How retail winners are optimizing their cost to serve

Mar 10, 2021 • 5 min

2020 was an exceptional year by any measure. While some challenges were entirely new, such as new health and safety protocols, the coronavirus also highlighted long-standing problems that retailers had, until this point, been able to put off addressing. For too many, these “cracks in the foundation” only grew under last year’s additional pressure, eventually causing the entire foundation to crumble as businesses closed their doors for good.

What were the most significant differences between those retailers who managed to “just survive” 2020 and those who adapted quickly enough to regain solid footing and even capitalize on new opportunities? What challenges are retailers taking most seriously and what initiatives are they planning to improve in the face of continued disruptive change? And most importantly, how are they optimizing the cost to serve their customers to gain a competitive edge?

Managing through Disruptive Times with Data-Driven Speed and Adaptability

We at RELEX have partnered with RSR (Retail Systems Research) on a report designed to investigate important questions on the state of retail, with a focus on supply chain: “Managing through Disruptive Times with Data-Driven Speed and Adaptability.” The survey-based report, which had 160 retailer respondents, highlights a surprisingly large gap in mindset and priorities between those retailers who overperformed in 2020 (deemed “Winners”) and those who did not perform as well.

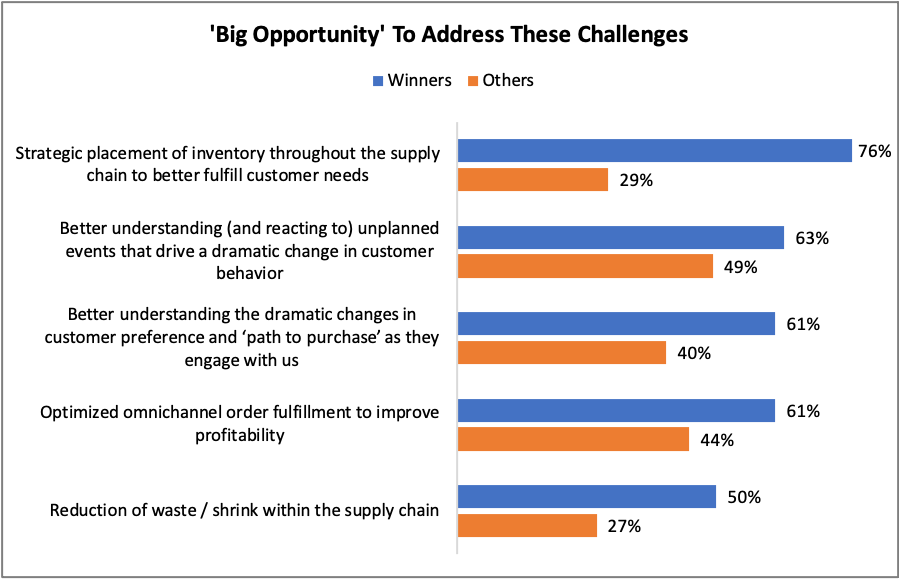

As an example, 76% of the noted retail winners surveyed said that improving inventory placement throughout the supply chain to meet customer needs was the “big opportunity” for improvement—compared to just 29% of normal and underperforming retailers. This makes sense, as the rapid acceleration of online ordering and returns has created a great deal of inventory distortion for retailers across the board.

There are many additional impacting variables, including extreme weather events, online return rates that continue to rise to levels of 25-35% (or more), as well as the need to remain hyper-local and responsive. When taken together, it’s clear that many retailers lack inventory planning technology that can provide accurate visibility into where their inventory is at any moment or predict, optimize, and place where inventory needs to be.

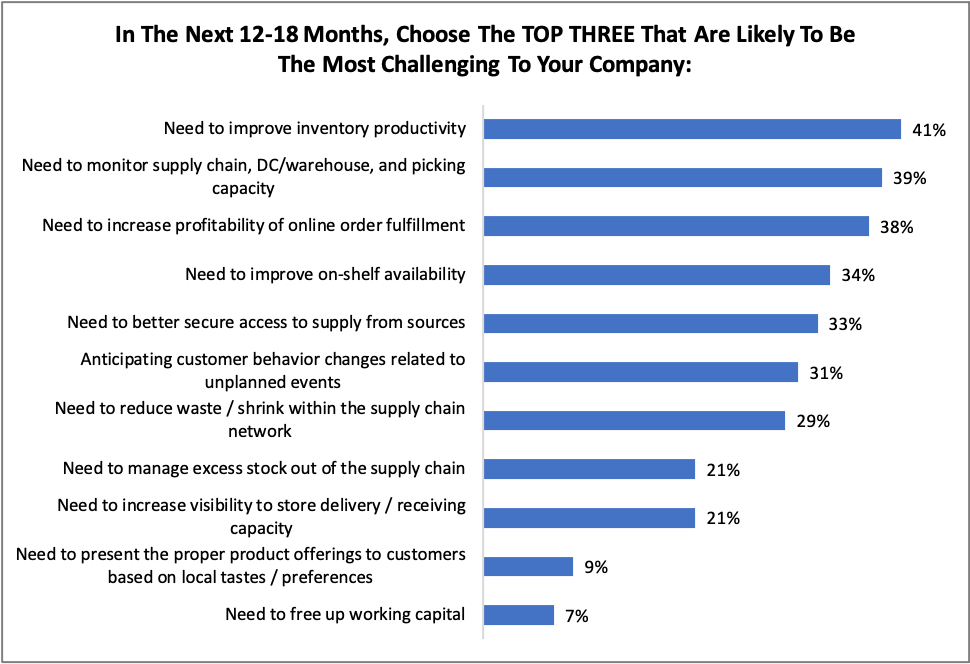

Of course, identifying opportunities is just one part of the process—retailers also need to know where their biggest challenges lie as they pursue any and all competitive advantages. While many retailers have been able to quickly react to the events of the last year, many are struggling to make online order fulfillment a profitable endeavor. In fact, 38% of those surveyed identified this as one of their three biggest challenges in the near future, as shown in the figure below. Even retailers with mature omnichannel models have struggled to keep pace with the explosion in online ordering as consumers either avoid brick-and-mortar stores or embrace the convenience of shopping from their couches.

To acquire and retain customers while protecting customer lifetime value, retailers must fulfill customer needs at any cost. It’s critical that they develop efficient, effective ways to reduce their cost to serve and dramatically alter their profitability models.

I don’t find it surprising, then, that retail winners also view omnichannel growth as an opportunity, not just an obstacle. 61% of retail winners see the optimization of omnichannel order fulfillment as a key step to making omnichannel more profitable. This opportunity-oriented mindset is very important, as customers have changed their purchase habits over the last year. We can expect this trend to continue accelerating, driving online demand levels higher with no end in sight. Retailers must find a way to make omnichannel profitable if they wish to remain competitive.

Retailers Should Seriously Consider “Tough Love” Advice

The RSR Research report shares six of what they call their “tough love” BOOTstrap Recommendations: the principles and lessons learned that retailers may not want to hear, but which analysts believe will be critical for sustained success going forward.

One of the more difficult pills to swallow may be the warning to abandon any notion that things will soon return to normal. With effective vaccines making their way into the population, some may be dreaming of a return to normalcy on the horizon. However, as the report points out, “the fact that so many are now living, working, and shopping in entirely different ways than they were even a year ago—and likely will be for the foreseeable future—has made them even more difficult to ‘delight’ during their path to purchase.”

The full report includes thorough “tough love” recommendations and insights into which aspects of retail planning are most important for future success, which obstacles are holding back their plans, how they plan to overcome those obstacles, and more. In addition, the report also reveals how retailers are investing today to ensure strong performance in both the short- and long-term future.

Technology Enablers: How Retail Winners Are Proactively Investing in their Futures

A final area of focus in the report highlights where retailer winners are actively investing in technology to address their challenges and further improve overall performance. This includes hiring key resources, including in-house data scientists—but more importantly, complementing their teams with AI-enabled solutions.

Forecast accuracy is an obvious area for improvement, but other standout areas include addressing how to best streamline processes and optimize the cost to serve their customers. This includes the optimization of workshifts (roughly 39% of respondents) as well as improved store- and DC-level capacity planning (also 39%).

For RELEX’s insights into how an updated technology strategy can help you tackle your business’s most critical challenges—and the opportunity to ask any questions you may have on the subject—I encourage you to watch our webinar, “Differentiating Your Business in the New Retail Supply Chain Battleground.” As one of your presenters, I’ll go over the major takeaways from the study, but will approach them from the RELEX perspective and expand the discussion to address key topics including:

- Why AI and machine learning are critical to reducing the cost-to-serve

- Best practices for profitable, unified retail planning

- Key considerations when assessing the many solution options available in today’s marketplace