms traditional approaches when dealing with complex situations, such as overlapping promotions or sales cannibalization.

3.3. Typical demand forecasting challenges for supermarkets, discounters, and convenience stores

Next, we will discuss how to overcome some typical forecasting challenges that supermarkets, discounters, and convenience stores face.

3.3.1. Predicting demand for new products and stores

Because machine learning relies on finding patterns in historical sales data, new products (which lack that data) can prove challenging. Fortunately, other routines are available to improve the management of new product introductions.

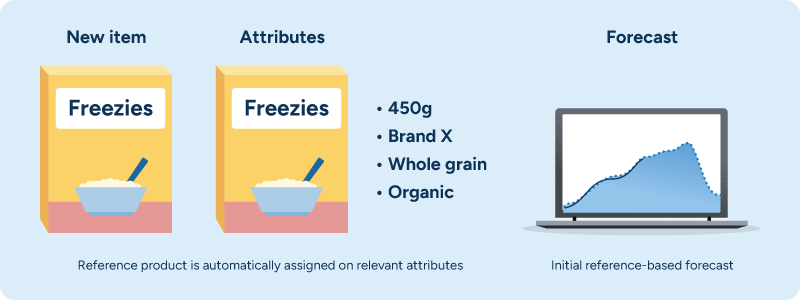

When introducing a new product, the most common approach is to assign a reference product to use as a blueprint for its sales pattern until the new product has accumulated sufficient historical data. However, in grocery retail, the number of new products per year can be massive, making manually identifying and setting reference products infeasible—or at least highly inefficient.

It’s far more efficient to use a system that automatically compares product attributes such as product group, brand, pack size, color, or price point to assign the most relevant reference product. The same approach can be applied to finding suitable reference stores for new store openings.

For example, a reference for a new product in the cereal category can be found by looking for products with the same brand, package size, and differentiating features, such as organic and whole grain.

3.3.2. Forecasting the impact of promotions and price & display changes

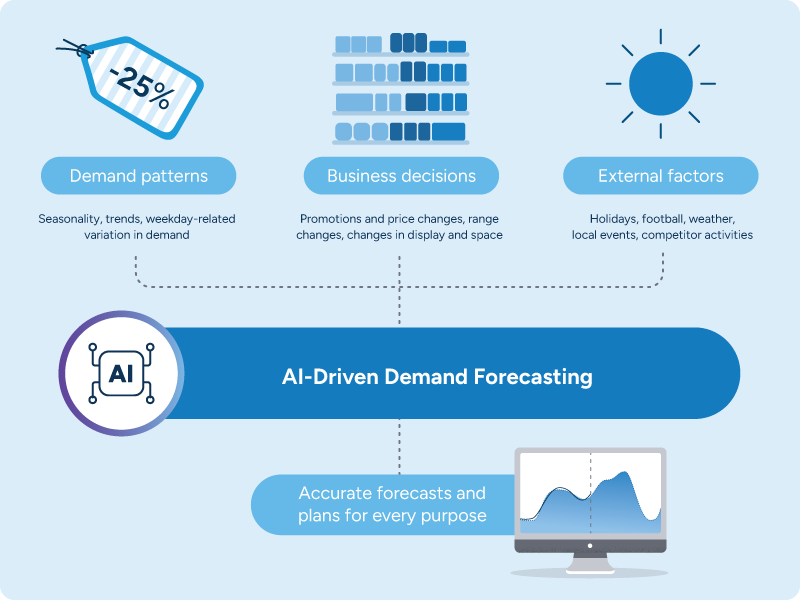

Your business decisions as a retailer are also an important source of demand variation, from promotions and price changes to how products are displayed throughout your stores. Even though retailers plan and control these changes, many in the grocery industry remain incapable of accurately predicting their impact.

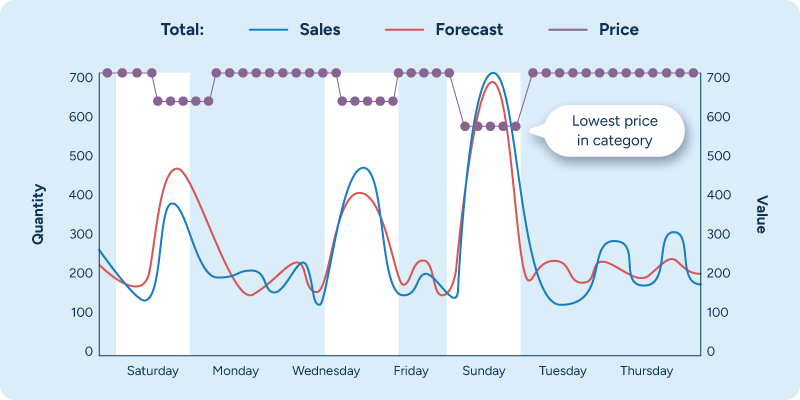

Machine learning allows retailers to accurately model a product’s price elasticity, or how strongly a price change will affect that product’s demand. Price elasticity alone, however, does not capture the full impact of a price change.

A product’s pricing in relation to other products in its category often also has a significant impact. In many categories, the product with the lowest price captures a disproportionally large share of demand. Machine learning-based demand forecasting makes considering a product’s price position straightforward.

Machine learning does more than simply leverage price data, however. With machine learning forecasting, grocery retailers can accurately predict the impact of promotions by taking into consideration factors including, but by no means limited to:

- Promotion types, such as price reduction or multi-buy.

- Marketing activities, such as circular ads or in-store signage.

- Products’ price reductions.

- In-store displays, such as an endcap or table.

3.3.3. Considering cannibalization and halo effects in forecasting

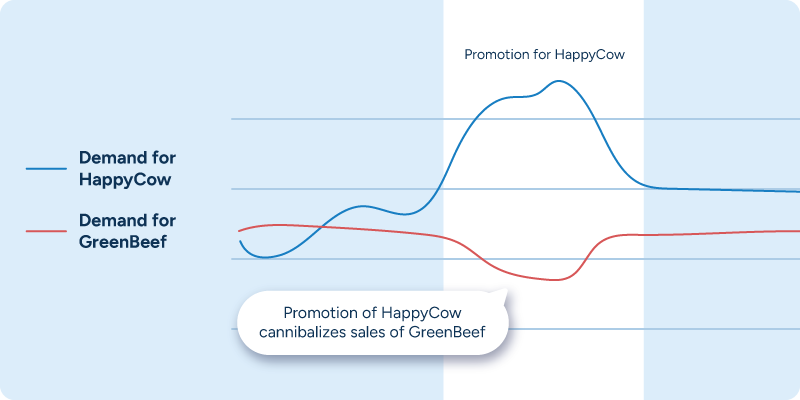

It’s common for a promotional uplift for one product to drive down sales for another. For example, suppose a supermarket carrying both the “HappyCow” and “Green Beef” brands of lean organic ground beef puts HappyCow on promotion. In that case, some of the baseline demand for GreenBeef will likely shift away. If planners don’t lower the demand forecast for the GreenBeef product, there will be a high risk of overstocking, leading to waste.

If demand decreases temporarily for ambient or center-store products, such as canned food or cereal, a replenishment order for the cannibalized product will be triggered later than usual. However, when it comes to fresh products, especially products with a limited number of direct substitutes, forecasts must also consider the impact of cannibalization to avoid excess stock and spoilage.

Manually adjusting the forecasts for all potentially cannibalized items is not feasible because the number of products to adjust is too large, and demand tends to be specific to individual stores’ assortments and shopping patterns. Machine learning algorithms can automatically identify patterns and adjust forecasts accordingly, which adds enormous value when addressing sales cannibalization.

The flip side of cannibalization, of course, is the halo effect — or when promoting the HappyCow product also drives sales for related products such as hamburger buns. Unfortunately, the halo effect’s impact can be so diffused across the assortment that identifying every product impacted by a given promotion becomes challenging, even with machine learning. But even if forecasting systems can’t identify all possible halo relationships, they should still make it easy for planners to adjust forecasts for the relationships they know to exist.

3.3.4. Estimating the impact of weather and other external factors on demand

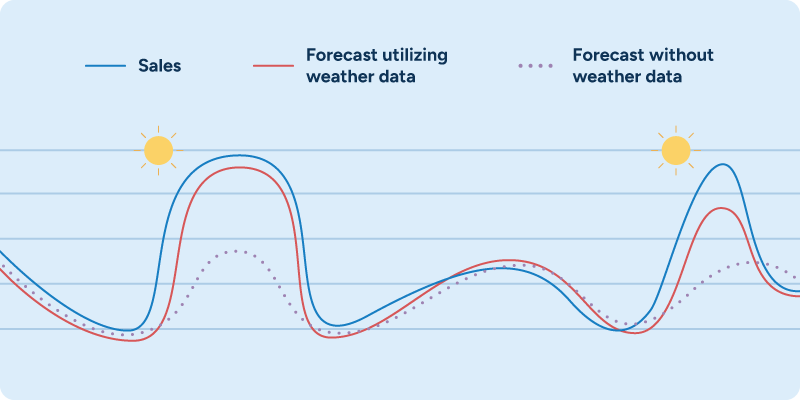

External factors such as the weather, local events, and competitor price changes can significantly impact demand.

Using local weather data and forecasts to increase demand forecast accuracy is a great example of machine learning’s power. Machine learning algorithms can automatically detect the relationship between local weather variables and sales for individual products in individual stores.

Machine learning algorithms can be used in this same way to take advantage of a wide range of data sources such as:

- Variable but recurring periods, including school holidays and heavy travel days.

- Past and future local events such as football games or concerts.

- Changes in competitor prices.

3.3.5. Dealing with unexpected changes in demand

In brick-and-mortar retail, local circumstances, such as a competitor opening or closing a nearby store, may cause a change in demand. Unfortunately, data on the factor driving this change may not be recorded in any system. Sometimes, retailers’ internal decisions, such as adding a product to a special off-shelf display area, go unrecorded.

Fortunately, machine learning can help in these situations. Machine learning algorithms can tentatively place what is known as a change point in the forecasting model. They then track subsequent data to either disprove or validate the hypothesis, allowing forecasts to adapt quickly and automatically to new demand levels.

Consider, for example, the sales impact when store staff creates a table display in addition to the regular shelf space for a product. The step changes in demand for this product—first up and then back down—result from the product getting an additional off-shelf table display in the store. Although this additional display was not recorded in the store’s master data, the machine learning algorithm could still consider the step change with minimal delay.

3.3.6. Incorporating planner expertise in demand forecasting

If you want to remain competitive in food retail, machine learning is something you must adopt, but you also need to understand its limitations. Automating most of your demand forecasting isn’t just desirable—it’s quite feasible. However, no matter how advanced, no demand planning solution can completely escape forecasting errors.

That’s why it’s so crucial that the experts on retail demand planning teams fully understand forecast errors. If the system they use provides transparency into how it forms the forecast, retail experts can quickly understand and correct any errors they see in it.

Too many retailers rely on so-called black box forecasting systems that can take in all sorts of data to produce accurate forecasts but lack transparency. Black box systems may reduce planning efficiency for several reasons:

Occasional extreme forecast errors can inflict far more damage on performance than minor, frequent errors. Consider driving on an uneven, bumpy road. Regular, small bumps can be managed with care, but a deep pothole will cause significant damage to the vehicle if you don’t see it coming.

When demand planners can’t make sense of forecast errors, their confidence in all forecast calculations erodes, leading to increased time spent on double-checking and manual forecasting, undercutting the purpose of automation.

That’s why best-practice retailers understand the value of transparency. Even when the system does the heavy lifting, human planners must always be able to both understand and control how their forecasts are generated.

4. Refine grocery replenishment for improved availability, waste, and efficiency

The quality of a grocery retailer’s store replenishment process directly impacts its top-line revenue and bottom-line profits. High-quality, forecast-driven grocery store replenishment consistently translates into the following benefits:

- Increased revenue from better on-shelf availability boosting sales by up to several percent.

- Up to 40% lower markdown and spoilage costs as supply more accurately matches demand.

- Optimized inventory flows, enabling up to a 30% reduction in goods handling costs in distribution centers and stores.

- Much more efficient capacity utilization in transportation, storage, and manual work phases throughout the supply chain.

4.1. Fresh food replenishment requires detailed planning and execution

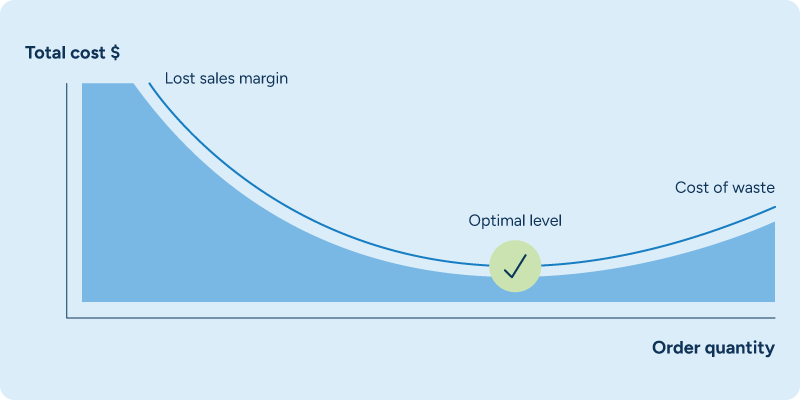

Well-managed store replenishment is central to finding the optimal balance between the risk of lost sales margins caused by stock-outs and the risk of waste or markdowns eating already slim margins.

Even though traditional supermarkets have decades of experience dealing with fresh products, many still do not excel in this area. Their supply chains are reactive enough to support frequent deliveries, but their replenishment planning is not up to scratch.

According to North American grocers, the annual value of spoilage averages more than $70 million and can reach several hundred million dollars annually for the largest companies offering a wide range of fresh products. A 10-40% reduction would translate into somewhere between $7–28 million in annual savings. This is feasible and something that modern food retailers should be expected to do to reduce their carbon footprints and make their businesses more sustainable.

4.1.1. Balancing waste and lost sales

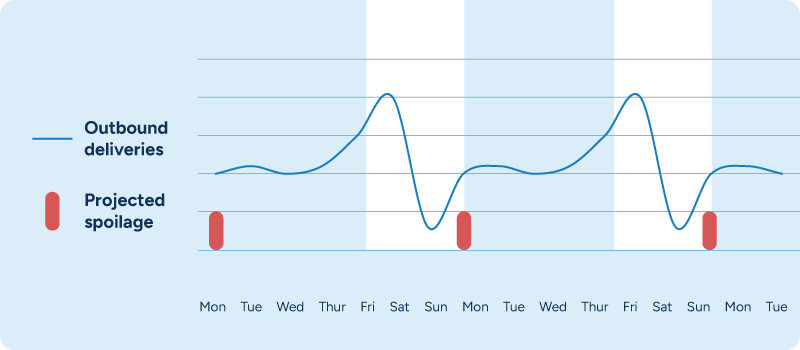

For ultra-fresh products, 100% on-shelf availability means there will always be waste or markdowns unless the forecast is consistently flawless on the day, store, and product level. This means that very granular control is needed to find the optimal balance between the risk of stock-outs and the risk of waste.

Demand for a product in a specific store typically varies between different weekdays. For some stores and products, weekday variation in fresh replenishment can be very dramatic. This means that when dealing with short-shelf life products, the same safety stock does not fit all weekdays.

Roast beef, for example, tends to sell a lot more leading into the weekend than coming out of it. For roast beef – even when the day-level forecast is accurate – a static safety stock level leads to:

- Excess inventory after the weekend, with an increased risk of waste.

- Perilously low safety stocks during the weekend, with an increased risk of stock outs.

To find the right balance between the risk of waste and the risk of stock-outs, safety stocks need to move up and down in step with the expected sales volumes and forecast errors for the different weekdays.

The best retail planning systems not only enable dynamic safety stocks but also optimize each order based on cost-benefit calculations. This balances the risk of waste against that of out-of-stocks to minimize the total lost sales margin and cost of waste.

The cost function needs to be adjustable in terms of how much weight it places on on-shelf availability vs. waste. This allows for the consideration of strategic roles of critical categories and items as well as whether there are opportunities for substitution within the product category.

When managing store replenishment of fresh products, it is essential that all calculations and optimizations are automated. It is an impossible task for any human to keep track of all factors influencing demand (weekday variation, seasons, weather, and promotions), as well as all factors influencing replenishment (delivery schedules, batch sizes, and day-level probabilities of waste and stock-outs) for hundreds or thousands of items per day in one store — let alone hundreds of stores.

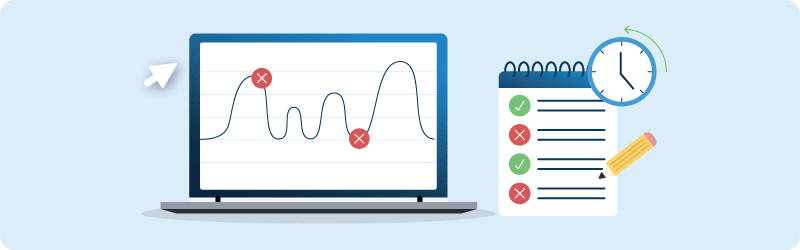

However, it is equally vital that the forecasting and replenishment system does not turn into a black box. Actionable analytics allow supply planners to quickly detect and remedy exceptions such as historical or projected waste or poor availability.

Examples of typical exceptions in fresh food replenishment include:

- When order batches are too large for a store’s demand, each delivery of that product will result in waste. Planners must be able to determine whether this is a problem in just a few or many stores and whether the problem can be mitigated by directing replenishment to specific weekdays.

- When too much space is allocated to meet visual minimums despite store demand, excess stock drives waste. Supply planners must be able to identify whether the problem is isolated to a few low-demand stores or whether there is a more widespread problem with the planograms in use.

- When systematic patterns of poor performance lead to low availability or high waste on specific weekdays. Planners need to understand the root cause of the problem, such as store personnel not checking sell-by dates and reporting waste to be accounted for in replenishment plans.

Automation radically reduces the time spent on routine tasks in store replenishment planning. At the same time, it multiplies the impact of your most knowledgeable process experts. When store replenishment is automated and planning centralized, planning experts can make a visible difference in hundreds of stores almost immediately, simply by fine-tuning replenishment settings.

4.1.2. Stores have turned into kitchens

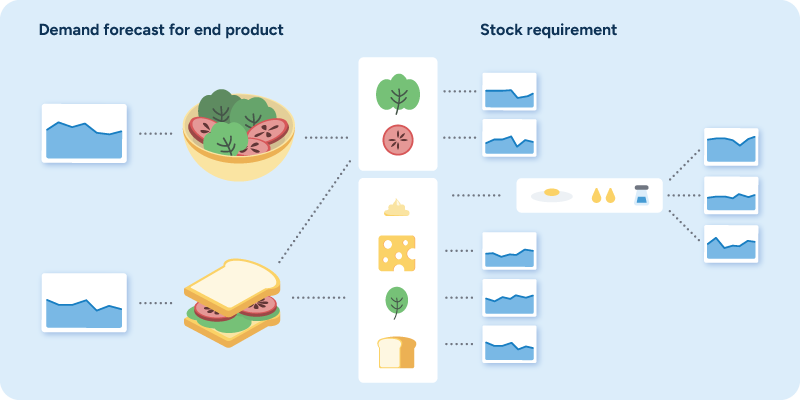

With consumers increasingly seeking convenience, food-to-go and meal solutions are becoming increasingly popular. While many grocery retailers have offered prepared meals for decades, the concept of in-store kitchens that prepare ready-to-eat meals, sandwiches, baked goods, and more has grown dramatically. Consequently, the importance of on-site production has grown much more pronounced and is critical to food retailers’ profitability.

Replenishing ready-made meals is not all that different from replenishing other products sold in the store. It is, however, a bit more complicated. Demand for the end products—the meals—needs to be broken down into the ingredients used to manufacture those end products. The replenishment calculations must be done for each ingredient, accounting for lead times and on-hand stock.

Essentially, the process is as follows:

- Forecast demand for the end product (meal).

- Translate forecasted demand for the end products into demand for the ingredients needed to manufacture the end product. This process requires knowing the recipe (sometimes also called the bill of materials, a term borrowed from the manufacturing industry) as well as the yields of the different ingredients. For example, if one sandwich requires 1.3 oz of lettuce, the calculations may need to be done according to 1.7 oz per sandwich to account for a part of the lettuce that is anticipated to be unusable.

- Calculate the estimated demand for each ingredient. The total demand for an ingredient often accounts for its use in several end products.

- Calculate the required replenishment quantity of each ingredient based on lead time, available stock, potential incoming orders, estimated demand, and target safety stock.

Sometimes, the ingredients in a recipe are composed of other components, such as special mayo or mustard produced on-site. In those cases, similar calculations must be conducted for multiple levels of recipes. At speed, that level of multi-layer analysis would be impossible for any human but quite manageable for a modern, optimized replenishment system.

4.1.3. High-frequency replenishment for ultra-fresh products

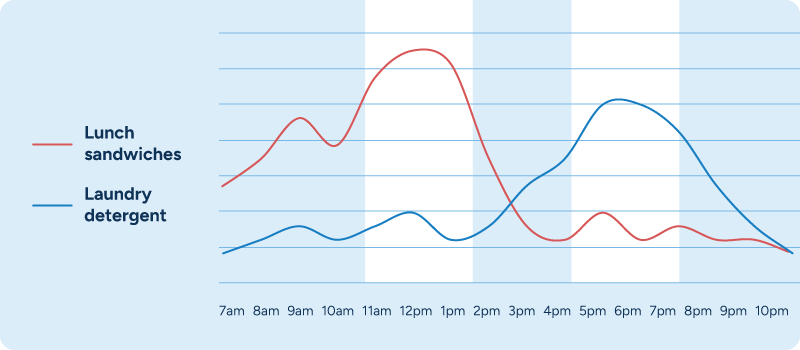

Many retailers have chosen to deliver ultra-fresh products to stores multiple times per day to guarantee freshness. Similarly, items produced on-site are typically prepared in several batches during the day, especially in the growing category of in-store bakery products. In addition, there is a trend of food retailers opening small stores in urban locations, and those stores require several replenishments per day due to a lack of in-store storage space.

Placing more orders per day or designing the optimal bake plan per day requires factoring in both weekday-related and within-the-day variations in demand. For some products, such as laundry detergent, intraday demand follows a general customer footfall pattern. For other products, such as lunch items, demand is more influenced by how the consumer plans to consume them.

Again, keeping track of both weekday and intraday demand patterns manually is quite a complex and error-prone process. Yet, many retailers still rely on their store associates to figure this out on their own. This is a high-stakes gamble, as ultra-fresh products inevitably have a big impact on how consumers judge the quality of all fresh products in a store.

Best-in-class retail planning systems can figure out the optimal split between multiple orders or production batches per day and automatically adjust the quantities as needed.

4.1.4. Adding science to the art of managing fruits and vegetables

Fruits and vegetables are often last in line when store ordering is automated. Produce faces the same shelf life and variable demand challenges as other fresh product categories. However, varying supply and product quality require additional flexibility from the planning system.

The regions from which fruits and vegetables are sourced constantly change as crops are harvested in different parts of the world at different times. Even growers in the same region may time their crops slightly differently. Furthermore, as there is always some uncertainty in the availability of quality products, food retailers need to maintain several vendors for the same product.

From a consumer perspective, a lemon is a lemon, but the supply chain may need to deal with tens of different product codes for lemons, each associated with a different vendor. Effective management of fruits and vegetables requires the planning system to be able to switch seamlessly between planning levels as needed:

1. Demand forecasting needs to be conducted at the product level. For example, “domestic organic lemon” uses historical sales data for all domestic organic lemons, regardless of supplier.

2. Replenishment quantity must also be determined based on the available inventory of domestic organic lemons and their forecasted demand.

3. The replenishment order is where the planning system needs to move from the product level to the SKU level—from “domestic organic lemon” to “domestic organic lemon supplied by GreenGrowers.”

4. Orders will often need to be split between several vendors, and the planning system must allocate the order accordingly, such as “65% to GreenGrowers and 35% to OrganicFarmers.”

The forecasting and replenishment process for fruits and vegetables is highly laborious to manage manually but can be effectively automated. The critical prerequisite is clear guidelines for which products will be included in the stores’ assortments and which vendors will be used for sourcing at any given time. As in any automation process, high-quality master data is essential.

4.2. Optimized center-store replenishment is key to supply chain efficiency

Fresh products need to be delivered to stores in perfect sync with demand. On the other hand, center-store products and other products with longer shelf lives offer more opportunities for an optimized flow of inventory in the supply chain. To lower costs in stores and throughout the grocery supply chain, it is vital to optimize the replenishment of center-store products.

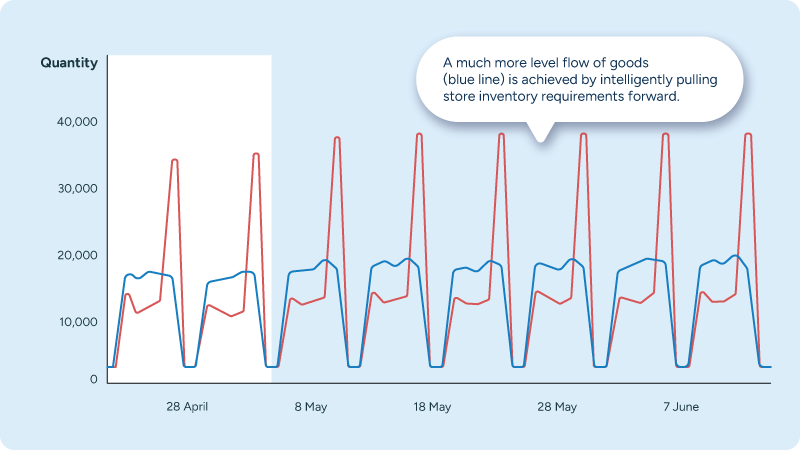

Retailers who have mastered replenishing non-perishable products benefit from a much more level flow of goods through their distribution centers, enabling a much quicker return on any investment in warehouse automation and reducing the risk of capacity bottlenecks harming on-shelf availability. Furthermore, as grocery retailers’ store staff spend a lot of time and effort shelving products, optimized replenishment helps retailers reduce operational costs.

4.2.1. Synching replenishment and shelf space for cost-efficient operations

Grocery retailers have traditionally operated in a very siloed manner with very little communication between the merchandising teams responsible for store planograms, the supply chain teams responsible for store replenishment, and the store operations teams responsible for in-store work processes. This must change.

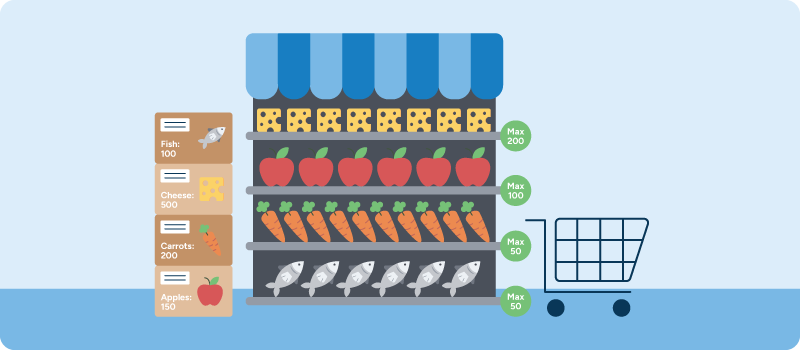

The space allocated to each product in a store has a significant impact on both the results and costs of the store replenishment process:

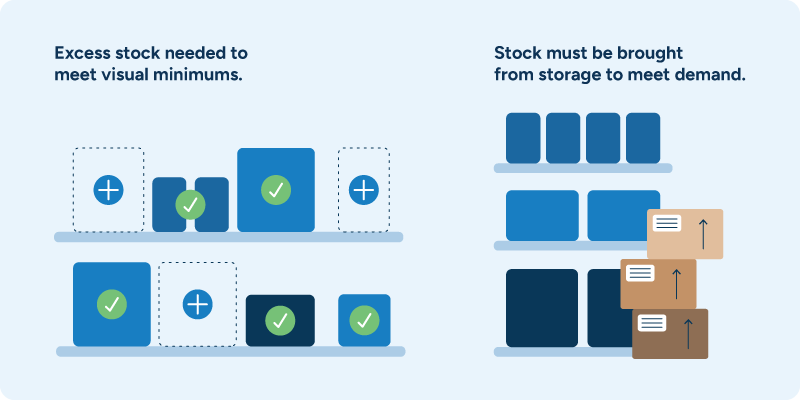

- If the allocated space is very large compared to demand, the inventory needed to ensure optimal on-shelf availability will not be sufficient to maintain a visually appealing, full display. For that purpose, additional visual minimums need to be defined. Visual minimums indicate how many units of a product need to be on the shelf to ensure the display is visually appealing. For slow sellers, the visual minimums will always be higher than the inventory levels required for necessary on-shelf availability. For long-shelf life products, this may not be a problem, but for fresh products, excessive visual minimums may cause unnecessary spoilage.

- If the allocated space is small compared to demand, incoming deliveries will not fit on the shelf, so at least part of the delivered quantity must be placed in a backroom or other storage area. The need for goods to be moved back and forth between the sales area and the backroom significantly increases the cost of shelf stocking. Further, using backroom storage substantially increases the risk of empty shelves, as timely replenishment from the backroom depends on the vigilance of store personnel.

Although surprisingly rare, complete integration between space and replenishment planning is an essential best practice for increased operational efficiency:

- Access to planogram data makes it easy to automate the maintenance of visual minimums on the product-store level based on the number of facings or total shelf space allocated to each product in each store.

- Access to planogram data makes it easy to automatically trim replenishment orders that would cause incoming deliveries to not fit on the shelf. Usually, this rule needs to be balanced with the risk of stock-outs if the space allocated to some products is very small in relation to their demand.

- Access to floor plan information enables assigning main replenishment days based on products’ locations in the store. Creating more focused deliveries minimizes the need for store personnel to unnecessarily move around the store when stocking shelves.

- Access to planogram information makes it possible to plan replenishment so that associates can fill shelves to the maximum each time a delivery comes in, minimizing shelving work in stores. Rather than getting two batches in one go, if there is space for a third one to be delivered next week, the order is calculated to fill the assigned shelf space upon arrival.

The space assigned to each product is vital to how efficiently the replenishment process can function, so delivering continuous feedback to merchandising is essential. Good analytics tools will help identify products and stores with a mismatch between space and sales, such as products and stores for which incoming deliveries do not fit directly on the shelves or those where visual minimums lead to waste or markdowns.

Ideal space planning is always based on detailed store-, product-, and day-level forecasts, as well as information on replenishment cycles and main replenishment days available from replenishment planning:

- Using accurate forecasts rather than looking at historical sales data when optimizing space allocation to products enables the space planning team to consider seasonality and trends quickly and easily.

- Basing shelf space on accurate forecasts of the expected maximum sales per delivery interval optimizes all products in a store on all weekdays. Such optimization makes it possible to attain fewer deliveries and direct-to-shelf flows for a much more significant proportion of the product range.

4.2.2. Smart replenishment for efficient store operations and more level goods flows

Typically, every large grocery retailer replenishes all or at least most of its stores from its distribution centers every day. This frequency is because fresh products demand frequent deliveries, and the overall inventory flows are substantial enough to warrant daily deliveries.

Using all replenishment opportunities for all product groups without discretion will result in two problems:

- Deliveries to stores will consist of a random mix of products from several categories displayed in different parts of the store. Store personnel will spend significant time moving roll cages around the store to stock shelves.

- Delivery volumes on different weekdays will not be roughly equal. Instead, they will reflect the daily variation in sales volume, often with significant delivery peaks towards the end of the week in anticipation of weekend demand. The resulting fluctuations in the capacity needs of distribution centers and stores will increase costs.

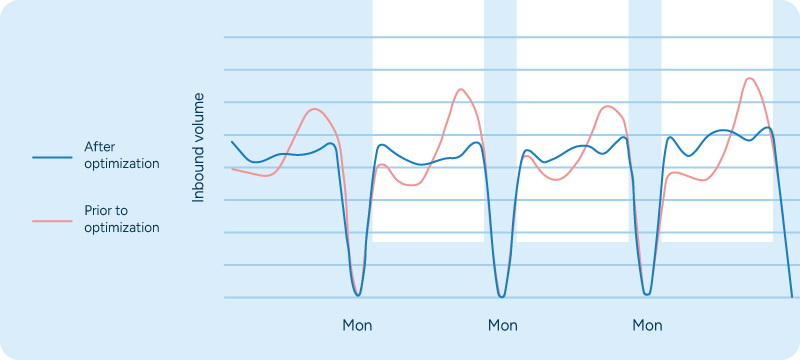

Instead of automatically using all available order or replenishment opportunities for all products, the best practice is to define main replenishment days for longer-shelf life products. To achieve this, the replenishment of some center-store product groups would be concentrated on specific weekdays instead of scattered throughout the week. Delivering goods on those specified days would form the basis for planning tasks like optimizing safety stocks and calculating order quantities. However, to ensure the highest possible availability, replenishment orders can also be triggered for the other available replenishment days to avoid stock-outs if there are unexpected demand peaks.

Main replenishment days allow for significantly more efficient in-store replenishment without hampering on-shelf availability. More consolidated deliveries make it more efficient for store personnel to replenish store shelves, especially when the main replenishment days are set based on product categories that share the same aisle or zone of a store.

As with many other processes, main replenishment days can be further optimized once the basics are in place. By using AI to optimize main replenishment days across the whole store, the inbound goods flow to a store can be leveled out across weekdays. In many stores, weekends can be hectic, with large numbers of customers doing their weekly shopping while large quantities of fresh products are being delivered. Assigning main replenishment days for center-store products to those with less in-store foot traffic balances the incoming goods flow and makes personnel planning in the stores easier.

4.2.3. Dynamic pack sizes to meet dynamic demand

One powerful method for increasing store replenishment efficiency is to optimize the use of different pack sizes. In many cases, stores can choose whether to order case packs, pallet layers, or full pallets from the distribution center. Larger batches are more efficient to handle both in stores and at the distribution centers, but the deliveries need to match the available space and demand in stores. Otherwise, inventory will pile up and reduce efficiency by congesting backrooms, causing multiple trips back and forth to the shop floor to replenish shelves.

Optimization of replenishment pack sizes per product and store directly impacts handling costs, especially for retailers who operate stores of different sizes. However, doing it only once as a concerted effort is not enough. Demand changes over time and, for some products, with the seasons. During the high season, a pallet might be most efficient, while smaller case packs may be more efficient outside the peak.

The retail planning system must be able to automatically optimize which pack size to use per product, store, and order. Whenever an order is placed, the system checks all available pack sizes—typically varying from the case pack to full pallets—and selects the most efficient pack size to meet forecasted demand.

Supplying warehouses need to be able to estimate demand for different pack sizes to attain a maximum efficiency gain. Otherwise, they may end up using individual packs to put together pallets for stores rather than having full pallets flow through the distribution system. This is possible when store projections used as the basis for distribution planning reflect the stores’ forecasted use of different pack sizes.

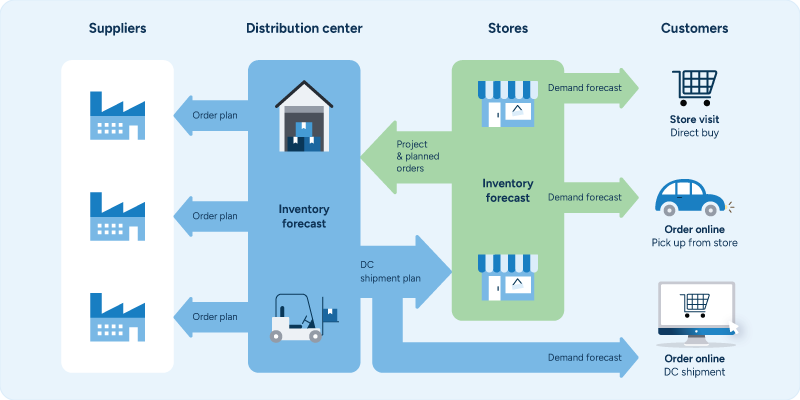

5. An integrated grocery supply chain driven by customer demand

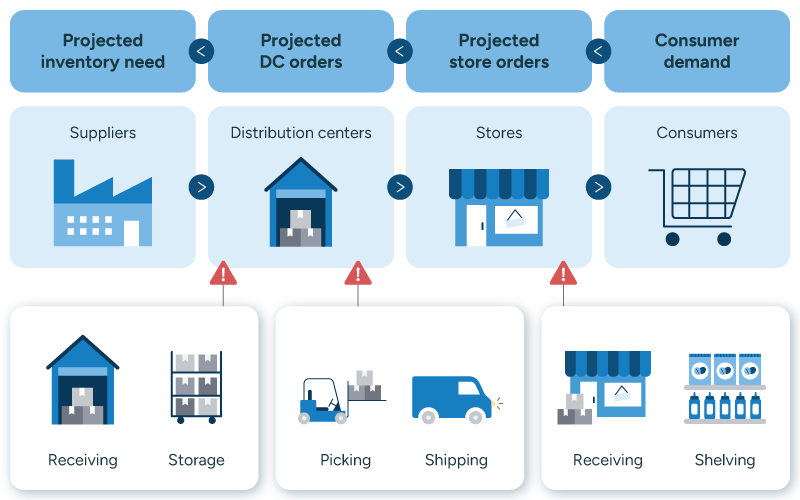

Traditionally, store replenishment and inventory management at regional distribution centers or central warehouses have been separate processes driven by separate demand forecasts.

A large number of grocery retailers still base their distribution center forecasts on historical data of outbound deliveries from those distribution centers, which is akin to driving a car while looking in the rearview mirror. Other grocers have adopted a more forward-looking approach, basing their distribution center forecasts on store demand forecasts. While this is a better approach than only looking at outbound deliveries, there are some significant disadvantages to using store demand forecasts to drive planning at the distribution centers:

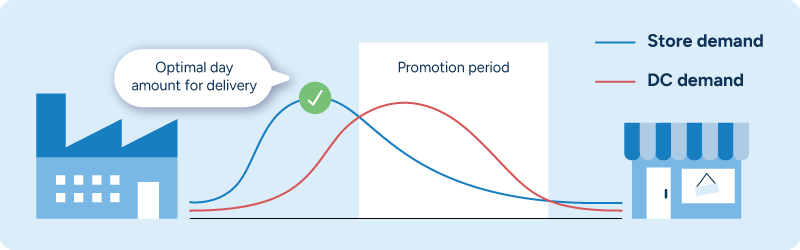

- Goods need to be delivered to the stores before the stores can sell them. The distribution center forecast needs to go up before the stores’ demand forecasts go up and vice versa. The difference in timing depends on the stores’ sell-through rates and replenishment schedules, which means that the difference in timing varies between stores, products, and sometimes weekdays. It is almost impossible to accurately account for the difference in timing, which is bad news for forecast accuracy at distribution centers.

- When goods are pushed rather than pulled through the supply chain, outbound delivery peaks at the distribution centers will not be visible in the stores’ demand forecasts. A typical example is promotions, where anything between 30% and 100% of the expected promotional uplift needs to be delivered to stores before the promotion starts. Thus, the promotion causes a much bigger demand peak at the distribution center than in the stores. This peak is fully controlled by the retailer itself but still requires a lot of manual planning work or “guesstimations,” whereby the supply planners at the distribution center will try to anticipate when and in which quantities stores will take in the promoted products.

It is quite ironic that many situations considered most difficult to tackle in the distribution centers, such as building up stock in stores for promotions or new product introductions, are in the hands of the retailers themselves.

The best practice is to base distribution center forecasting on the stores’ projected orders, which reflect both pull-based demand and planned, push-based stock movements.

To achieve seamless integration of store and distribution planning, the planning system needs to be able to calculate projected store orders per day, product, and store several months or even a year into the future, reflecting current and known future replenishment parameters as well as the demand forecast. These calculations, of course, require significant data processing capacity, which is likely to be one explanation for surprisingly low adoption rates.

An integrated supply chain driven by consumer demand should be able to consider all known factors, such as delivery schedules, on-hand inventory, and pack sizes. The shipment plan for the distribution centers consists of projected store orders and demand forecasts for potential direct-to-customer inventory flows, such as online orders picked at the distribution center.

In practice, stores’ order projections consolidate data on current inventory, safety stocks and visual minimums, and delivery schedules (including main replenishment days). They also take into consideration any planned inventory movements, such as stocking up for promotional displays and shifting orders to level out the capacity requirements in distribution.

There are several situations where the use of projected store orders (rather than stores’ demand forecasts) allows for much more accurate planning at the distribution centers, including:

| Product introductions | When retailers launch new products, at least one case pack or a sufficient amount of product to fill up the allocated shelf space is pushed out to each store. This creates store inventory buffers, which will take days or weeks to digest. As long as this surplus inventory remains in stores, their proposed orders – and outflow from the distribution centers – will be lower than forecasted consumer demand. |

| Product terminations | When a product termination has been planned, the distribution center forecast will automatically go down as the termination date approaches, creating a controlled ramp-down of inventory. Distribution center forecasts based on projected store orders will automatically consider existing inventory buffers and accurately estimate how long it will take to clear out the remaining stock in each store. |

| Promotions | Typically, 30 – 100% of promotional inventory is pushed to stores in advance. The good news is that these planned inventory movements are entirely predictable and will automatically be included in the projected store orders. Further, if stores are left under or overstocked following a promotion, their resulting fulfillment needs will be accurately reflected in the distribution center forecast. |

| Seasons | A certain amount of buffer stock is usually distributed to stores before the start of a major season to create displays, level out peak volumes, or because weather changes make the season’s exact start uncertain. Like promotions, these planned stock movements, automatically visible in stores’ projected orders, are used as forecasts for the distribution centers. Impacts such as local weather may cause seasonal demand – and buffer consumption – to vary from store to store. These variations will also be visible in the forecast for the distribution center. |

| Changes in replenishment schedules | Store replenishment schedules are frequently changed either temporarily, perhaps to match increased seasonal demand, or permanently, such as in response to transportation route changes. While changes in replenishment schedules have no impact on consumer demand, they directly impact goods flow to stores. Such changes will automatically be captured in the distribution center forecast when it is based on projected store orders. |

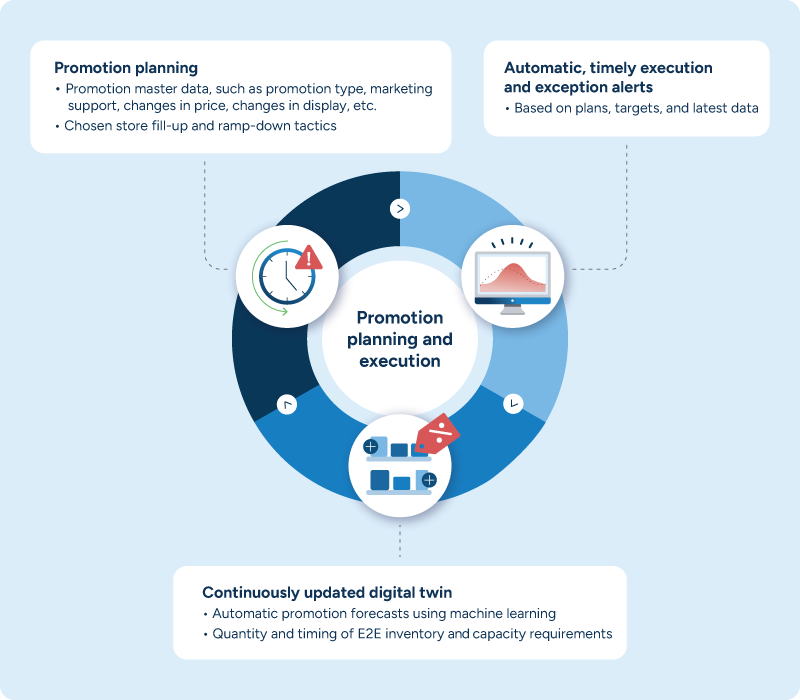

5.1. Plan once and execute automatically throughout the supply chain

When planning at the distribution centers is based on the stores’ projected orders, the impact of planned activities, such as promotions or pre-season allocations, is immediately visible throughout the supply chain. To reap the full benefits of this transparency, all planning data must be made available to the planning system as soon as a decision has been made about, for example, a promotion plan, assortment change, or price change.

A planning system that supports time-dependent master data is a crucial enabler of proactive planning. Below are a few examples of how time-dependent master data enables you to register valuable information immediately when it becomes available. This, in turn, allows your replenishment planners to rely on the planning system to automatically trigger the necessary actions at the right time with very little manual work.

- Time-dependent replenishment schedules: When store replenishment schedules can be managed using dates, it becomes possible to update future replenishment schedules in your planning system as soon as the information becomes available. Replenishment planners are thus able to trust the system to automatically consider these changes as they occur and when calculating supply chain projections.

- Assortment activation and termination dates: Product ramp-ups and ramp-downs are much easier to manage when start and end dates for the active product range have been defined. Routine planning tasks, such as pipeline fills for new products or inventory ramp-downs for products to be discontinued, can be automated. This automation reduces manual work and ensures optimal inventory levels in all product lifecycle phases.

- Stock-ups before promotions: Promotions naturally have start and end dates, but it is equally important to be able to specify beforehand how stores should be stocked. It is usually ideal to define how many days before the promotion the promotional goods should arrive in the stores, what stock quantities stores should receive to be able to build the planned promotional displays, and what proportion of the forecasted promotional demand the first deliveries should cover. Rules and templates make it possible to attain accurate replenishment plans for each store and product without manual work.

- Temporary supplier delivery restrictions: Suppliers may have temporary delivery restrictions. For example, Chinese manufacturers may not dispatch shipments during the Chinese New Year. If information like this is made available to the planning system, the system knows to put in orders for this period early enough to ensure high availability during the affected period while minimizing manual work and dependence on human memory.

An integrated supply chain removes the need for double-planning. The impacts of planned changes in store replenishment are automatically reflected in the projected store orders forming the demand forecast for the distribution centers. This means that as soon as the required store stock-ups for promotions are planned, they will be visible in the distribution center forecast on the proper dates and quantities.

Of course, having the right functionality in your planning system is a key enabler, but the real challenge is getting the whole organization to work more proactively. Ensuring that decisions are made early enough—but not too early to unnecessarily reduce flexibility in a dynamic market—requires everyone in the organization to understand how the supply chain works and the relevant lead times for different types of decisions.

5.2. Multi-echelon optimization of goods flows

An integrated supply chain makes it possible to manage multi-echelon inventory flows efficiently, with minimum waste and a high level of automation. By having all data on demand forecasts, available stock, delivery schedules, lead times, and batch sizes for all supply chain echelons available in the same planning system, the system can seamlessly optimize inventory flows throughout the supply chain.

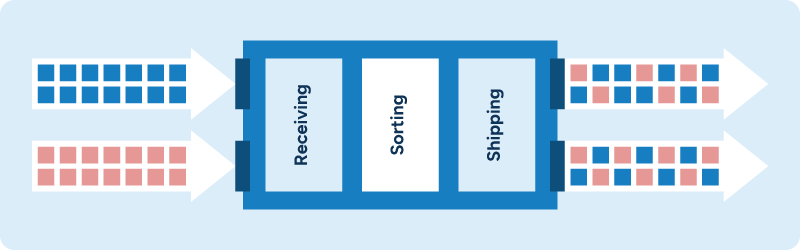

Cross-docking is an inventory strategy to maximize transportation efficiency while minimizing handling costs. Cross-docking is often applied to bulky products, such as beverages, to attain lower storage and handling costs. It can also be used to cut lead times for short-shelf life products. In a cross-docking set-up, goods are delivered from the supplier to a cross-docking facility where the goods are not put into storage but instead moved from the inbound truck to an outbound truck for distribution to stores.

There are several requirements for cross-docking to work efficiently, and the system needs to be able to optimize goods flows to meet them.

1. Suppliers need to be able to deliver full truckloads to the cross-docking facilities.

2. The delivery units, such as pallets or roll-cages, need to be ready for immediate movement to the outbound trucks without additional handling.

3. The outbound trucks need to get a high fill rate to keep transportation costs down. Thus, the planning system needs to optimize both inbound and outbound flows to and from the cross-docking facilities and understand the total lead tome from supplier to store.

Pick-to-zero is another example of an inventory policy that requires integrated supply chain planning. In this inventory strategy, orders to the suppliers are based on the stores’ replenishment needs. However, rather than fixing the quantities to be delivered to each store, the supplier delivery is reallocated to the stores upon receipt based on the latest inventory and forecast information. This allows for adjusting the delivery quantities per store in case the supplier cannot deliver in full or in response to potential unexpected demand peaks in the stores after the original replenishment need was calculated. As a result, supply matches demand more accurately than when using the traditional cross-docking approach. The pick-to-zero method shortens the order-to-delivery lead times to the stores, as the store-specific quantities are finalized not when ordering from the suppliers but when preparing the goods for store distribution.

When supply chain planning is fully integrated, exceptions can be resolved optimally and automatically. Let’s look at inventory scarcity due to, for example, an incoming shipment being delayed. Instead of fulfilling store orders on a first-come, first-served basis, the available inventory can be automatically allocated to stores to maximize overall on-shelf availability or strategically prioritize the stores. In the best case, on-shelf availability is not even affected. Similarly, inventory batches nearing expiration dates can proactively be forced out to the stores with the best chance of selling the products at full price.

6. Efficient inventory management in distribution centers

Replenishing central warehouses and distribution centers is sometimes seen as more of an art than a science. Indeed, longer lead times and a lack of control over external suppliers introduce complexities. Yet, in principle, replenishing central warehouses or distribution centers is not that different from replenishing stores.

When replenishing stores from their own distribution centers, retailers can optimize order fulfillment as they find best. When ordering goods from suppliers, though, there may be complex restrictions regarding minimum order value or quantity. In addition, there may be volume-based discounts or other rebates that can significantly impact margins. However, many retailers have not been able to put this kind of supplier contract or price information into their planning systems, making it necessary for the operative buyers to invest significant time double-checking orders.

When replenishing stores, any large retailer’s active goods flows (combinations of products and stores) are typically measured in millions or tens of millions, which means that automation is crucial. For central and regional warehouses, the number of order lines is much smaller, and the value per order line is much higher, making the economic impact of each order line more pronounced. This has enabled and encouraged a lower degree of automation in operative buying compared to store replenishment.

Setting up operative buying processes in a structured way with good system support can also result in very high levels of automation at the distribution centers. This does not, however, necessarily mean that best practice retailers have a significantly leaner buying team. A key result of increasing the automation of routine tasks is that operative buyers have more time to proactively deal with potential capacity, delivery, or quality issues and analyze the performance of the current assortment, suppliers, and supplier agreements for continuous improvements.

6.1. Total cost of optimization of inbound flows

Because the flows of inbound goods to distribution centers are more consolidated than outbound flows, there are more opportunities for order optimization when replenishing distribution centers than when replenishing stores.

It is vital that the planning system can optimize orders on multiple levels to reach the most cost-efficient outcome.

Some examples of order optimization on different levels are:

- Calculation of the economic order quantity (EOQ) per product to minimize inventory and handling costs

- Selecting the optimal order batch size—such as case pack, pallet layer or full pallet—when several order batch options are available, considering potential price differences between the different batch options

- Building mixed pallets for efficient transportation and goods handling

- Building orders that fill one or multiple load carriers, such as trucks or containers, or that meet suppliers’ order restrictions, such as minimum order value or minimum number of pallets

Although it seems simple, pooling orders for multiple products to fill load carriers or meet supplier order limits can test your planning system’s flexibility.

To meet supplier requirements and benefit from lower transportation costs or supplier discounts without accumulating excess stock, you typically need to be able to:

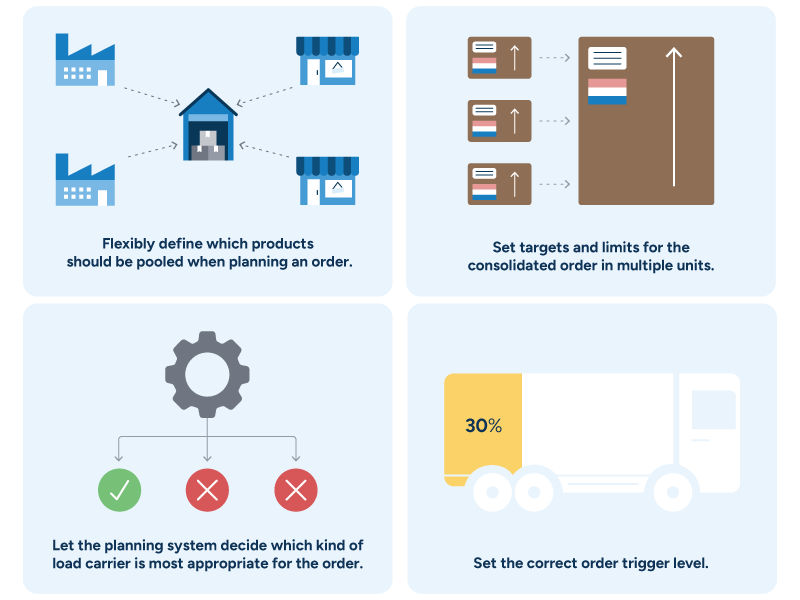

- Flexibly define which products should be pooled when planning an order. Products from the same supplier are often pooled together, but there are cases when the same supplier’s different manufacturing sites should be considered separately or when all products sourced from the same region should be considered as one group, regardless of supplier.

- Set targets and limits for the consolidated order in multiple units. Consider dimensions such as value, volume, number of pallets, and weight (or any combination of these) when filling trucks. For example, you want an order to fill available space efficiently so as not to incur costs for transporting air while at the same time ensuring that the legal maximum weight is not exceeded.

- Let the planning system decide which kind of load carrier is most appropriate for the order. With some suppliers, it may make sense to order a truck sometimes, a truck and a trailer other times, or even two trucks, only one of which has a trailer—all depending on the forecasted demand.

- Set the correct order trigger level. When supplier order restrictions are difficult to meet, it may make sense to require enough demand for at least 30% of a truckload before the planning system starts building an order that fills up the entire load carrier.

In addition to letting the planning system do the heavy lifting when it comes to supplier order requirements, the best practice is to constantly evaluate these restrictions and their impact on the flow of goods. Multi-year contracts in a dynamic market or fixed order restrictions for products with seasonal demand may become costly or infeasible as demand changes.

To support this, the ideal planning system should highlight all order suggestions more or less than needed due to these constraints and show the difference from the actual need. Furthermore, it should provide analytical support to help the operative buyers make rational decisions concerning whether the benefit of meeting a supplier restriction (such as a rebate) is greater than the resulting increase in inventory carrying cost and risk of obsolescence.

6.2. Smart buying takes advantage of good prices

The cost of goods sold dominates retail costs. The operative buying team must be responsible for efficiently exploiting rebates to improve gross margins.

In theory, smart buying when prices are changing is relatively straightforward:

- When you know that the price of a product will go up, stock up just before the price increases.

- When you know the price of a product will go down, only order the quantity you absolutely need before the price changes, and then stock up after the new price is in effect.

- When a price is lowered temporarily, such as during a supplier campaign, reduce the order just before the price reduction and stock up when the price is low.

To be able to truly benefit from price changes, you also need to factor in your inventory carrying cost, time your orders correctly relative to when the price is changing, and potentially split the investment buy—the additional quantity you are buying above what you would need to meet demand—into several orders.

To be able to truly benefit from price changes, you also need to factor in your inventory carrying cost, time your orders correctly relative to when the price is changing, and potentially split the investment buy—the additional quantity you are buying above what you would need to meet demand—into several orders.

To further complicate things, there may be other factors that have an impact on the optimal order quantity. For fresh products, shelf life is always a factor. It makes no sense to stockpile inventory that will end up as waste or harm your reputation because you’ve put products on shelves that are close to their expiration dates.

In addition, when storage space is scarce, inventory costs may suddenly increase if you exceed the capacity limits of your current warehouses. When your existing warehouse storage space is full, you need to find additional space elsewhere, quickly turning your investment buy into a very unprofitable move.

The best practice is to feed your planning system with time-dependent price data to let the system optimize when to buy and in what quantities when prices are changing. This enables you to take advantage of even minor price changes effectively, as the operative buyers do not need to figure out the optimal order quantities manually. It is essential to remember that restrictions like shelf life for perishable items or capacity limits on storage space must be considered. If your planning system cannot deal with such limitations automatically, the suggested investment buys will need to be double-checked by the buying team.

It is not unusual for supplier contracts to include a rebate when buyers’ annual order value exceeds a set quota. However, keeping track of supplier quotas, placed orders, and forecasted orders is very hard to do manually. Intelligent planning systems support smart buying decisions by suggesting additional orders to get the rebate when feasible and not suggesting any further orders that would result in counterproductive stockpiling.

6.3. Batch-level inventory management of perishables

Knowing the exact expiration date of each piece of on-hand store inventory is virtually impossible. It can even be hard to get a decent estimate if several batches of a product are simultaneously on the shop floor, as some consumers work hard to find the freshest products available.

However, distribution centers are a different story. Modern warehouse management systems in distribution centers ensure that inventory is shipped first-in-first-out. In addition, they track the exact expiration date for each batch in stock.

Making good use of batch-level expiration data in inventory management reduces waste and improves your service level:

- When the planning system can calculate projected spoilage based on forecasted demand and the expiration dates of the available inventory, it can order enough goods to replace soon-to-expire inventory before the products actually expire. This significantly improves the service level of your distribution centers towards your stores.

- When there is a risk of waste, best-in-class planning systems trigger early warnings. This enables efficient force-outs to those stores most likely to be able to sell the products at a reasonable price. It also gives you time to find other sales channels, such as discounters, that may be willing to take batches off your hands at a discount.

- Spoilage projections also show if there is a systematic risk of waste, such as products that have large order batches compared to demand.

6.4. Real-time data for fresh product purchasing

For perishable products, it is essential to maintain a very high inventory turnover both in stores and in supplying distribution centers. This means that the supply chain is very vulnerable to quality issues, delivery problems, or unexpected peaks in demand. Quick reactions are of the essence when store requirements exceed available inventory.

Suppliers of short-shelf life perishables often make several daily deliveries to the same distribution centers. This is partly to guarantee freshness and partly to level out volumes.

Several daily supplier deliveries allow a retailer to accommodate actual demand by placing orders as close to the different ordering deadlines as possible using the latest demand and inventory data. However, to identify demand surges, the planning system must be tightly coupled with the underlying transaction systems and have access to real-time data. The planning system must also process the data quickly enough to turn the latest data into orders as accurately as possible.

Similar quick reactions and within-the-day calculations based on real-time data are valuable when produce, which is prone to supply and quality issues, is received in the morning. Because the actual available inventory may differ from what is planned, it makes sense to reallocate stock based on the latest forecast and stock data from stores rather than fulfilling store orders arbitrarily.

7. Planning for optimal capacity and resource utilization throughout the grocery supply chain

In a business as dynamic as retail, capacity bottlenecks can emerge in almost any part of the supply chain in response to various events, from holidays or unusual weather to promotions or significant assortment updates.

To identify and proactively resolve these bottlenecks, retailers must understand how the forecasted demand will impact inventory, capacity, and resource requirements throughout their supply chains.

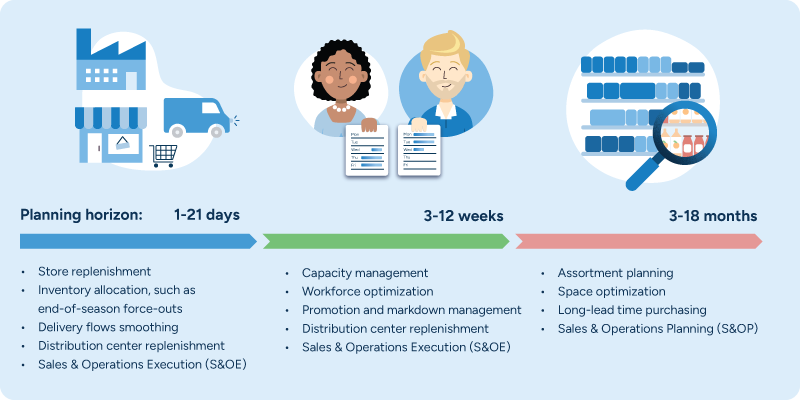

7.1. Retail sales and operations execution (S&OE)

The S&OE process aims to ensure that retailers can fulfill short-term demand for the upcoming 0–3 months as cost-effectively as possible. The starting point is a very granular demand forecast at the SKU-channel-day level. Planners can then use supply chain projections to understand inventory, capacity, and resource requirements throughout the supply chain.

Systems that enable end-to-end visibility into retail operations drive many S&OE benefits, including:

- Cross-functional alignment: Increased visibility allows the impact of business decisions made in one function to be instantly available to others so it can be accounted for in their planning. For example, the expected impact of a planned promotion is immediately reflected in all local demand forecasts and inventory and resource projections throughout the supply chain. The result is that business decisions like promotions only need to be planned once for automatic execution.

- Proactive exception management: With visibility into current and future inventory, capacity, and resource requirements throughout the supply chain, the system can automatically detect potential bottlenecks and help planners prevent or quickly resolve them. For example, the system can alert planners that an upcoming promotional stock-up combined with seasonal allocations will create an exceptionally large delivery peak. This allows the planners to proactively manage the problem before it starts congesting store backrooms or exhausting distribution center picking capacity.

- Effective contingency planning: With digital twin modeling, retailers can compare and better understand how different planning scenarios could impact their supply chain. For example, if a sales region is outgrowing its fulfillment capacity, a distribution planning team can easily model when and how to shift fulfillment for some of this regional demand to another fulfillment center, effectively balancing capacity requirements across the distribution network.

When dealing with millions of goods flows, tens of thousands of employees, hundreds of vendors, frequent promotions, and regular price and assortment changes, there are bound to be exceptions to any retailer’s plans. Many exceptions require immediate attention and quick adjustments to avoid or minimize any negative impact on S&OE.

However, retailers can resolve most deviations without human intervention by turning to AI and advanced optimization. Best-in-class, autonomous issue resolution increases the speed and accuracy with which a retailer can manage exceptions by:

- Autonomously rebalancing inventory in the supply chain to trigger optimized scarcity allocations and force-outs in line with the retailer’s business priorities, for example, or re-optimizing store orders on the fly following a pick-to-zero fulfillment approach.

- Ensuring throughput and efficient use of capacity to proactively enable smoothing out fluctuations in goods flows, continuously optimizing replenishment and space to reduce in-store goods handling, and optimizing workforce deployment using continuously updated workload forecasts.

- Recommending corrective or “next-best” actions automatically suggesting optimal markdowns to clear excess stock from the supply chain.

The best-performing retailers can combine human expertise with technology, quickly adapting to new situations and implementing new business priorities at scale. An excellent example is German drug store retailer Rossmann, who took only two days to stand up entirely new planning configurations that prioritized delivering essential products to stores during 2020’s COVID-impacted demand shift.

7.2. Retail sales & operations planning (S&OP)

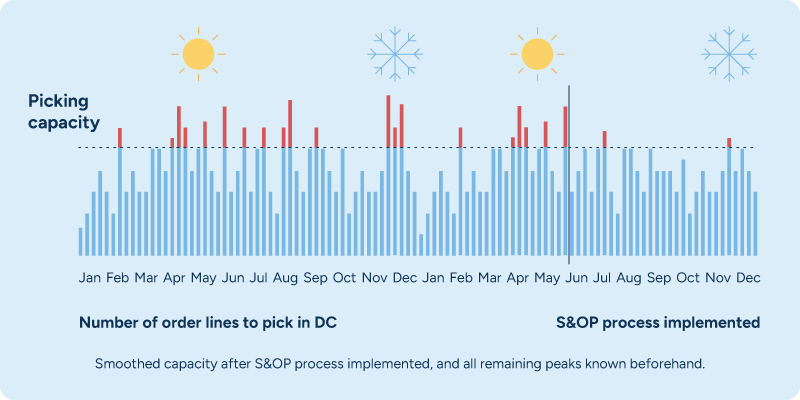

If the goal of S&OE is to resolve unforeseen capacity and resource challenges in the short term, then retail S&OP, by contrast, looks further into the future. The goal of retail S&OP is to ensure sufficient capacity and resources to support future growth targets, planned changes in the distribution network, major seasons, and more.

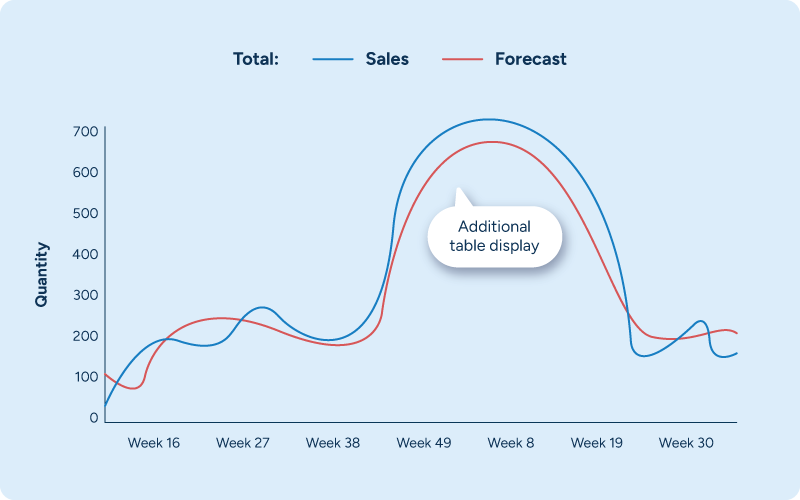

Preparation for major holidays provides a critical use case for retail S&OP, with the November-December holiday season being the most important and challenging in most markets. Holiday seasons typically experience higher-than-normal demand that increases steeply until the holiday peak. After that peak, demand usually returns to or even dips below typical levels for a while.

But the retail S&OP process is about more than supply chain efficiency alone. It’s about maximizing profitability. S&OP results should include:

- Goods flows that match, rather than exceed, capacity throughout the supply chain, securing reliable supply and preventing lost sales from delivery problems.

- Cost-effective operations that can identify and minimize costly overtime in all parts of the supply chain.

- Informed decisions that still support company profitability when capacity restrictions prevent guaranteed availability for all products.

- Full transparency into resource requirements to ensure that all resources, including store workforce availability, are based on the same operational plan.

Retail preparations for a major holiday such as Christmas usually start around six months before the season begins. The first step is to agree on the constraints: will there be changes in delivery schedules/lead times or supplier capacity constraints due to the holiday season?

After agreeing to the constraints, the next step is reviewing sales and delivery plans to identify potential bottlenecks, which can emerge anywhere in the supply chain throughout the holiday season. Potential bottlenecks include overly large deliveries adding to store congestion on busy days, days when warehouse staff face more order lines than they can pick, or days when a warehouse receives more frozen products than it can store.

With all its complexities, it would be impossible to model the supply chain accurately enough to proactively identify bottlenecks using spreadsheets. Even building a simplified model would be enormously time-consuming and prone to error. The only way to detect the types of moving capacity bottlenecks described above with any degree of certainty is to use supply chain projections.

Once they’ve identified potential bottlenecks, retailers should use “what-if” scenario planning to examine and eliminate them. Bottom-up scenario planning allows retailers to see precisely how changes in delivery timing, replenishment schedules, or forecasted sales volumes would impact goods flows.

Typically, food retailers must deliver long-shelf life products to stores earlier to free up capacity for effective management of fresh products in their high season. Different strategies and scenarios for leveling out the goods flow ahead of a holiday season include:

- Filling up store shelves: For many center store products, full shelves could cover demand for many weeks. Because waste is not an issue, it makes sense for retailers preparing for a holiday to fill those shelves early so fresher products can be delivered closer to the peak.

- Allocating longer-shelf life products to stores: Fill-ups respect the assigned shelf space, but that isn’t always enough. Sometimes, allocating demand to stores once for the next two to four weeks makes sense. Stores can house those items in a backroom and replenish them as needed. While this approach isn’t appropriate for all products, it can be useful in special cases.

- Adjusting delivery schedules: Most food retailers make regular, frequent store deliveries, even outside the holiday season. But when appropriate, it may make sense to schedule additional deliveries to help meet the increased demand during the holiday period.

Retailers should use their software’s scenario planning capability to identify the strategy that best meets their goals and come to an agreement with their suppliers on it. They can then lock their plan well before the season and focus on execution and corrective actions.

An effective S&OP process leads to more level capacity utilization throughout the season. Furthermore, it allows planners to know of and plan for any remaining peaks beforehand rather than scrambling to manage costly surprises as they pop up.

7.3. Efficient supplier collaboration

Supplier collaboration has been a point of discussion for decades, but surprisingly few retailers have successfully implemented it. To establish fruitful collaboration, both parties must put in the effort and receive measurable benefits. Unfortunately, because this has rarely been the case, many collaboration initiatives fail.

While technology doesn’t solve the challenge of supplier collaboration, it can ease the pain. For example, most collaboration projects focus on collecting data from various sources, but the right planning system can minimize that work. Rather than trying to fix everything in one go, it’s better to build your supplier collaboration processes bit by bit.

A good starting point is sharing order forecasts with your suppliers because it’s a lean way to collaborate. For example, when your planning system can calculate supply chain projections, the purchase order forecast (which tells your supplier what you plan to buy from them in the coming weeks and months) is already available. A good system can use that existing information to send automated reports to your suppliers.

Additionally, you can send relevant details on planned promotions, upcoming events, or other changes to help your suppliers understand the reasoning behind your purchase order forecast. You can also share demand forecasts or point-of-sale (POS) data, but the essential information is what you expect the supplier to deliver and when.

A more collaborative way of working requires both parties to recognize the value that investing their time and effort will bring. Whereas sharing a forecast is one-way communication, Collaborative Planning, Forecasting, and Replenishment (CPFR) is proper two-way communication. A good planning system helps by providing reliable projections of future purchase orders, analytical tools to understand potential changes and issues, and a platform or portal for collaboration.

Ideally, suppliers can access a retailer’s view of their projected demand, plans for purchase order placements, and data on promotions, seasons, events, and so on—and then add their own view. Combining the supplier’s holistic view of their categories and products with the retailer’s understanding of its business and marketing activities results in a more accurate overall plan.

Best-in-class planning systems can support this kind of collaboration by providing a platform that can take in multiple forecast types, alert users to any differences, allow users to edit plans, and disaggregate the agreed plan to whatever level of detail is needed—whether stores, products, or days—to support operational execution.

8. Team up with the machines to win

Retail is in turmoil, and the impact of emerging sales and delivery channels, store formats, and retailer concepts is unclear. In 10 – 15 years, we will probably look back on this time in amazement and wonder, “How did we not see this coming?”

Some predictions about the future of food retail are, however, easy to make:

- Waste reduction will remain imperative. It is a disgrace to spend so many resources growing, transporting, and handling food products, only to have them end up in the dumpster. Grocery retailers must and will take responsibility for significant reductions in food waste, and because waste eats profit, their efforts will also be great for their businesses.

- The food retail supply chain will become more effective. Consumers have become very price-conscious and will not accept premium prices to keep inefficient supply chains in business. No one benefits from wildly fluctuating workloads or capacity requirements caused by poor planning and management, so neither retail employees nor management should be sad to see old, inefficient practices go.

- Technology and automation will be essential in transforming retail. We have already seen this in other sectors that once relied heavily on manual routine work. There is no reason why retail wouldn’t follow the same path.

Retail supply chains need to become more responsive and finely controlled than ever before to meet the demand for fresh products with minimum waste. At the same time, retail supply chains need to become more efficient by optimizing inventory flows from multiple perspectives—store operations, distribution, picking, and warehousing—to meet price pressure. Achieving these goals is only possible by teaming up with intelligent machines.

The world of food retail is too complex to be managed with notepads and intuition. Of course, this has been true for a long time, but now, not only can the simplest tasks be automated but significantly more advanced planning processes can as well. More importantly, intelligent automation will do more than just replace manual work—it will take planning to a never-before-seen level of granularity.

Will there then be any role for humans in this brave new world? Yes, there will be plenty. Three essential roles are:

- Master of the machines: We are making significant progress in specialized AI, the machine intelligence used for solving specific tasks. However, we still need talented people to design the systems and determine when and how the available machine intelligence is best used.

- Colleague to the machines: Machine learning algorithms are very dependent on access to data. They have difficulty applying common sense or developing innovative solutions in new scenarios with insufficient data, which is where their human colleagues can provide invaluable insight.

- Innovators who think beyond the machines: In businesses undergoing creative destruction, there is a great need for novel thinking, new business models, and new ways of delivering food and services to consumers. Retail innovation is still far beyond the capabilities of AI.