More efficient seasonal inventory management

Jul 1, 2022 • 11 min

When the snow is piling up several feet deep, you simply can’t buy a snow shovel for love nor money. When it rains through July and August, sunscreen sits on the shelves. And regardless of the weather, there always seem to be season’s greetings cards available at half price around the first of the year, bags of candy going cheap after Halloween, and flowers wilting after Singles’ Day.

No one is suggesting that seasonal inventory management is easy. There are so many variables to consider in inventory planning, not least the weather. However, there are plenty of companies who have managed to master seasonality, turning it from a problem into an opportunity. These companies have managed to increase their sales and their profits by improving the on-shelf availability of seasonal products and reducing residual stocks when the season ends. So how do they do it?

Categorize Your Seasonal Products

What do we mean when we talk about a season? That depends, to some extent, on who is doing the talking. One man’s season is another one’s page on the calendar and a third one’s holiday. Broadly speaking, we categorize seasonal products based on three variables:

- Life cycle of the product.

- Length of the season.

- Lead time of purchases.

The life cycle of the product refers to whether the product has a life off-season as well as during the season with which it’s associated. For some products, sales are related to a specific season, such as Easter or summer. You don’t want to offer these products outside the season. A good example is Christmas decorations; any left in stores on Christmas Eve are transformed at the instant the store closes from a must-have to a liability.

Some products are sold year-round but still experience peaks and troughs of demand according to the season. For example, ingredients to make jam sell throughout the year, but sales spike during the berry harvest season and may spike again, albeit more modestly, in January, when Seville oranges are available for people to make marmalade.

In general, the more seasonal a product is, the more difficult it is to manage. There are three key challenges:

- A high risk of residual post-season stock.

- Products often have to be purchased before the beginning of the season.

- Turnover of products from one year’s season to the next is usually high, i.e., sales of a certain item during a previous season cannot be used reliably to predict future sales.

The length of a season generally determines the extent to which it’s possible to respond to actual sales during the season. A distinction should be made between short seasons that you have to prepare for by delivering the entire estimated demand to the stores in advance and longer seasons that allow stock to be replenished several times.

The lead time of purchases dictates whether the purchasing decision has to be made in advance or allows the purchase of more goods during the season. This determines the degree of risk related to purchase decisions made before the start of the season. If the lead time is long, purchase decisions have to be made well in advance of the season. On the other hand, a short lead time means that sales during the season can be used to forecast demand and inform additional purchase decisions.

Select an Efficient Seasonal Inventory Management Model

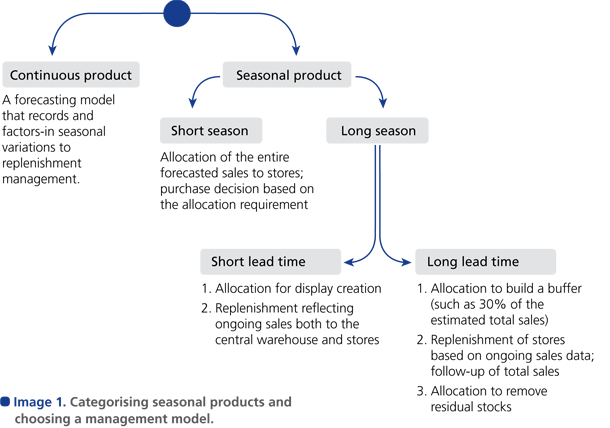

Based on these three variables – product life cycle (continuous/seasonal product), length of season (all demand to be delivered to stores at one time/possibility of stock replenishment during a season), and purchasing lead time (ordering in advance/possibility of placing additional orders with the supplier during the season) – seasonal products can be categorized, and the correct inventory management model can be selected for each situation.

Product Life Cycle Affects Forecasting

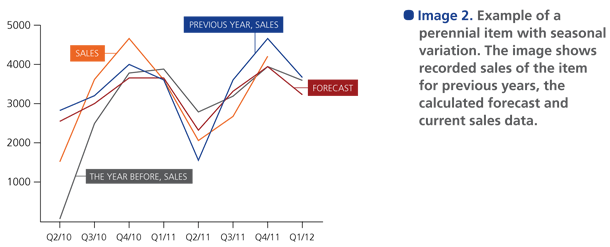

The turnover of perennial products is usually lower than that of purely seasonal products. Life cycles of products like jam sugar or double cream can be quite long, and data showing seasonal variations in sales may go back several years.

A good sales forecast based on historical data and that accounts for seasonal variations is often enough to drive product replenishment for perennial products throughout the year. There are, of course, situations where additional shelf space or a specially commissioned display unit is given over to a product as part of a seasonal promotion. Nevertheless, a calculated forecast combined with an updated reserve supply or shelf replenishment goal will normally provide a solid basis for managing its replenishment.

A couple of different models for seasonal forecasting are available. They usually aim to predict the development of basic sales or seasonal trends using indices linked to a given week or month. When holidays, such as Easter or Eid, shift around the calendar, the usual seasonal models do not work. Forecasting models in which the index is linked to the event give much better results. If the turnover of products is not significant, a reference product can be specified against which seasonal or event-specific indices can be calculated for new products.

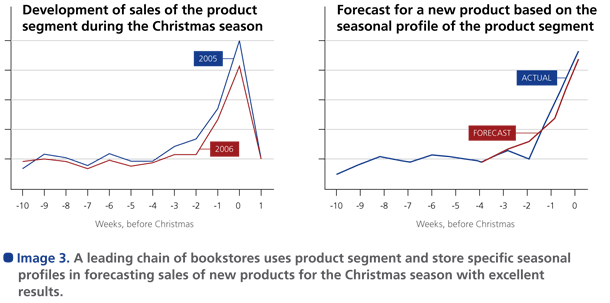

In many sectors, the nature of seasonal sales means that there’s a high turnover of product lines from a given season one year to the next. While a lot of books and PC games are sold every Christmas, this year’s selection of books and games will be markedly different from the previous year. When a really large number of new products enter the market at the same time, specifying reference products for every product is simply overwhelming. In practice, businesses tend to reference the most important lines and simply hope for the best with the rest. So to spread the gains from this sort of indexing across one’s entire seasonal range, you need to automate.

In these situations, using product-segment-specific seasonal profiles gives good results. In practice, basic sales are estimated based on the available sales history for the product (even if just a couple of weeks’ history is available before the beginning of the high season).

The effect of the season on the sales of the product is estimated based on previous seasonal variation in the product segment and in the store in question. As far as possible, the product and store-specific forecast is updated during the season based on actual sales.

A Short Season Requires Efficient Allocation

Short seasons, such as that for selling roses before Mother’s Day, do not allow for responses based on actual sales. The entire demand has to be purchased in advance and delivered to stores before the season.

Short seasons are generally managed by stores placing advanced orders. This approach ensures stores commit to purchasing agreed quantities and minimizes the risk of residual stock left in the central warehouse. It also prevents the stores that place their orders first from emptying the central warehouse before slower stores place their orders. However, the accuracy of orders is often poor. The ability of staff to judge demand correctly and focus their orders correctly varies greatly from store to store. Some take a lot of time and trouble to estimate demand. Some base order quantities purely on gut feeling, while others forget to order altogether. All too often, the result is that some outlets are unable to meet demand while others can’t shift what they’ve ordered.

Centralized purchasing and allocation usually lead to better results. Centralized distribution allows for systematic evaluation of needs on a store-by-store basis – moving from orders based on instinct and guesswork to an evidence-based decision-making process.

Utilizing store-specific sales data is important when making allocation decisions. Generalization and categorizing stores based on size or type of store, for example, may lead to poor results. Distribution should be based either on product and store-specific forecasts or, if not available, on the store-specific historical sales of the given product segment. In the case of seasonal products sold year-round or outside the season, inventory levels in the store must also be taken into account when allocations are made. The end result then reflects as closely as possible the potential of an individual store to sell a particular item.

Smarter, More Responsive Replenishment During Longer Seasons

Where products have long seasons, smart replenishment clearly improves a store’s responsiveness regardless of whether stock must be purchased as a single batch or offers flexible repeat ordering based on sales. Using opportunities efficiently to respond to the needs of stores typically leads to much better results without additional investment in stock. If you ship out your entire season’s stock of an item to stores all at once, the only possibility to respond to actual sales is to move goods between stores. That’s inefficient, labor-intensive, and expensive.

A good solution is to deliver only a part of the forecast demand to stores at the beginning of the season. Better to send a store enough stock to build a display or, alternatively, a third of what you expect a particular store to sell throughout the season. When the season begins, and sales data comes in, stocks at individual stores can be replenished through pull control, i.e., based on the latest data-based, store-specific forecasts and their actual inventory. This allows you to respond far more effectively to local conditions, such as variations in the weather (the barbecue season generally starts earlier in some parts of a country than others) or a change in competition for an individual store.

Where products are bought in advance, push control should be used toward the end of the season to ensure that seasonal products don’t pile up unnoticed in the central warehouse. Efficient follow-up quickly determines when and where residual stocks should be sent. Good system support allows allocations to be directed to the stores with the best chances of selling the products – those with the highest sales and no excess inventory.

Shorter Purchasing Lead Times Reduce Inventory Risk

Product lead times are a key factor in purchasing patterns. If the delivery time is long, purchase decisions have to be made well in advance of the season. Chances to increase or decrease the total volume during the season become more limited the longer the delivery time. Take garden furniture bought from Asian factories and shipped by sea. Orders have to be placed several months before the beginning of the season, when information on the actual sales for the season is finally available and the goods have either already arrived or are on board a ship on the way to the port.

Storing the furniture over the winter is expensive, and it may not sit well alongside next season’s ranges. If the sales don’t meet forecasts, residual stock has to be sold off at the season’s end, often at a large discount. Monitoring sales and following up efficiently means that you can make your inventory work harder for you by deploying it to the greatest effect. As the old saying goes, “The first discount is always the cheapest one,” meaning that even a small discount during the season can speed up sales, as can changes in display or advertising. At the end of a season, however, getting rid of inventory means discounting far harder, and that can consume practically the entire margin.

A quick response also helps if sales exceed forecasts. Even if lead times prevent re-orders from being placed with the original supplier, an alternative source with a shorter lead time may be found closer to home. The purchase price may be slightly higher, but as by now you already have hard sales data, your forecasting becomes much more reliable, and there is a far, far lower inventory risk. Margins may be a little slimmer, but you can still make a profit by meeting demand that would otherwise have been untapped.

Conversely, if a product’s delivery time is relatively short, you don’t need to hoard supplies for the entire season. Your start-of-season stock levels should give stores enough to build and maintain displays while you can keep a suitable buffer stock in your main warehouse. The buffer stock should be calculated with particular care, especially where weather plays a significant part in driving or impeding sales. The buffer has to be big enough to be able to meet a sharp peak in demand. On the other hand, the buffer should be modest enough so that you can shift the entire lot if the weather is against you. The buffer stock should be run down after the main seasonal peak and maintained for the most critical products as the end of the season approaches.

Toward More Efficient Seasonal Inventory Management

Understanding the dynamics of seasonal products helps determine the best control method. Forecasting, purchasing, and store replenishment need to be approached in different ways for different seasons and products.

It is important to remember that a model of operations is not necessarily the best one simply because it has been used for years. Time and time again over the years, retailers have had enough stock to cover the whole season pushed to stores at once, even though the season was long enough to have allowed store replenishment to be based on sales.

Typically the reasons for this include:

- Time-saving: if multiple replenishment orders created a lot of work, allocation as one batch might have saved time.

- Lead times: If the purchasing lead time is long, control may have been based on advance orders placed by stores.

- Minimum delivery size: If products are delivered from the supplier straight to the stores, the supplier may have required large delivery batches.

All these things can be changed, however, as many of RELEX’s customers have come to realize. A good understanding of the most advantageous control models and the results that can be obtained with them helps bring about change.

The best results are achieved when the importance of seasonal inventory management is understood throughout the company. In practice, the process of selection has a major bearing on the results of season management. If the seasonal selection is too extensive, there will be residual stocks regardless of the control method. The management, on the other hand, should be able to determine the goals, especially how service level and inventory risk should be weighted for different products. If it’s decided that all products should be available in all stores all the time until the end of the season, there is no way to avoid residual stocks.

It shouldn’t be hard to persuade your business to put proper seasonal inventory management in place. Real benefits can be achieved that directly affect the company’s results. RELEX’s customers have been able to improve the availability of seasonal products, increase their sales and their market share, reduce residual post-season stocks, and free up space and time in stores through the more efficient management of product flows.

One Retail Chain’s Results

RELEX worked with Vianor, a global tire and car service chain with 800 outlets in 20 countries, to develop their seasonal sales forecasting and store replenishment to reduce reliance on advance orders. The results were impressive!

- Average inventory value before the season decreased by 30%

- Improved availability in all product groups

- In shortage situations, products could be distributed to the places they were most likely to sell.

- Comparable sales growth 7%

- Order and delivery sizes increased to cut transport cost

- Store space used for stock storage was freed up for their “tire hotel” business

- Staff spent less time placing orders and more on productive work