How strategic floor planning maximizes retailer profitability

Apr 30, 2024 • 10 minThe one-size-fits-all approach to floor planning of the past is obsolete. Retailers recognize that store layouts should be flexible and adapt to changing customer behaviors and market trends. Seasonal changes, promotional events, and new product launches are all catalysts for layout adjustments.

Strategic floorplan optimization requires understanding how space is designated in each store. Planners must recognize that no two stores are identical. Even two stores with the same architectural design will likely require different merchandising approaches and category strategies, especially given the differing shopper demographics of each location.

This often requires retailers to revisit the architectural designs of each store. These layouts provide the foundation for floorplans as they include elements like:

- Gondolas.

- Cooling cases.

- Display fixtures.

- Category performance.

- Adjacencies.

- Brand elements and signage.

Micro-space planners view each category uniquely, but the architectural layout aids in visualizing their relative positioning. This perspective helps reveal unexpected insights into a store’s layout and flow.

Planners must go beyond analysis at the category level and delve into the specific stock-keeping units (SKUs) that make up each category. To comprehend the holding capacity of a floorplan section, one should determine the movement, contribution, and capacity of every SKU in that section at the location performance level. All dynamic attributes of each SKU across various data sources must be directly tied to store location, planogram, and floorplan.

The challenges of strategic floor planning

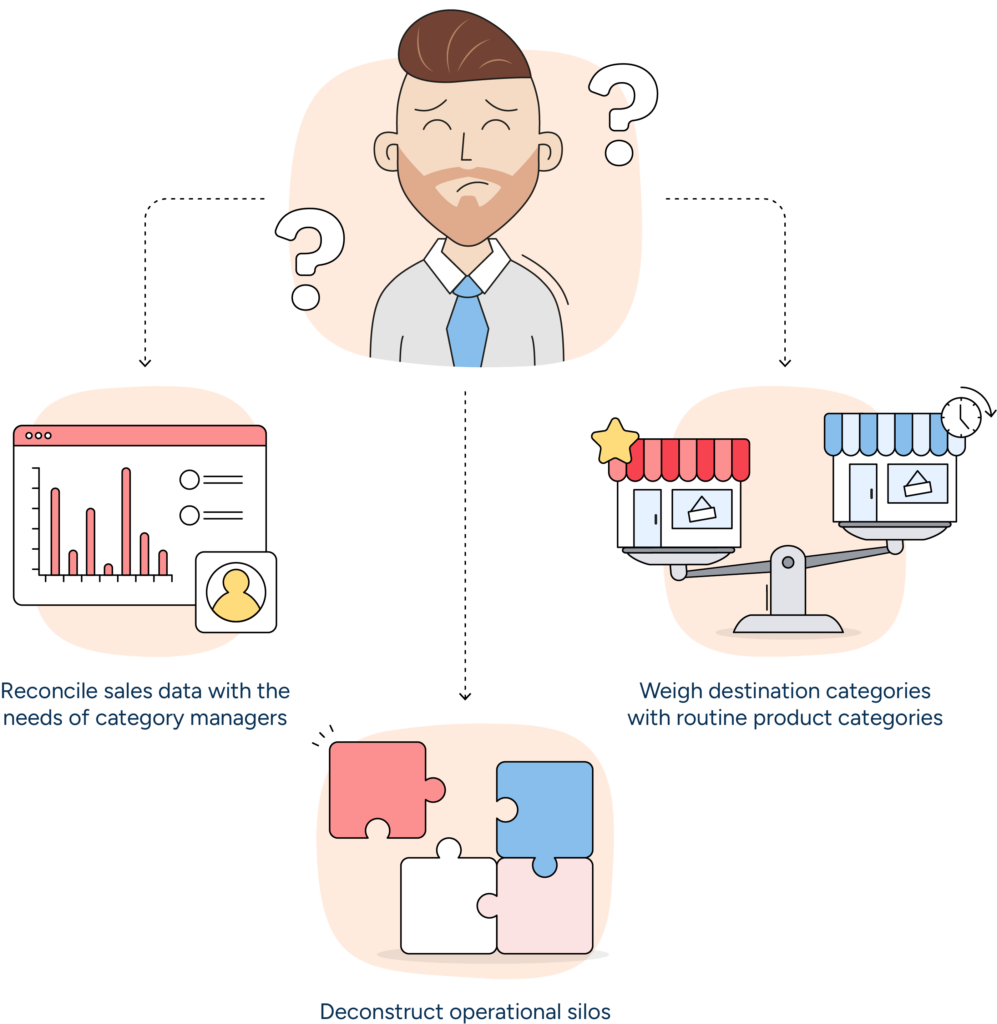

Macro-space planners attempt to maintain a unified strategy for the standard store in a retail chain. Achieving this feat without a unified space management solution is easier said than done, as it requires planners to analyze vast amounts of data. Insights gleaned from this data are used to:

- Reconcile sales data to meet the needs of category managers.

- Weigh destination categories with routine product categories.

- Deconstruct operational silos.

Fielding category management requests

During merchandising planning phases, category managers or merchants push for increased linear space for their segments. The retailer’s analytics team then revisits clusters and compiles sales data by category within these clusters, integrating this data into the overall store blueprint for planning considerations.

Category managers or VPs often also lodge requests with planners that are difficult to answer without the use of a capable space management solution. Imagine that a category manager asks for data on the gross margin return on investment per square foot for baby food in city stores compared to those in suburban areas. Without the right technology or visibility into the data, a planner won’t be able to consolidate data access and translate business insights into actionable strategies and tactics.

The sheer amount of data involved in making these decisions necessitates using a unified space management platform. Planners often switch between floorplan space allocations, planograms, adjacencies, and reports. They also must consider the stores’ diverse designs and sizes and may recommend expanding space for certain categories when possible or reducing space for others as needed.

Pursuing a customer-centric approach for every store arrangement is daunting, especially without the right unified space solution. If planograms are crafted with consumer behavior in mind, then it’s logical that floorplan optimization should do the same.

Balancing destination categories with non-destination categories

An essential aspect of strategic macro-space planning is recognizing that not all categories are equal. Traditionally, macro and micro-space planners relied on intuition, experience, or conventional wisdom to categorize products into four category roles:

- Destination.

- Routine/core.

- Convenience.

- Seasonal/promotional.

The categorization of products in this manner allows for a macro-level understanding of their contribution to the retailer’s strategic goals. Products commonly fall into multiple category roles, especially in grocery retail. For instance, Dijon mustard may belong to both the “condiment” and “international foods” categories. Retailers operate more efficiently when they create clear category definitions, meaningful role designations, and distinct performance targets and metrics. They also allow more flexibility when products cross roles and exhibit different category behaviors.

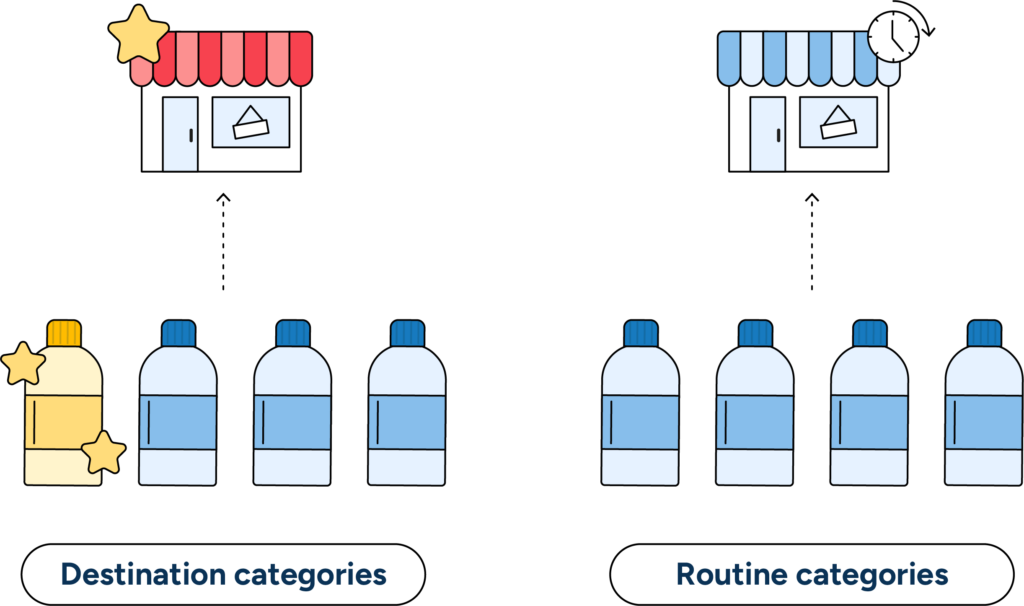

Destination categories only comprise 5% – 7% of in-store categories, but they define a retailer’s core identity. They play a significant role in driving foot traffic, which increases sales opportunities in routine, convenience, and promotional categories from the same shopper. Category managers often strive to position their products as destination categories to gain allocation priority, senior management attention, and increased marketing investment.

Retailers typically prioritize space allocation within destination categories due to their impact on brand integrity and shaping shopper perception. Companies often give these categories more space relative to actual sales or unit movement data. Micro-space planners (also known as Planogrammers) then balance this allocated space among individual destination products within each category or planogram.

One common guideline involves allocating space based on transaction count instead of unit sales. This process is not as straightforward as it may seem, as various factors make the decision-making process complex and time-consuming. These complicating factors include:

- Varying price points.

- Average cube size of products.

- Demand signals across the category.

- Days of supply.

- Merchandising tactics.

- Case-pack requirements.

- Vendor agreements.

Once the planners finalize these decisions, the focus transitions to routine, convenience, and seasonal/promotional categories. Planners must allocate enough space for comprehensive market coverage while considering consumers’ expectations for assortment variety. Interpretations of “market coverage” and “assortment” can differ based on product category, especially factoring in any combination of the following elements:

- Brand.

- Unit count.

- Perceived value.

- Flavors.

- Colors.

These routine categories demand a diverse assortment to address the unique preferences of shoppers and prevent them from seeking alternatives from competitors.

One significant limitation of the current approach is that planners often rely on historical rather than forecast-demand data. This implies that their planning is based on past trends instead of proactively aiming to enhance future performance. A unified approach enables retailers to be more proactive by connecting the supply chain, demand forecasting and replenishment with space and merchandising planning. When all functions operate on a single source of truth, they have the visibility and insights to make the best data-driven decisions possible.

Deconstructing operational silos

Many retail organizations tend to silo micro-space planning, macro-space planning, and assortment planning, treating each responsibility as a separate entity. Larger retail chains often compartmentalize functions as departments grow and specialize. It’s common for macro and micro teams to be housed under different departments or even report to different leadership, reinforcing this divide.

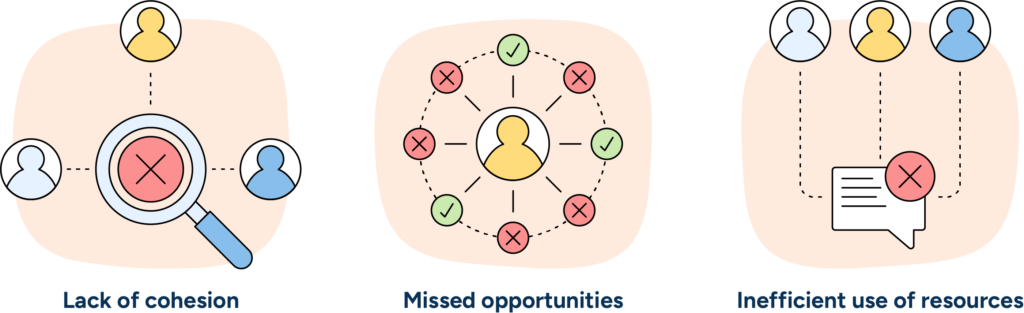

This siloed approach creates problems for planners. For example:

- Lack of cohesion. A disjointed approach can lead to inconsistencies. For example, the macro team might designate an area for a particular category, but the micro team might struggle to effectively implement a planogram in that space due to a lack of collaboration.

- Missed opportunities. Retailers might miss out on optimizing the holistic shopping experience. For instance, insights at the micro level (like a particular product’s performance) could inform broader layout decisions and vice versa.

- Inefficient use of resources. Duplication of effort or contradictory strategies emerge when there’s a lack of communication between the two teams.

The goal of floor planning in the modern retail environment is to offer a seamless and intuitive shopping experience, so breaking down these silos and fostering collaboration between micro and macro-space planning teams is becoming more crucial than ever.

Thankfully, the best modern retail planning solutions make SKU-location-specific performance metrics readily available through a unified retail planning solution. Beyond basic details like brand, flavor, and size, macro-space planners should also have visibility to crucial category management metrics like SKU-specific performance data that guide more strategic decisions.

What is the right solution for my organization?

Retail organizations contain a group of individuals commonly known as “software decision makers” (SDMs). SDMs hold the authority to purchase or approve the acquisition of technology on behalf of the company. Smaller retail organizations often see a significant overlap between the end users of floor planning software and the SDMs. The opposite is true in larger Tier-1 or Super-Tier 1 companies, where a considerable gap exists between SDMs and end users.

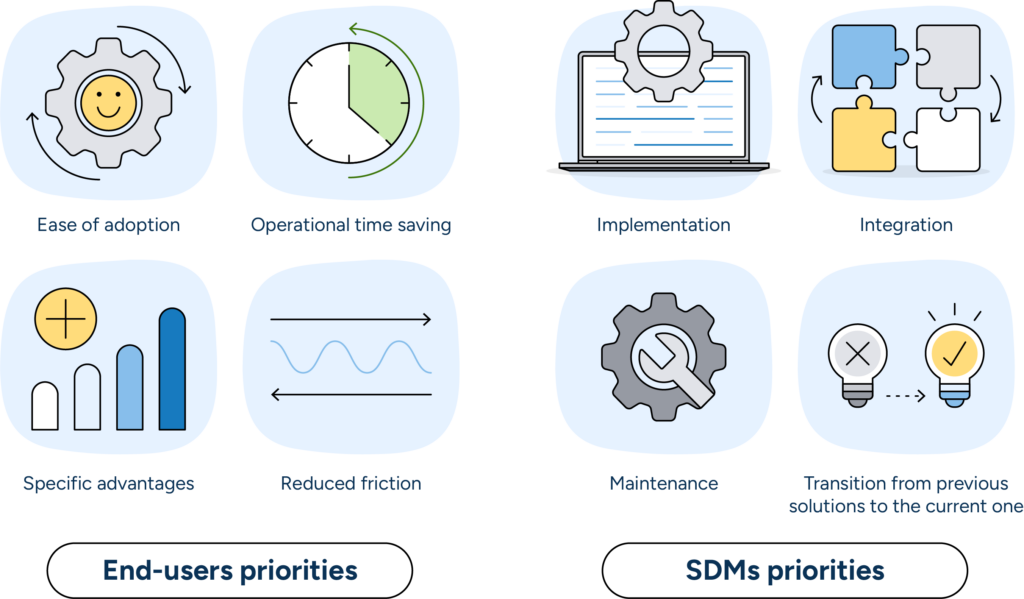

End-users and SDMs have different priorities regarding the functional capabilities of floor planning software. End-users primarily focus on practical aspects and effective communication. They seek tools that can support their day-to-day tasks, with considerations such as:

- Ease of adoption.

- Operational time savings.

- Specific advantages.

- Reduced friction.

Meanwhile, SDMs prioritize processes and cultural aspects. They consider the financial and time allocation costs associated with:

- Implementation.

- Integration.

- Maintenance.

- The transition from previous solutions to the current one.

Both parties frequently expect the other to adapt effortlessly to their selected solution. End-user groups might not fully grasp the challenges and effort needed for a seamless shift, while SDMs might undervalue the urgency and autonomy end-users seek in their tasks.

Purchasing choices encompass broader business ties and monetary aspects, but the notion of “value” tends to be overshadowed. Decisions usually lean heavily on the “total contract value,” which neglects the intricacies of expansive business ties and fiscal considerations. This causes businesses to focus on cost over a comprehensive assessment of value.

READ MORE: Retail space planning: Building the case for tech investment

What capabilities should be considered when selecting a solution?

The selection of a retail floor planning solution is a strategic decision. The right solution optimizes space utilization, improves the customer shopping experience, and boosts sales. Here are some essential capabilities to consider when evaluating options:

How will the tool help users increase day-to-day efficiency?

- User-friendly interface. The software should be intuitive and modern, reducing the learning curve and increasing efficiency and user adoption.

- Mobile compatibility. A mobile-friendly solution can benefit from two-way communication between store associates and merchandising teams in today’s dynamic environment.

- Collaboration tools. Floor planning often involves multiple stakeholders. Features like real-time editing or feedback mechanisms that support collaborative work can be advantageous.

- Feedback mechanism. The software needs a feedback loop wherein store operations managers and floor planners provide input on the practical implications and challenges of specific floor layouts, leading to continuous improvement.

- Support and training. A good solution provider will offer ample support and training options to ensure users can maximize the tool’s potential.

Does the tool have the robust data processing and analytics that I need?

- Data analytics and reporting. The solution should offer analytics capabilities that can extract insights from sales data, footfall, and other relevant metrics to reveal actionable opportunity improvements.

- Highlighting. Highlight performance metrics on the floor plan without creating complex formulas.

- Real-time data processing. This feature can help planners make swift decisions based on current data.

- Unified data modeling. The same data from a single-layered platform drives both micro and macro space planning decisions. This eliminates inconsistencies and data silos that can emerge when these processes are managed separately.

- Simulation and testing. The capability to simulate different floor layouts and their potential impact can be a game-changer, allowing retailers to test before implementing changes.

- Footfall analysis. Advanced solutions can analyze foot traffic patterns, helping retailers understand customer behavior and optimize store layouts accordingly.

- Digital wayfinding. Utilize floorplan data to integrate with advanced wayfinding systems, providing a seamless navigation experience for shoppers.

Can the tool scale and support us as our business grows and evolves?

- Configuration and scalability. The tool should be configurable to cater to the retailer’s specific needs and scalable to accommodate growth or changes in the retail format.

- Cloud-based. Cloud-based solutions offer flexibility, scalability, and the ability to access the system anywhere.

Companies must also think beyond technical capabilities when choosing a retail floor planning solution and consider if a solution provides a more holistic and agile approach to store optimization. This will lead to better space utilization, improved customer experience, and increased sales and profitability.

Unlock your full floor planning potential with a unified space management solution

Question: Why did the floor planner get promoted?

Answer: Every time they laid out a plan, sales went through the roof!

It’s a fun quip, but the joke accurately reflects the realities of the retail world. At the core of each thriving retail outlet stands a well-crafted floor plan. Macro-space planning is integral to retail operations beyond mere product and category allocations. Its essence lies in fostering a setting that amplifies the shopper’s experience, encouraging customers to linger longer and increase in-store spending.

Floor planning in the retail sector has recently undergone a transformation. Thanks to advancements in retail merchandising technology, responsibilities traditionally reserved for store operations or real estate departments are now distributed across category management, merchandising, and store operations teams.

This shift has introduced new capabilities in space management and optimization. Retailers must capitalize on this shift to enhance the consumer experience and drive revenue — and they’ll need the right unified space management solution to do it.