Planning shelves optimally

Aug 16, 2023 • 5 min

This article was originally published in Lebensmittel Praxis.

Optimizing shelves by planogram can quickly go awry. However, using a store-specific planogram is a successful approach that has been possible for a longer period of time.

A new planogram is supposed to be implemented on the shelf. But it doesn’t work. It provides too few facings for the fast-moving store brand article, but too many facings for products that do not perform. Some products are in the planogram, even though they are not profitable for the store and are marked down again and again. Why are they even included in the planogram? In the end, the store creates its own planogram, which is very cumbersome, costs a lot of time, and even more nerves. And worse, valuable insights into category-specific placement are lost in the process. Store-specific planograms can provide a remedy.

Store-specific planograms

If store-specific performance data is considered for optimization instead of average data, planograms often gain a whole new relevance. The result is a layout that is tailored to each individual store, and, most importantly, it can also be implemented. This proves to be a real added value for all involved.

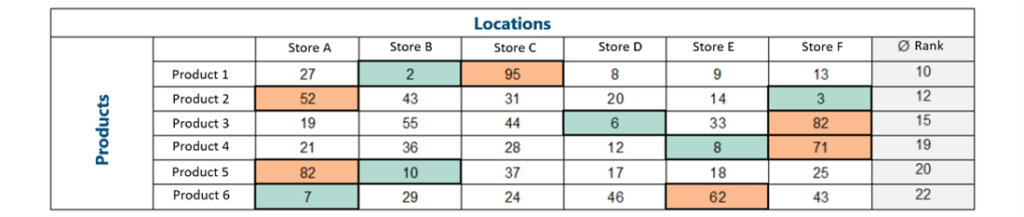

Store-specific planograms consider the special requirements of each individual store. The product ranking (see illustration) is factored into creating store-specific layouts. Products with a high ranking, therefore, have more facings. Products with a low ranking are placed with fewer facings. Uneconomical products can even be rationalized away. “This is not based on historical data, but on forecasts for the future,” says Josef Ilgen, Lead Principal Category Management at RELEX Solutions.

Measurable results

An automated solution that creates store-specific planograms is the prerequisite for implementing planograms. It adjusts the facings and thereby achieves:

- 1–3% higher turnover

- 5–10% reduction in spoilage and

- increased product availability.

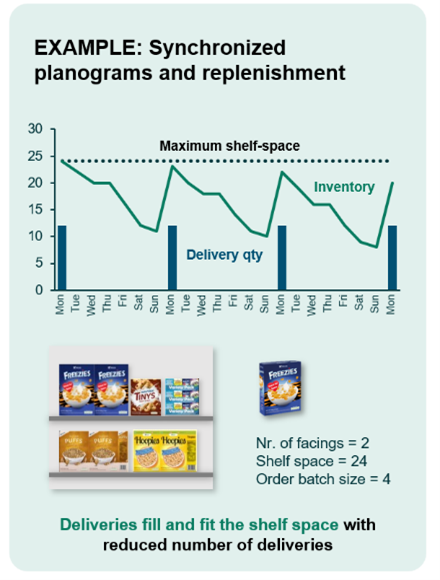

When planograms are also synchronized with the supply chain, their full potential is realized. The difficulty is that space & assortment and supply chain are treated as different areas organizationally and their KPI drivers may differ. For both the supply chain and the stores, store-specific planograms offer significant cost-saving opportunities.

This is also demonstrated by the analyses of Sam Welton, Vice President of Product, Space & Assortment at RELEX Solutions: “In our experience, retailers save operating costs of up to 1% with direct-to-shelf replenishment, reduce delivery rows to the store by 25 to 35% and experience 15 to 25% fewer breaches of the shelf space available.”

Automation as a prerequisite

This is particularly important for fast-moving items, these should be picked less frequently, but in larger quantities, to provide sufficient days of supply over the delivery cycle. This is also good news from the logistics point of view.

UK grocery retailer East of England Co-op, for example, saw a 2.2% increase in sales by introducing store-specific planogramming. “It takes the latest shopper insights as well as profound space & assortment know-how for deriving accurate rules that provide the basis for an optimal automated solution. In addition, these rules must heed the requirements of retail,” emphasizes Alexander Ehrl, Managing Director of Plan + Impuls.

The planogram requirements can vary by category and size. When it comes to placement, is the relevant search criteria for the shopper more likely to be the brand? The sub-category? Or something completely different? Should the product be placed vertically or horizontally? Which quotas should be allocated to which sub-category, of course the retailer who decides which KPIs are decisive according to his strategy.

Planograms and the supply chain

The full potential is tapped when planograms and supply chain communicate with each other, i.e., there is a two-way exchange of information. Supply chain data is taken into account when creating store-specific planograms. And vice versa, shelf space information (how much space do I have on the shelf?) is fed back from the store-specific planograms to the supply chain to optimize the store’s order proposals.

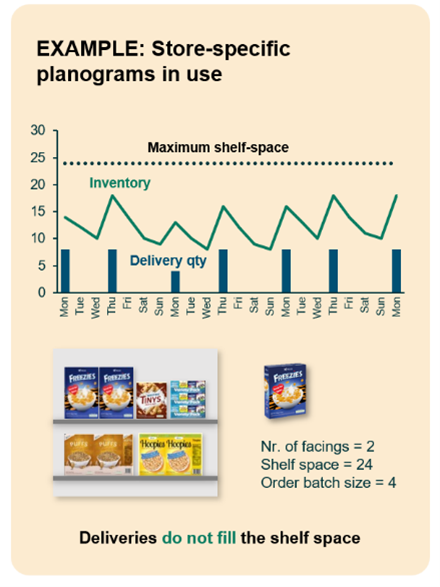

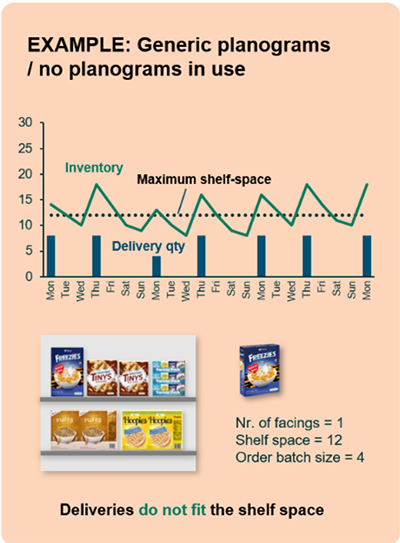

If the planogram is created independently of the supply chain, the delivered goods may not fit onto the shelf – a classic problem. In retail, this is commonly referred to as overstock or excess inventory. The opposite situation is also possible: the shelf capacity is not fully utilized. The goods are delivered repeatedly, although one delivery would be sufficient for replenishing.

The influence of planograms on the supply chain

Suitable categories

Categories with high turnover and sales fluctuations are particularly suitable for store-specific planograms, e.g., disposable drinks, savory biscuits or even dairy products.

To unpack trays or not?

This is an exciting question that is not easy to answer. Unpacking trays costs time. But not unpacking trays costs even more time. It is better to refill a slow-mover a few times than to constantly refill the fast-mover. Store-specific planograms can make unpacking possible for slow-movers, thereby freeing up valuable space for fast-moving items.