Availability, fresh management, store replenishment, space management, demand planning — these are all essential processes that enable retailers to effectively present inventory to customers. However, all this effort is at risk of success if the retailer’s pricing strategies and processes are inadequate. When prices are too high, retailers risk lost sales and falling customer loyalty. If prices are too low, already thin margins are further endangered.

Effective pricing depends on two critical actions:

- Setting the right price for the right products.

- Balancing when to be competitive and when to prioritize margins.

Monitoring competitors, negotiating with suppliers, analyzing customer behaviors, and complying with local regulations are relatively common practices for pricing planners. However, challenges like limited resources, inflation, and the need to cover increased costs of goods sold to maintain margins complicate adherence to strategic pricing. When consumer budgets stretch and competitive pressures grow, retailers must drive agile, responsive, and data-driven pricing decisions.

1. Building the case: Family Hypermarket’s price optimization needs

To demonstrate building a business case for technology investment, we will follow a fictional model retailer, “Family Hypermarket.”

Family Hypermarket is a $5 billion general merchandise and grocery chain based in the United States. They have grown to 300 stores and five distribution centers, carrying an average of 40,000 SKUs per store. The company also supports online channels offering direct delivery and in-store pick-up.

Patricia, Family Hypermarket’s VP of Pricing, has noticed increasing margin erosion with their current base pricing strategy and feels pressure from increased competition regionally and online. To protect their margin while maintaining a competitive price image, she decides that Family Hypermarket needs to invest in a new solution to give her planning team processes that are less manual, faster, and more data-driven.

Patricia knows that her coworker, Matthew, was successful in his efforts with promotion planning technology investment by building a comprehensive business case. After speaking with him, she commits to building a case for investment in a new pricing optimization solution.

1.1 Assess the current state of Family Hypermarket’s pricing process

Patricia understands that to get Family Hypermarket where it needs to be, she must have a clear and honest picture of its current state. She meets with her planning team to assess the current state of their pricing planning strategies and processes.

After the meeting with her team, Patricia creates a list of the top five topics discussed:

- Overreliance on spreadsheets. The Family Hypermarket pricing process is very manual, and the team must rely heavily on spreadsheets, which are time-consuming and prone to errors. When they need to collaborate with other teams or each other, the process of sharing spreadsheets without risking data corruption or loss can be challenging.

- Reactivity to price changes. The team’s manual process means it struggles to adapt and adjust prices quickly to reflect market dynamics, cost changes, and competitor prices. They know that this is critical, especially in times of inflation, but they lack the agility and automation to move quickly without fear of error.

- Inaccurate pricing. The team’s current processes limit them when implementing tailored pricing strategies for different levels, such as channels, regions, or stores. They struggle to scale pricing to match customer segmentation and local competition, resulting in decreased sales and customer satisfaction.

- Lack of internal alignment. The team operates largely in isolation from other planning functions essential to everyone’s success, particularly promotions. Their lack of alignment and visibility means that promotions may skew overall profit accuracy and impact halo, cannibalization, and switching effects, leading to inaccurate sales and profit insights.

- Ineffective strategy development. The team lacks the level of insight needed to drive highly effective strategies. Questions like, “Which products should we price competitively, and which products should be used to bring in margin?” and “Should we have an ‘every-day-low-price’ strategy for a certain category in a certain store, or should we plan deep promotions?” are difficult to answer at a product-location level.

1.2 Use the current state to identify challenge areas and improvement needs.

A clear understanding of the current challenges allows Patricia to identify the critical areas where Family Hypermarket’s pricing strategy needs improvement. Her objective is to enhance agility, accuracy, and data-driven decision-making in pricing, ensuring the retailer remains competitive and profitable in a volatile market environment.

To accomplish this, Patricia focuses on four main initiatives:

Automated price recommendations

Patricia proposes implementing an automated pricing solution that supports flexible rule-setting that aligns with Family Hypermarket’s strategic goals. The solution would enable the configuration of dynamic pricing rules that account for competitive pricing strategies. These rules would allow the company to adjust prices to be more, less, or equally priced compared to competitors while maintaining desired margins and ensuring regulatory compliance. It would also enable “resort pricing,” allowing the company to automatically respond to changes in local seasonal demand and the spending pattern of customers.

AI-driven price optimization

Patricia plans to use AI-driven technology to optimize pricing at every level, including product, assortment, and region. This approach will take advantage of advanced predictive analytics and price elasticity models to determine the most effective price points. Integrating AI capabilities will enable the team to make precise, data-driven pricing decisions that balance competitiveness with profitability, enhancing their ability to respond swiftly to market dynamics.

Robust analytics and scenario testing

Patricia suggests implementing robust scenario testing capabilities to ensure strategic and informed pricing decisions. This will allow the team to simulate the potential impacts of different pricing strategies on sales, margins, and competitive positioning. The insights gained from these simulations will enable the team to forecast the effects of price adjustments, ensuring compliance with internal guidelines while making more confident, informed decisions.

Streamlined pricing process

Patricia sees an opportunity to enhance the pricing process through better collaboration and integration to improve efficiency. She advocates for tools that facilitate seamless communication, like built-in approval workflows and real-time notifications. Unifying pricing with promotion planning in a single platform will provide greater transparency, alignment, and accuracy, leading to a more coordinated and effective pricing decisions.

Ultimately, Patricia aims to create a dynamic and data-driven pricing strategy that positions Family Hypermarket to better navigate market changes, maximize profitability, and maintain a strong competitive edge.

1.3 Develop realistic improvement goals based on researched data and benchmarks

Gaining a clear view of Family Hypermarket’s current challenges and improvement areas allows Patricia to establish realistic goals for enhancing the retailer’s pricing strategy. She breaks these down into two categories: commercial goals focused on revenue and profit and operational goals aimed at efficiency and productivity. These goals are informed by researched data and benchmarks, ensuring they are both ambitious and achievable.

Commercial goals

Patricia’s commercial objectives center around AI-driven price optimization and scenario planning to boost revenue and profitability. She aims to attract returning and new shoppers through more competitive and responsive pricing strategies to realize a 1-2% increase in sales volume. This gain would stem from AI-powered insights that fine-tune prices to meet customer demand patterns and competitive pressures.

She also expects a 1-2% improvement in gross profit margins stemming from using scenario planning to simulate different pricing actions. This goal hinges on optimizing pricing strategies across products, assortments, and regions, ensuring Family Hypermarket remains competitive while preserving margins.

Operational goals

On the operational side, Patricia focuses on enhancing efficiency through automated price recommendations and a streamlined pricing process. She targets a 15-25% increase in team productivity resulting from the new pricing solution’s ability to automate routine tasks. This would reduce the manual workload, allowing the team to focus on strategic decision-making rather than time-consuming data entry and spreadsheet management.

Patricia also wants to consider the impact of integrating a streamlined pricing process with improved collaboration tools and workflow efficiencies. Patricia aims for a 1-3% increase in net profit, driven by faster, more accurate pricing adjustments and a more cohesive planning environment.

Non-financial goals

Beyond financial targets, Patricia also sets non-financial objectives that will strengthen Family Hypermarket’s internal processes. She emphasizes better alignment with the promotion team, ensuring pricing and promotional strategies work in tandem to maximize sales and customer satisfaction.

Patricia also seeks to enhance the team’s ability to react swiftly to price changes, minimizing the lag between market shifts and strategic responses. These goals support a more agile, data-driven pricing strategy, positioning Family Hypermarket to thrive in a dynamic retail landscape.

Setting these goals enables Patricia to lay the groundwork for a price optimization journey that balances profitability with operational excellence, aligning Family Hypermarket’s strategy with its growth ambitions.

2. Family Hypermarket’s business case for investing in pricing optimization technology

Patricia needs to quantify the financial benefits that the technology can deliver to build a compelling business case for investing in a pricing optimization solution. She uses real-world data and benchmarks gained from collaborating with the technology vendor to estimate potential gains across both commercial and operational metrics. This approach provides a clear, evidence-based projection of the value Family Hypermarket could achieve by implementing advanced pricing optimization tools.

2.1 The financial benefits of improved pricing and optimization

Patricia’s financial assessment focuses on both commercial and operational improvements. She calculates potential gains over three years, providing a robust foundation for her business case.

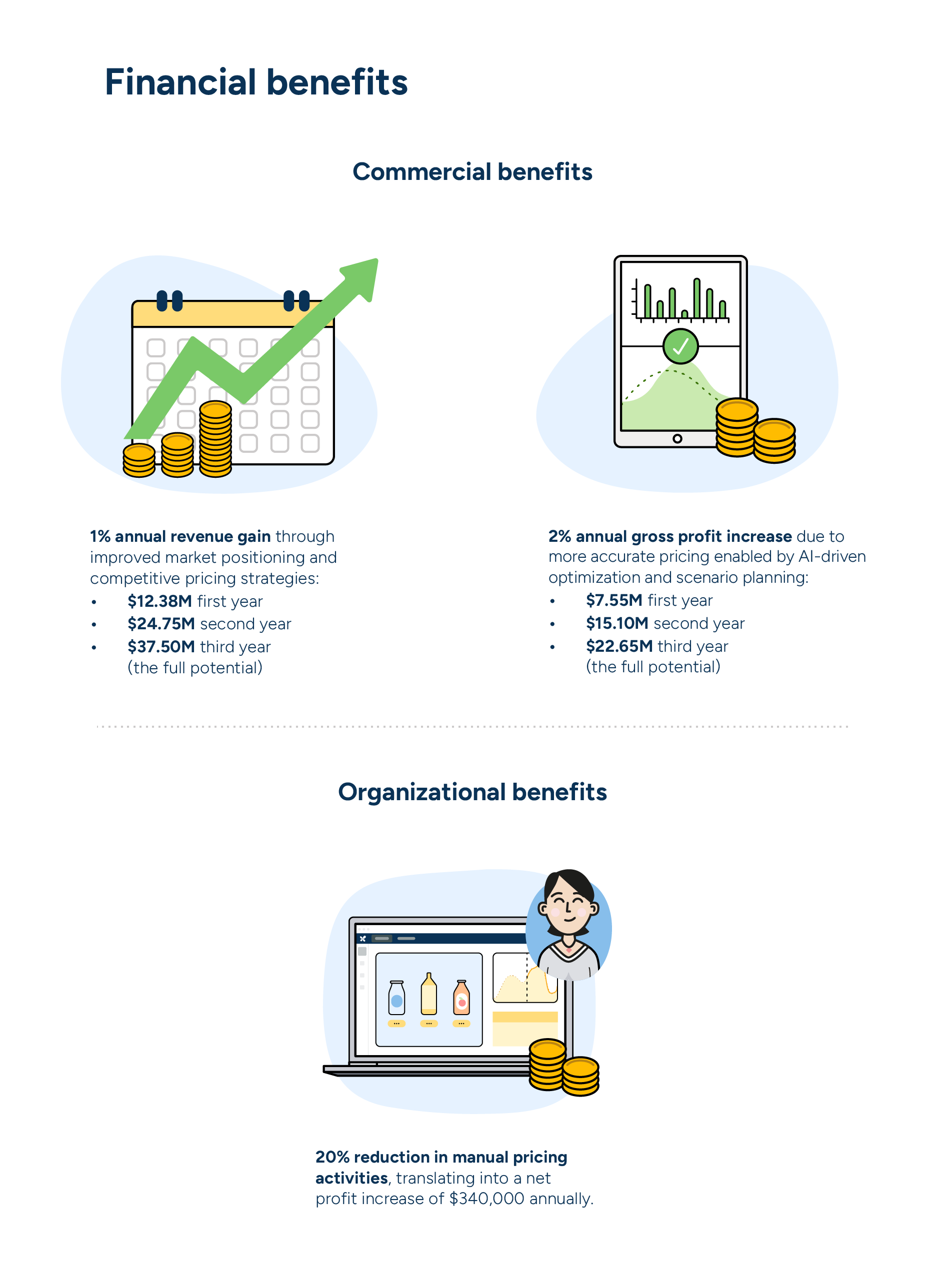

Commercial benefits

Patricia’s analysis, incorporating a safety margin and targeting categories that would benefit from optimization, reveals that the solution could drive a 1% annual revenue gain through improved market positioning and competitive pricing strategies. This increase would result in an annual benefit of $37.5 million, with the value ramping up progressively:

- $12.38 million in the first year

- $24.75 million in the second

- $37.5 million by the third year (the full potential)

Additionally, she projects a 2% annual gross profit increase due to more accurate pricing enabled by AI-driven optimization and scenario planning. This improvement would add $22.65 million to Family Hypermarket’s annual gross profit. As with the revenue gains, the company would realize the financial benefits from gross profit enhancement gradually over three years:

- $7.55 million in the first year

- $15.1 million in the second year

- $22.65 million in the third year (the full potential)

Operational benefits

On the operational front, Patricia estimates a 20% reduction in time spent on manual pricing activities. Once fully realized, this efficiency gain is expected to translate into a net profit increase of $340,000 annually. The savings would primarily come from automating routine tasks, allowing the pricing team to focus on strategic initiatives rather than manual data handling and spreadsheet management.

2.2 The intangible benefits of improved pricing optimization

The financial gains from a price optimization solution are compelling, but Patricia also recognizes several intangible benefits that would enhance Family Hypermarket’s overall business performance. These less quantifiable yet equally critical advantages further support the investment case.

- Unified collaboration with promotions. Family Hypermarket can align pricing strategies closely with Matthew’s promotions team to create a seamless link between pricing and promotional planning. This unified approach ensures that promotional discounts and base pricing strategies complement each other, reducing conflicts and maximizing the impact of both efforts. This collaboration will help maintain consistency across all customer touchpoints and improve overall sales effectiveness.

- Increased precision and productivity. Implementing a more automated, data-driven pricing process allows the team to reduce reliance on manual tasks and focus on higher-value activities. This shift boosts productivity and enhances the accuracy of pricing decisions, ensuring that prices reflect real-time market conditions and customer preferences. The streamlined process will free up time for strategic planning, fostering a more agile and proactive pricing strategy.

- Improved competitive edge. Advanced pricing optimization gives Patricia’s team the tools to position Family Hypermarket more effectively against competitor prices. The company can dynamically adjust prices in response to market movements and competitor actions to maintain a strong competitive stance, ensuring customers see them as a top choice for value and selection.

- Enhanced customer experience and margin protection. Maintaining competitive prices without eroding margins enables Family Hypermarket to offer the shopping experience customers expect. The retailer can retain and attract customers through data-driven pricing that balances customer needs with profitability while safeguarding its bottom line. This strategic balance helps build customer loyalty and reinforces the retailer’s market position.

- Maintained or improved price image. A more sophisticated pricing approach allows Family Hypermarket to maintain, if not improve, its price image in the eyes of consumers. Family Hypermarket can consistently offer fair and competitive pricing that reflects market conditions to enhance customer trust and loyalty, further cementing its reputation as a retailer that provides value and quality.

Highlighting these intangible benefits empowers Patricia to make a strong case that the price optimization solution offers more than just financial advantages. It also provides strategic gains that will support Family Hypermarket’s long-term growth and competitive positioning in a challenging retail landscape.

3. The key takeaway: Data-driven insights and strategic collaboration fuel sustainable results

As Patricia’s approach shows, a persuasive business case for price optimization relies on a thorough assessment of the current state, enriched by accurate, real-world data. Industry benchmarks provide a helpful starting point, but they fall short of capturing Family Hypermarket’s unique pricing dynamics and their specific challenges. A tailored approach — grounded in the retailer’s own data — offers a more realistic perspective for making informed investment decisions.

Because she carefully constructed her business case with detailed research and data-backed analysis, Patricia feels confident in her choice of technology and the vendor she will present to Family Hypermarket’s leadership team. Her well-founded business case justifies the initial investment while also serving as a strategic tool to:

- Guide discussions with vendors to verify they fully understand and can meet Family Hypermarket’s unique pricing needs.

- Define clear priorities and expectations internally and externally, ensuring all teams remain aligned throughout the technology’s implementation and beyond.

- Establish concrete KPIs and timelines that will drive the deployment process and support ongoing evaluation of the solution’s effectiveness.

In cases where retailers lack comprehensive data or historical pricing insights, open dialogue with potential vendors becomes crucial. Vendors can often provide valuable guidance based on their industry experience, but evaluating their credibility through customer references is critical to ensure that their estimates are realistic and reliable.

The combination of data-driven analysis and strategic vendor collaboration allows Patricia to set the stage for a pricing optimization strategy that will deliver measurable results and sustain Family Hypermarket’s competitive advantage.