The keys to building a store-specific retail planogram

Jun 12, 2024 • 10 min

Planograms have long been a go-to method for retailers to plan and execute their space strategies. They continue to be an essential aspect of space planning, but several pitfalls threaten retailers’ ability to build their shelves effectively and efficiently.

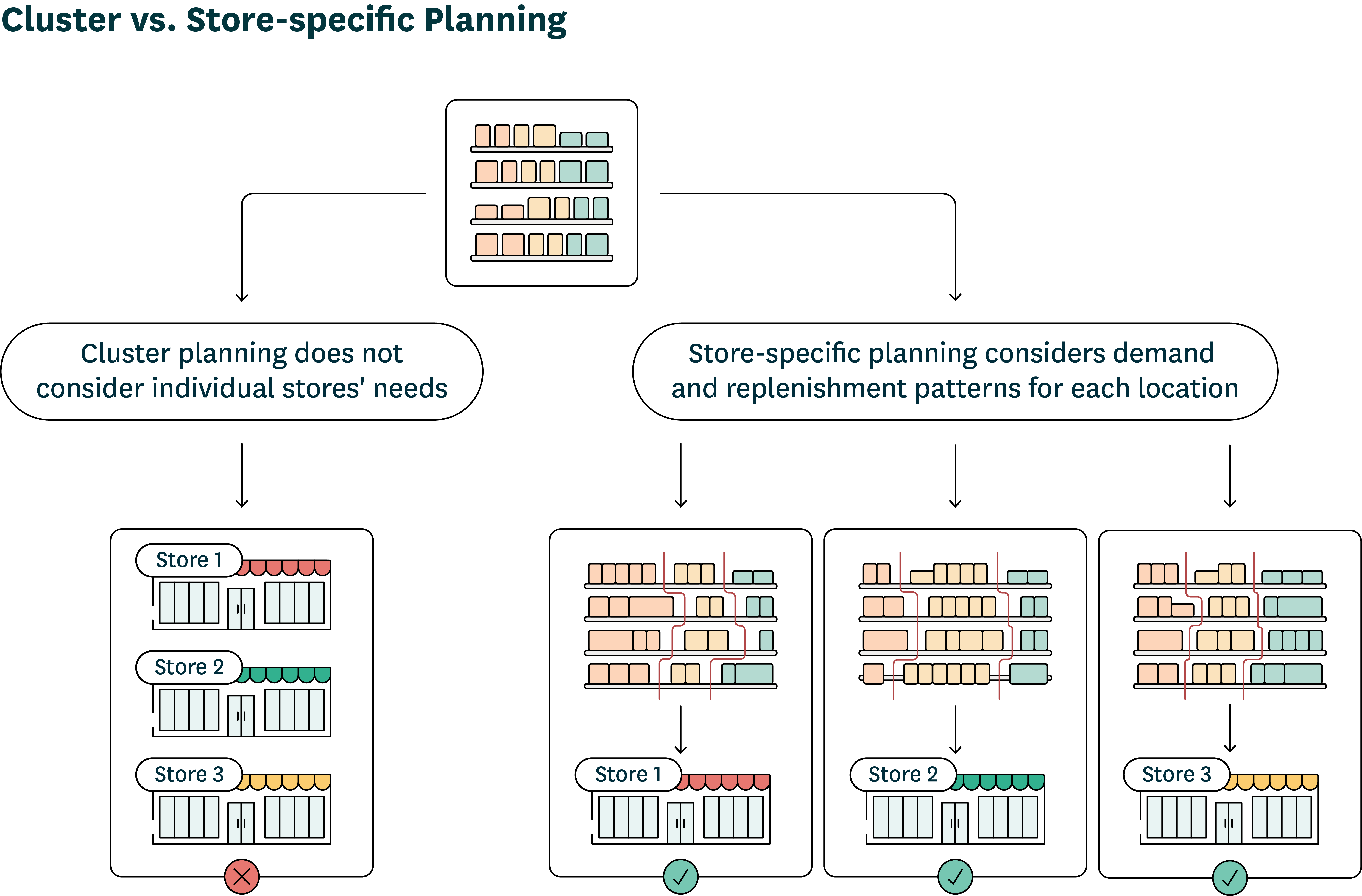

Cluster-based planogramming is the go-to methodology for many retailers. This approach shares a singular, centralized planogram across multiple stores with similar characteristics. Cluster-based planogramming minimizes the number of planograms that need to be created, Unfortunately, this method can lead to issues due to overgeneralization and lack of attention to stores’ unique needs and situations.

A store-specific retail planogram considers a store’s unique sales patterns, demand fluctuations, and space constraints. This approach is ideal, as it provides compelling benefits for availability, sales, and operational efficiency. But implementing such a plan can feel overwhelming for many retailers given the sheer number of calculations required to produce even a small volume of store-specific retail planograms.

Fortunately, digital planning solutions capable of processing vast amounts of data at scale can mitigate planogramming headaches. Store-specific retail planogramming is essential to a retailer’s long-term success, and the only way to do so efficiently and effectively is with an automated planning system.

What are retail planograms?

Retail planograms are visual plans that guide store associates on product placement and shelf quantities. They ensure an organized and functional store layout, helping maximize sales and improve customer satisfaction.

Effective planogramming is crucial to successful category management. Optimized planograms align product placement with sales data and consumer behavior to address unique sales patterns and demand fluctuations, boosting efficiency. Strategic product placement, especially on a store-by-store basis, helps retailers meet consumer needs and drive sales, improving product availability and supporting broader category management goals.

The benefits of store-specific retail planograms

There are many different approaches to building efficient planograms. The cluster-based approach uses a singular, centralized planogram across multiple stores with similar characteristics. This methodology is popular because it minimizes the number of planograms that need to be created. It also streamlines the planning process and reduces the time and effort required to manage planograms.

But centralized planogramming fails to account for individual store variations, which can lead to costly stockouts and overstocks. Retailers are increasingly turning toward a store-specific approach, which involves tailoring planograms to each store’s unique sales patterns, demand fluctuations, and space constraints.

The reasons for this shift include:

- Increased sales. Optimized product placement and alignment with local consumer preferences stemming from store-specific planogramming can lead to a 1-3% increase in sales.

- Reduced waste. Tailored planograms help reduce waste by 5-10%, as inventory levels are better aligned with actual demand to minimize overstocking and perishable spoilage.

- Enhanced stock presentation. Customized product placement ensures that items are displayed in the most appealing and accessible manner, improving the shopping experience and boosting sales.

- Strengthened collaboration with CPG partners. Detailed insights into product performance and placement foster more effective vendor partnerships, leading to optimized inventory levels and better promotions.

- Streamlined communication. Tailored planograms simplify communication between planners and store teams, reducing errors and ensuring consistent execution of merchandising strategies.

- Elevated efficiency. Automated planning systems manage complex calculations, freeing planners to focus on strategic initiatives and long-term planning.

- Improved flexibility. Store-specific planograms can quickly adapt to changing market trends and consumer behaviors, ensuring stores remain competitive and responsive to customer needs.

The growing preference for store-specific planogramming underscores the need for a more tailored approach to space planning. However, understanding the complexities and strategically shifting from cluster-based models requires careful consideration and planning.

The argument for store-specific planograms over cluster-based planograms

Despite the benefits of a store-specific approach, cluster-based planogramming is still prevalent across retailers. This reality is largely due to the complicated nature of traditional planogramming processes.

For many retailers, space planning has primarily relied on spreadsheets to input product data and output PDF planograms to deliver to stores. While this method works to a point, it becomes increasingly complex as retailers add stores, categories, and SKUs.

Imagine a retailer with 20 planners managing 150 categories per store. If each planner spends, on average, 20 minutes per plan, the collective team spends approximately 15,000 hours, or 750 hours per year per planner, on planogram management and creation. As the retailer grows, this manual space planning process will only become more time-intensive and the results less successful.

Spreadsheets and manual processes are not conducive to marrying speed and accuracy. The more spreadsheets are pushed to their limits and passed back and forth between planners, the more error-prone and susceptible they become to data corruption. Data integration becomes a significant issue as these manual systems often fail to synchronize real-time updates across all relevant platforms, leading to inconsistent information and outdated planograms. Retailers then need to constantly review and assess their planograms to make necessary and accurate adjustments to react quickly to demand, trends, and competition.

A cluster-based model involves sharing a singular, centralized planogram across multiple stores with certain common characteristics. However, this can lead to several issues, as individual stores have unique demand patterns, footprints, and storage capabilities.

Retailers often turn to one-size-fits-all plans when cluster-based models fail, but these plans have even less hope of success. Typical outcomes include inaccurate or suboptimal space allocation and low planogram compliance in stores.

Further, capacity limitations mean that many space planning teams cannot manage cluster-based planograms for all product categories. Some product categories still rely on a one-size-fits-all approach despite local differences in demand. The inaccuracies inherent in planning based on averages can result in too much or too little space being allocated to certain items, leading to issues with planogram execution and compliance.

A planogram is quite a sophisticated thing — the final tool through which retailers can engage with their customers at the shelf edge. The most effective way to meet customer needs is a store-specific approach to assortment, layout, and use of space. However, this approach further complicates an already challenging process.

The 5 biggest challenges to store-specific retail planogramming

Despite the clear benefits of store-specific planogramming, retailers often hesitate as they consider moving away from cluster-based approaches. Traditional planogramming methods are often inefficient and hard to maintain by themselves, and the added complication of tailoring planograms to individual stores only compounds the issue.

Truly efficient store-specific planogramming requires a robust space planning system, which introduces its own wrinkle of complication. Undertaking this complex change without taking proper precautions risks disrupting business processes, and any shortcomings in shelf stocking and organization can lead to missed sales opportunities and dissatisfied customers.

The main challenges associated with implementing store-specific retail planogramming include:

1. Lack of integration with other planning systems

Retailers need a space planning system that can integrate cleanly with other tools to achieve store-specific planogramming. Retailers working with outdated tools may struggle to integrate with their existing inventory management and point-of-sale systems effectively, leading to errors and inefficiencies.

2. Data management difficulties

System integration only means more data for space planners to wrangle. Store-specific planogramming requires far more data analysis than cluster-based models, including sales, customer behavior, and inventory data at the store level. Retailers often worry about efficient data management and analysis at this level of scale and granularity — especially when stores in their network vary in layouts and customer demographics.

WATCH: Conquering microspace optimization through data and AI

3. Store input limitations

Traditional planogram solutions often can’t accommodate individual store layouts or changes in local customer behavior, leaving retailers with inaccurate or outdated planograms that fail to meet shopper or staff needs. This scenario is especially challenging for retailers who lack a reliable process for gathering real-time feedback from store operators. These workers have boots on the ground and can provide valuable information on everything from shelf breaches to local shopper preferences.

Traditional planogram solutions often can’t accommodate individual store layouts or changes in local customer behavior.

4. Time and resource constraints

Creating store-specific planograms can take longer than traditional ones, especially considering the volume of data involved. This concern looms particularly large for retailers relying on already-time-consuming manual planogramming methods. Retailers fear that overwhelming their planners could lead to delays, errors, and potential employee dissatisfaction.

5. Lack of in-house expertise

Retailers may delay advancing their space planning practices because of concerns that staff lack a hard-to-achieve combination of visual and technical skills to create effective store-specific planograms. Typical store-specific planogram solutions don’t do a lot to alleviate this concern, as most force retailers to either:

- Simplify the sophistication of planograms so a generic, plug-and-play solution can produce them.

- Hire a team of highly skilled specialists capable of producing complex code.

Both options are far from ideal.

Planners who can creatively visualize and plan space to drive customer engagement often lack the technical knowledge to automate planograms. And those who can code the complex scripts needed to automate planograms often lack that subtle understanding of consumer drivers or the creative vision to build beautiful shelves. This expertise gap can result in either oversimplified planograms that fail to drive engagement or overly complex solutions that are difficult to manage and execute.

WATCH: From planograms to realograms: How emerging technology is transforming merchandising and planning

5 strategies for optimizing retail planograms with retail planogram software

As retailers seek to streamline their space management processes, several key strategies can form the foundation for their efforts. Embracing these strategies can help overcome the challenges that stand in the way of the efficiency and effectiveness associated with well-implemented store-specific planogramming.

1. Use a unified retail planning solution

Companies can’t afford to have the cure for one headache create another one entirely. Retailers need a unified retail planning solution that seamlessly integrates space planning with inventory management, supply chain forecasting, and replenishment processes. A unified platform ensures that operations are aligned, reducing errors and inefficiencies.

RELEX centralizes retail operations data within a single platform, ensuring decisions are based on a unified source of truth. It integrates with existing systems for real-time data exchange. Advanced analytics and machine learning optimize space planning with precise, store-level insights. These insights help align collaborative decision-making across departments, allowing retailers to synchronize space planning efforts with broader supply chain initiatives.

2. Embrace advanced data management tools and analytics

Big data requires a big solution. Retailers need robust data management tools and advanced analytics capabilities to handle large volumes of data and provide actionable insights beyond the capabilities of the human brain. The right tools incorporate real-time sales, customer behaviors, and inventory data to enable more accurate and efficient store-specific planogramming.

RELEX combines advanced analytics and AI capabilities that enable retailers to manage and analyze vast amounts of data efficiently. The solution provides insights into customer behavior and product performance at the store level, allowing for the creation of highly optimized, store-specific planograms.

3. Enhance communication between stores and central planning

Digital solutions can help retailers overcome poor communication between stores and central planning operations that often derail store-specific planograms. Advanced communication tools enable real-time data sharing, ensuring timely updates and reducing miscommunication. An integrated platform also allows central planners and store staff to collaborate through shared insights and direct feedback, aligning strategies and ensuring consistent execution of planograms across all stores.

Advanced communication tools enable real-time data sharing, ensuring timely updates and reducing miscommunication.

RELEX facilitates this essential communication between central planning teams and store personnel. The solution’s collaborative toolkit enables the direct sharing of insights, planogram adjustments, and operational feedback within the system, ensuring swift action based on the latest data. Advanced analytics generate actionable insights and alerts, prompting immediate communication between stores and planners. This approach leads to optimized store layouts, improved inventory management, and enhanced customer satisfaction.

4. Optimize retail space planning with automation

Store-specific optimization is impossible with manual processes. Automation reduces time spent on manual adjustments across thousands of products, categories, or points of purchase, keeping 3D planograms current without draining planner time.

Retailers have traditionally adjusted their facings based on historical sales to improve outcomes with store-specific planogramming. This conventional approach can result in some marginal improvements to availability and sales.

A more forward-looking unified approach to category management informs planograms with granular, localized demand forecast data. Combining unified retail space optimization efforts with machine learning algorithms helps retailers automate the time-intensive, complex task of optimizing store-specific planograms to meet shopper needs at every store in their network.

READ MORE: Boost profitability through automated, store-specific planogram optimization

5. Empower retail teams with user-friendly tools

Adopting an intuitive planogramming solution helps bridge the gap in expertise among retail staff. The right tool empowers planners with visual and technical capabilities, allowing them to create effective store-specific planograms without requiring extensive training or specialized skills.

RELEX offers user-friendly planogramming tools designed for ease of use. The system’s intuitive interface and automation capabilities allow planners to efficiently create and optimize store-specific planograms, regardless of their technical expertise. This mitigates the need for in-house expertise and ensures that planograms are visually appealing and technically sound.

Keep customers at the heart of planogramming

Hyper-competition in the retail market means companies must pull out all stops to appeal to customers. Long-term success hinges on a retailer’s ability to remain customer-centric, even in the face of volatility and shifting consumer sentiment. This speed with which the market changes necessitates using a robust space planning solution capable of data-informed, automated store-specific planning.

Not just any software will do. Retailers need the unified, all-encompassing space planning powers of RELEX to truly optimize their store-specific planogramming. RELEX provides a comprehensive tool suite that integrates space planning with inventory management, supply chain forecasting, and real-time data analytics. This unified approach ensures that all aspects of a retailer’s operations are aligned, reducing errors and inefficiencies while driving better business outcomes.

Retailers must steer their planogramming toward a more automated future. Their customers — not to mention their bottom lines — will thank them for it.