From fragmented to unified: Why retailers need to integrate pricing and promotions

Oct 7, 2024 • 5 min

With technology and market trends reaching a tipping point, pricing and promotions are on the verge of a renaissance. We partnered with Incisiv to produce a report, From Fragmented to Unified: Why retailers need to integrate their pricing & promotions capabilities, that provides new insights into the state of retail strategies. Drawing on executive input from both US and European retailers, findings indicate that, while prices influence consumer decisions more than ever, retailers at large must overcome substantial tech debt to optimize their planning capabilities and capitalize on growth opportunities.

Retailers increasingly prioritize promotional strategies

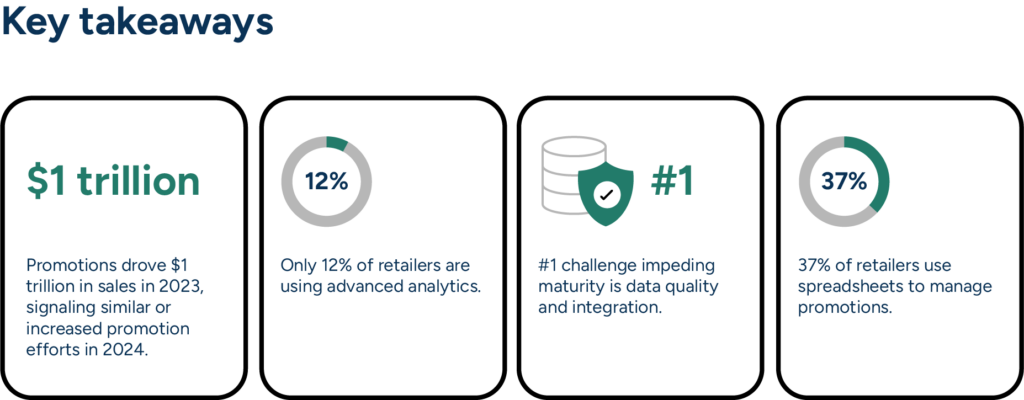

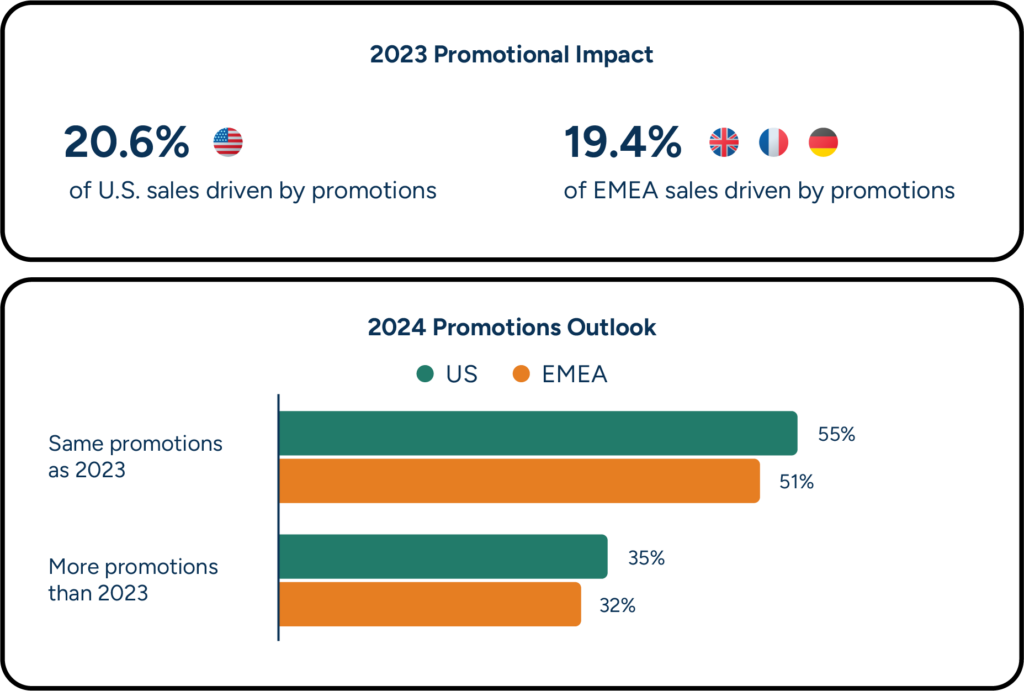

In a nervous world of uncertain markets and rising inflation, the pervading consumer mindset chooses bargain-hunting over splurging. Price-conscious consumers are guarding their wallets and staying alert to promotions. In 2023, those “on sale” stickers helped retailers grab shoppers’ attention, delivering savings and perceived value to consumers and driving a staggering $1 trillion in sales.

Retailers are taking heed, especially as the winter holiday season – which can make or break a company’s year – rapidly approaches. Considering the high volumes driven by promotions, many are looking to shift their strategies from reactive processes to active, strategic components of their overall growth strategy. In fact, over half the executives surveyed across regions plan on continuing their promotional strategies and over 30% anticipate increasing their promotional focus.

Modern markets require modern analytics

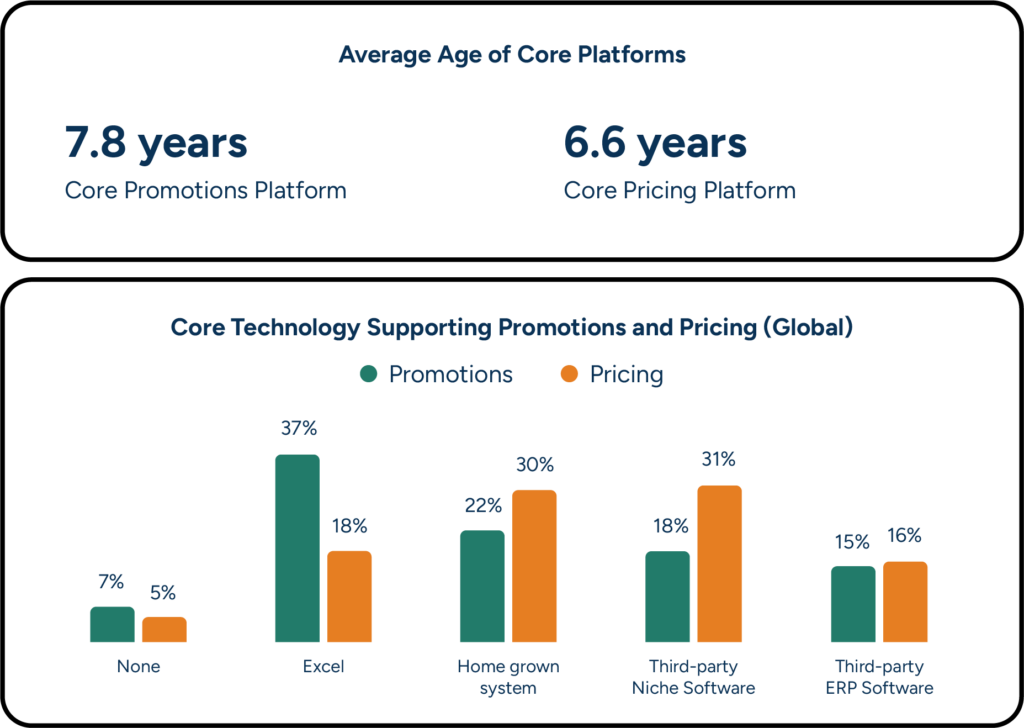

Legacy tech stacks are crumbling under the weight of today’s datasets. Increasing supply chain complexity only compounds the issue. Despite this, only a small percent of retailers has the analytical capabilities that leverage real-time data, advanced algorithms, and AI to optimize their pricing and promotions. Retailers are missing out on almost a decade’s worth of tech improvements.

Lack of investment in more advanced solutions is no longer a viable strategy. The market is only getting further ahead of outdated legacy systems. Lack of adoption today means delayed responses to demand shifts in the future – in many cases, the immediate future. A solution that provides those all-important analytics lays the foundation for a more agile and profitable long-term strategy.

Poor data and internal friction impede promotional effectiveness

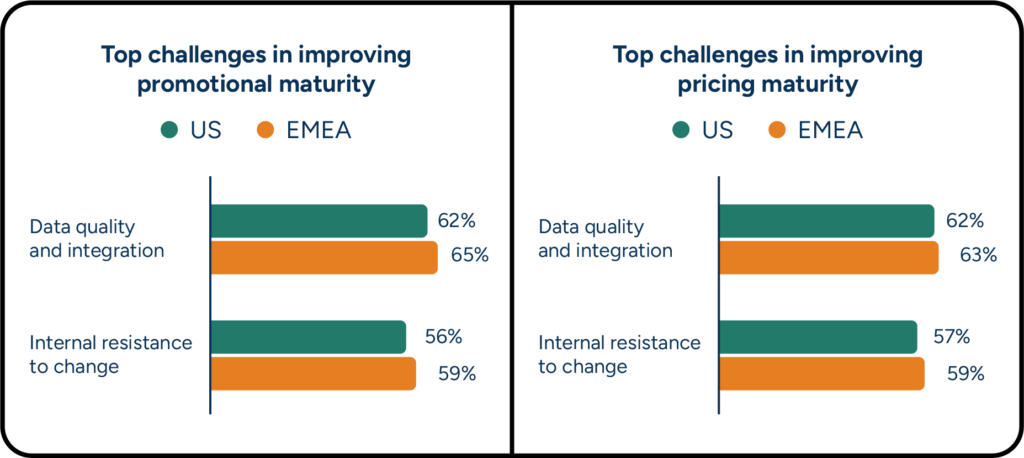

Poor data quality tops the list of promotional and pricing challenges, with cultural resistance coming in a close second.

Data is flooding in from multiple channels, funneling into siloed planning functions. Without accurate, unified data, retailers cannot form effective promotional strategies. At the same time, efforts to implement a powerful data-driven solution are marred by cultural reluctance to transition out of legacy systems that support familiar, if broken, practices.

The solution to both problems starts at the top. Leadership must be willing to:

- Actively explore and invest in tech innovations that provide automation and AI/ML capabilities.

- Prioritize the training and change management that will ease solution adoption so teams can embrace (and benefit from) innovations.

Tech upgrades could help retailers realize unprecedented profit potential

Outdated solutions and spreadsheets still form the cornerstone of many pricing and promotion planning processes, but retail has reached the point where these legacy systems are spoiling their legacy. Price and promotion decisions are often siloed both from other planning functions and from each other. While their familiarity and low cost add to their popularity, these solutions lack the agility, analytics, and collaborative capabilities that drive the insight-rich decisions current supply chains require.

“The path forward isn’t just about technology; retailers also need to overcome cultural inertia and unlearn years of legacy behavior.”

If, however, retailers make the necessary investments in technology and adopt an innovation-centric mindset, a wealth of benefits awaits. With a unified solution, planners can make strategic, data-driven decisions and avoid getting sucked into the supply chain maelstrom. “What got retailers here won’t get them much further. Driving $1 trillion in sales on the back of outdated analytics and technology platforms highlights the immense growth potential that’s possible,” said Gaurav Pant, Chief Insights Officer at Incisiv. “The path forward isn’t just about technology; retailers also need to overcome cultural inertia and unlearn years of legacy behavior.”

How a unified approach benefits retailers to the tune of billions

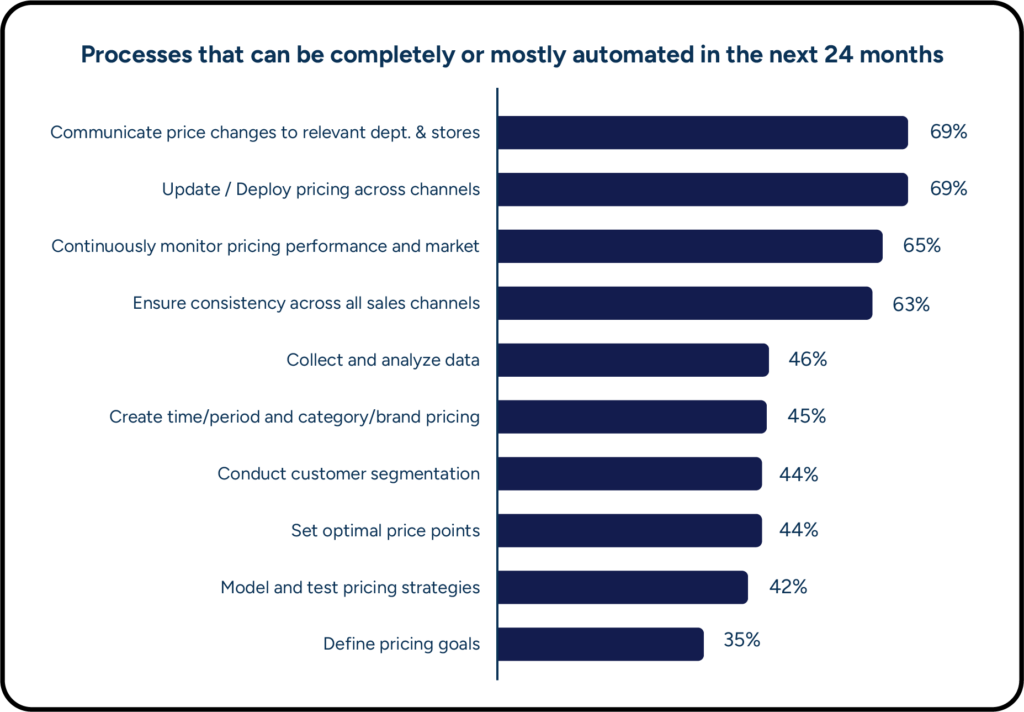

Given these findings, it’s no surprise retail leaders are looking for more ways to incorporate automation and AI into their planning systems. Key tasks such as communicating price changes, deploying pricing across channels, and maintaining consistency across all sales touchpoints are seen as prime candidates for automation.

By improving data sharing, visibility, collaboration, and decision-making across teams, these solutions refine pricing and promotions in real-time, ensuring swift responses to market changes, competitor actions, and demand fluctuations. Unified, AI-supported solutions can:

- Synchronize pricing and promotional tactics.

- Reduce manual intervention.

- Improve forecast accuracy and inventory management.

- Deliver consumer-first strategies that protect margins.

By making sure their teams aren’t working at cross purposes, retailers can potentially drive up to $450 billion in incremental sales.

The Incisiv report tracks market shifts and strategic tech-driven responses

The intersection of consumer behavior shifts, pricing and promotion strategies, and new technologies is rife with opportunities, but too many retailers are held back by outdated tech stacks. More sophisticated planning tools provide the data processing and analytics, transparency, agility, and accuracy companies need to remain competitive.

Learn more in the full report.