How to improve customer-centricity with in-store assortment collaboration

Sep 20, 2023 • 6 min

Today, customer-centricity is at the heart of any successful retailer. Sales and profit are no longer the only critical measurements of success, with retailers focusing more on the total retail experience. Given this new focus, the store’s role is increasingly essential to deliver a differentiated and satisfying shopping experience.

While many retailers widely use category insight data such as product performance, area demographics, and demand patterns to produce more customer-focused assortments, they fail to leverage the knowledge of those closest to the customer – the local store staff.

The customer is at the heart of all you do

Customer-centricity is the art of building and operating an organization based on its customers, not its products or the organization itself. For a retailer to be working in a customer-centric way, the following statements would be true:

- The organization and its stores are built considering the customer’s perspective.

- Customers have more input on the entire retail experience.

- Customer information is used appropriately to enhance the shopping experience.

- Stores are tailored to different customer profiles and shopping goals.

A correctly implemented customer-centric strategy helps create a more positive shopping experience for customers, which, in turn, drives customer satisfaction, loyalty, and increased sales.

Localized means optimized

Optimizing at the store level is complicated by the number of stores and the geography and demographic spread they represent. The most common and effective way retailers mitigate this is by building product assortments focused on localized consumer demand, meaning that the products in the store reflect the demand for that area.

To facilitate this, retailers must first fully understand their categories and the consumers that shop them. Centrally collected information such as product sales, consumer wealth, ethnicity, age, and lifestyle helps retailers understand an area’s demographics and what consumers are likely to buy.

By bringing about a more granular understanding of the consumer through an awareness of the role of localization by category, these valuable insights allow retailers to enhance their assortment offering, considering the following:

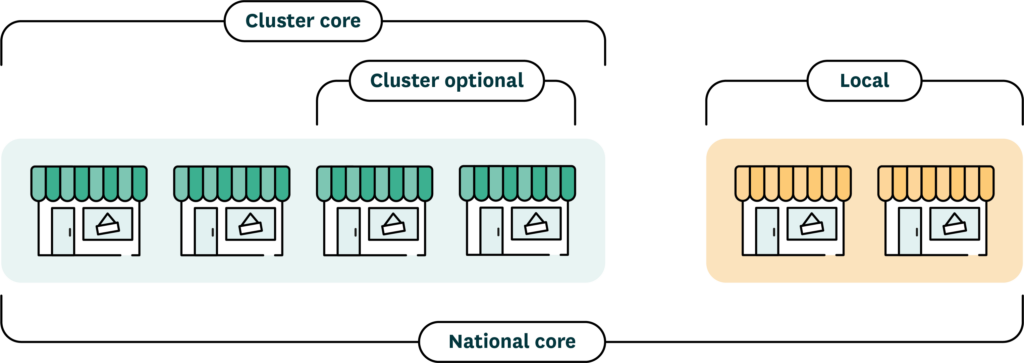

- National core – Items sold in all stores regardless of cluster or size.

- Cluster core – Items in addition to the national core products that are sold in specific stores based on clustering criteria.

- Cluster optional – Items sold where possible but may be dropped due to availability or sourcing issues.

- Local – Items required for a single or limited group of stores, such as locally sourced, independently manufactured products.

Given a typical business process, once a retailer creates the cluster-level assortments, store-specific product performance data is fed into the retailer’s planogramming software. Based on rates of sale, this software will then recommend the inventory each store should carry to satisfy local demand and build the planograms to suit. This approach can result in the most optimal assortment and inventory levels when considering both commercial and supply chain perspectives.

The challenge lies in collaboration

Consumer and category insights paired with product performance data are essential to building localized assortments that provide a credible reflection of localized demand and will undoubtedly increase category performance and customer-centricity.

The problem with averages is that they only suit some and, quite understandably, these insights cannot cater to every bespoke and local edge case, such as when the cultural makeup of an area has rapidly changed or a loyal customer’s favorite product has been replaced with another. The challenge then becomes how to produce a cost-effective assortment that satisfies average local consumer demand while understanding and satisfying smaller, local edge cases that tend to be known only by the store staff.

The best way to meet local consumer assortment requests is through intervention from the store staff–those closest to customers and who know the exact products they want. This issue is especially relevant for convenience retailers, where stores tend to be situated in the heart of neighborhoods and for whom satisfying local demand is critical to success.

Today, some retailers have established collaboration between stores and central headquarters teams. However, the mechanisms currently used to facilitate collaboration require significant improvement. Traditionally, collaboration has been done through email, telephone, or face-to-face meetings, resulting in poor traceability and visibility and limited reporting capabilities.

Without stores having clarity on core products, product dimensions, performance data, and merchandising strategy, retailers often feel nervous about allowing their stores to request changes to centrally proposed planograms. This lack of visibility frequently leads to many store requests being declined, thus reducing buy-in and wasted time.

Solving the challenge by leveraging in-store knowledge

Augmenting an optimized planogramming process with the ability to leverage in-store knowledge enables centralized merchandising teams and stores to collaborate on proposed assortments while delivering the visibility and guidance to support such decisions. This visibility and direction, often overlooked, can be the critical factor in whether a collaboration process fails or succeeds.

It is essential to remember that store employees generally will not be as well-versed in industry talk or space planning as those within retailers’ central merchandising teams. Therefore, a mutually understood communication method is essential when communicating between stores and their support centers. For example, central merchandisers use planograms to communicate how store assortments should be displayed. The planograms are centrally created and communicated to stores, where store employees review and implement them according to their live date.

It’s clear why planograms are omnipresent across most forms of retail, as they depict what products should be placed where and in what quantity. Therefore, it seems logical for stores to use planograms to communicate suggested assortment changes to their colleagues at the support centers to review.

When stripping away complications such as repository location, versioning, statuses, and blocking, the fundamentals of modifying a retail planogram are relatively simple. Today, one can simply select a box on a screen (a product) and drag it into position on another part of the screen where it is to be placed (the planogram).

To ensure a streamlined support center review process, planograms should run through merchandising quality controls that inform and guide store employees as they suggest changes so that requests are more likely to be approved. Guidance from the support center can come in various ways. Therefore, they must focus on the most common reasons assortment change requests may be declined or require intervention.

Performance is one of the most important factors when choosing what products to include in an assortment. Therefore, enabling store employees to see product performance data is vital in ensuring that their assortment change decisions are informed, lessening the need for input by support center staff. For additional insight, performance data should be visible only for the store suggesting changes or, where not available, for similar stores such as those in the same cluster.

Another critical factor when defining an assortment is finding the right balance between core and non-core (optional) products. When central merchandisers determine their core assortment; they should make stores suggesting changes aware of which products are core and cannot be changed and which are optional. Further, the retailer can implement controls to stop store staff from making changes based on specific criteria.

Once stores submit change requests, the system should automatically notify central users with supporting information, such as which store requested the changes and what they are. It is vital that the store-requested changes can be easily reviewed as either a planogram, where there are only a few stores requesting changes, or a report, where there are many.

The authorization process should be as streamlined as possible to ensure little or no manual steps are required from the central team. Changes should be easily approved or declined, and the subsequent communication should be sent to the appropriate stores.

Implementing an in-store collaboration process enables retailers to tailor assortments to their customers’ needs, improving customer loyalty, business revenue, and the overall shopping experience. In addition to making use of centrally collected data, retailers can leverage the knowledge of those closest to their customers to create a genuinely bespoke customer experience.

As with customer-centricity itself, the return on investment of an in-store collaboration process is not only measured in additional revenue but also in customer satisfaction. In an increasingly competitive marketplace, catering to customer needs at these micro levels could well be the key differentiator for customers when choosing where to shop.