How quick commerce retailers can establish market dominance

Aug 16, 2021 • 4 min

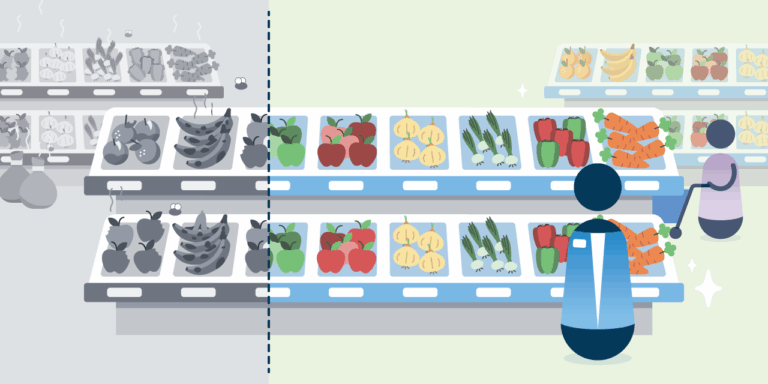

As retailers and consumers alike come out of the COVID-19 pandemic, we’re seeing the emergence of a new business model tailored to meet rising consumer expectations for extreme speed and convenience. Thought by many to be the next evolution of e-commerce, “quick commerce” retailers like Delivery Hero are making their presence known as the newest disruptors in the grocery and convenience sectors.

What Is Quick Commerce?

Though many traditional retailers quickly ramped up online channels due to COVID-impacted store closures in 2020, most still struggle to make those channels profitable. Quick commerce retailers have now raised the stakes even higher, providing home delivery within an hour of order placement—with some companies promising delivery times as fast as ten minutes. How are quick commerce companies achieving this stunning level of efficiency and speed?

The first element of their success is small basket sizes. Quick commerce retailers guarantee speed by utilizing bike couriers who can beat traffic congestion in dense urban areas. This, of course, means basket sizes must be small enough to transport by bicycle. While many omnichannel and e-commerce players encourage larger baskets through minimum amounts for low-priced or free delivery, quick commerce actually encourages consumers to purchase fewer products to enable faster picking and delivery speeds.

The second element to quick commerce success, then, is their ability to fulfill orders from networks of small-format dark stores.

In addition to influencing how consumers themselves are shopping, quick commerce is also speeding up the rate of change in how retailers will fulfill online orders going forward. The second element to quick commerce success, then, is their ability to fulfill orders from networks of small-format dark stores. While a few larger retailers have begun exploring micro-fulfillment centers and dark stores to speed up their online fulfillment, quick commerce companies are adding to their urban dark store networks at a truly astonishing rate—with the fastest-growing companies adding multiple new locations per week.

Quick Commerce’s Big Challenge: Speed to Scalability

The biggest challenges for quick commerce players are time and scale. With companies adding dark stores at an astounding rate, it’s impossible for many to develop informed projections for even the next year’s targets and needs, much less the next two to five years’.

In this newly emerging segment, the competition for survival is already fierce.

However, they can’t slow the speed of their growth to a more manageable rate to improve in this area because none of their competitors are showing any signs of slowing down. In this newly emerging segment, the competition for survival is already fierce.

Because quick commerce profitability depends on high volume and customer density, there simply isn’t room for multiple players to thrive within the same service areas. That’s why they must grow as quickly as possible to avoid the fate many of these companies will ultimately face: falling by the wayside as a handful of dominant players separate from the pack and consolidate market share.

The biggest challenge quick commerce players face now is the need to scale as quickly as possible while achieving the extreme operational efficiency required to reach the market position and cost structure needed for profitability.

How Can Quick Commerce Retailers Establish Market Dominance?

In this tech-oriented segment, many hope to gain a competitive advantage by building in-house planning solutions—but it makes little sense to spend time reinventing the wheel for core processes. The powerful, flexible tools needed to master demand forecasting, replenishment, and space optimization are already widely available on the market. In practice, building in-house only steals valuable time from technology teams that could drive far more value by focusing on tasks that improve business outcomes and customer experience.

Because of the rapid growth in quick commerce, the true competitive advantage goes to the company that implements first. That’s why quick commerce retailers would be better served by partnering with a software vendor who can provide speed-to-ROI and best practices earned from other successful projects. Combining your team’s knowledge of the business with a vendor’s expertise speeds up the journey to improve forecast accuracy, optimize dark stores for high picking efficiency, and replenish dark stores in a way that ensures both high availability and efficient goods handling.

High levels of configurability and flexibility are paramount, ensuring your in-house teams have full control of the solution and can adapt it to the business’s needs.

Because of their impact as disruptors, it’s also quite important for quick commerce retailers to work with a vendor who continuously invests in research and development, enabling them to not only keep pace with the industry, but to continue driving it. High levels of configurability and flexibility are paramount, ensuring your in-house teams have full control of the solution and can adapt it to the business’s needs (read the case study). With a configurable system, retailers can build robust global planning “blueprints” they can easily adapt across different markets, ensuring harmonious global planning and visibility into supply chain performance without compromising local market requirements.

But can young companies afford this type of technology investment? In quick commerce, the answer is yes. Having proven their value on the market, quick commerce retailers are experiencing an influx of funding from investors. The task at hand, then, is to turn that funding into smart, long-term investments that ensure they can scale quickly and capture market share while improving operational efficiency. Quickly establishing a healthy cost structure and improved planning capabilities in these early days will likely also be key to securing additional future investment that will support long-term growth.

Like many in the industry, we predict that quick commerce will only continue to grow in market share and importance. Smart investments today will set retailers up to weather the storm of competition and ensure they come out on top well into the future.