SKU rationalization: How and why you should narrow your assortments

Mar 28, 2025 • 9 min

If you’re wondering where your margins have gone, they’re probably hiding in your assortments.

Across retail and manufacturing, business growth is hitting a wall. Inflation continues to drive up costs, and customers have more choices than ever before, diluting demand across products and channels.

In these conditions, expansive portfolios become expensive portfolios. Companies can easily fall into broad assortments that may support some KPIs but undermine the business’s overall health.

A growth-oriented strategy starts with a hard look at your assortments and a “less is more” attitude. To achieve streamlined, high-performing assortments, retailers and manufacturers must reconsider how they conduct SKU rationalization and measure assortment quality. This approach involves shifting focus from net and gross profit to a more holistic view of each SKU’s total associated cost and revenue.

RELEX’s AI modeling techniques help transform rationalization strategies from simple SKU reductions to precision assortment design. These solutions determine SKU-specific profitability and model demand transference using millions of data points so companies can determine optimal, customer-focused product selections, monitor performance, and make assortment changes with confidence. Integrated into a full suite of unified planning functions, they ensure data-based decisions, effective category management, and cross-functional alignment.

With AI-backed SKU rationalization, companies can adapt to demand shifts and grow their businesses, keeping assortments lean, targeted, and profitable.

Why smaller assortments stimulate overall business health

SKU rationalization is the process of analyzing assortments and removing underperforming or highly duplicative products to maximize margins and efficiency – without jeopardizing customer satisfaction.

But before we get into the “how” of SKU rationalization, let’s look at the “why.” Why shrink assortments in the first place? And what role does SKU rationalization play in business growth?

Reducing costly inefficiencies

First off, the more SKUs you have, the more vulnerable you are to volatility and the more opportunities there are for waste. With a smaller assortment, you can concentrate consumer demand on fewer products, eliminating some of that complexity and cost. You’re focusing your time and resources on the products most important to the customer, prioritizing consumer tastes and ensuring availability.

Plus, as more retailers begin tracking their cost-of-goods metrics, they can save money through efficiency gains like negotiating more affordable quality ingredients or reducing excess inventory and spoilage.

Across industries, smaller assortments help companies enhance customer experience while reducing time-consuming, expensive, and wasteful inefficiencies.

These wins aren’t limited to retailers, either. In the manufacturing world, having fewer items to produce increases upstream efficiency. For example, instead of managing production lines for five variations of the same product, you may discover that four variations easily meet demand and would allow you to optimize resource, labor, and production line utilization. This SKU reduction results in fewer cleaning and maintenance delays and better resource and labor utilization.

Across industries, smaller assortments help companies enhance customer experience while reducing time-consuming, expensive, and wasteful inefficiencies. Planners spend less time correcting errors and more time strategizing where to invest those cost savings and profits.

Achieving the KPI trifecta

Strategic SKU rationalization can be a step to broader business improvements. The same issues that lead to poor assortments lead to problems across other planning functions. By examining and refining your assortment strategy, you are, by default, shining a light on how well your business manages the most important KPIs: sales, stock, and profit.

Every planning decision should involve these three KPIs. You want to drive sales growth while controlling the amount of stock required to maximize profitability and availability.

All too often, companies overfocus on one goal – typically, driving sales. But how does this play out? Sure, you can drive sales by flooding your stores with as much stock as possible, but this ties up your cash flow. Plus, all that inventory requires more people to handle more boxes in more places, increasing your operating costs and reducing the full profit potential.

Decision-making can become even more convoluted if different planning functions focus on different KPIs. Competing objectives can become more difficult and costly to manage over time.

This is why teams across your company need an end-to-end view of the sales you’re driving, the stock you’re holding, and the operating costs you’re generating.

A “less is more” approach to SKU rationalization both requires and delivers this 360-degree view of the business. The very process of strategically minimizing assortments involves looking at sales, stock, and profit per SKU. It’s a much more balanced view of activities, helping companies make the right end-to-end, cost-based decisions. You’re reviewing and balancing competing goals for the overall good of the company.

This holistic view helps you stop wasting your limited resources, direct them to the right products, and reinvest that growing profit into new and better opportunities.

So how can you put this approach into practice?

The technology behind smart SKU rationalization

At RELEX, we’ve developed the technology and strategies that help companies design optimal assortments – and update them as customer needs change.

The solution enables teams to determine each SKU’s profitability, estimate demand transference, and align decisions with other functions across the supply chain. This level of analysis and data sharing helps them minimize assortments while still delivering customer favorites.

1. Determining direct product profitability (DPP)

The RELEX approach to SKU rationalization encompasses every product’s total cost-to-serve. Consider what it takes to manage every product in your portfolio. You have to move it from the supplier to your DC, to your backroom, to your store floor. At each stage, you’re paying for all the overhead, transportation, storage, and labor.

You also have to consider any operational hiccups, such as shelf breaches. For instance, let’s say you deliver twelve units of a product. The store employee brings those twelve units up to the front, but there’s not enough space, so the extra stock must return to the backroom.

RELEX uses all of this information – even shelf breach frequency – as a cost input.

This total cost-to-serve is integral to calculating an item’s direct product profitability (DPP). DPP accounts for all the costs and revenue associated with getting a product into the hands of the customer. Essentially, DPP is the cumulative measurement of an item’s sales, stock, and profit. It allows companies to take advantage of customer-focused, location-specific assortments that drive sales and improve margins while reducing supply chain costs.

Let’s say a product generates fewer sales than other items, but it costs very little to deliver to the customer, generating overall profit. If sales numbers were the deciding factor in determining assortments, you may be tempted to discontinue the product. If you look at the item’s DPP, however, you can see it’s actually more profitable than other items and would be risky to remove.

The RELEX solution conducts this analysis across your range, helping you prioritize high performers and remove low performers by determining the direct effect on your bottom line.

2. Calculating demand transference

DPP, however, is not the whole story. Companies must also consider a product’s uniqueness.

The burning question when trimming assortments is: “If I remove this product, where will those sales go?”

Say you have two different brands of yogurt, Brand A and Brand B. You want to know what will happen if you delist Brand B.

For many companies, it’s a gamble. If Brand B is a duplicate, a customer will likely switch to Brand A, and congratulations – you’ve improved overall efficiency. But if Brand B is unique, your customers have no other options, and you’ve just lost all those sales.

So how can you improve your chances of correctly estimating demand transference and removing the right products from your assortments?

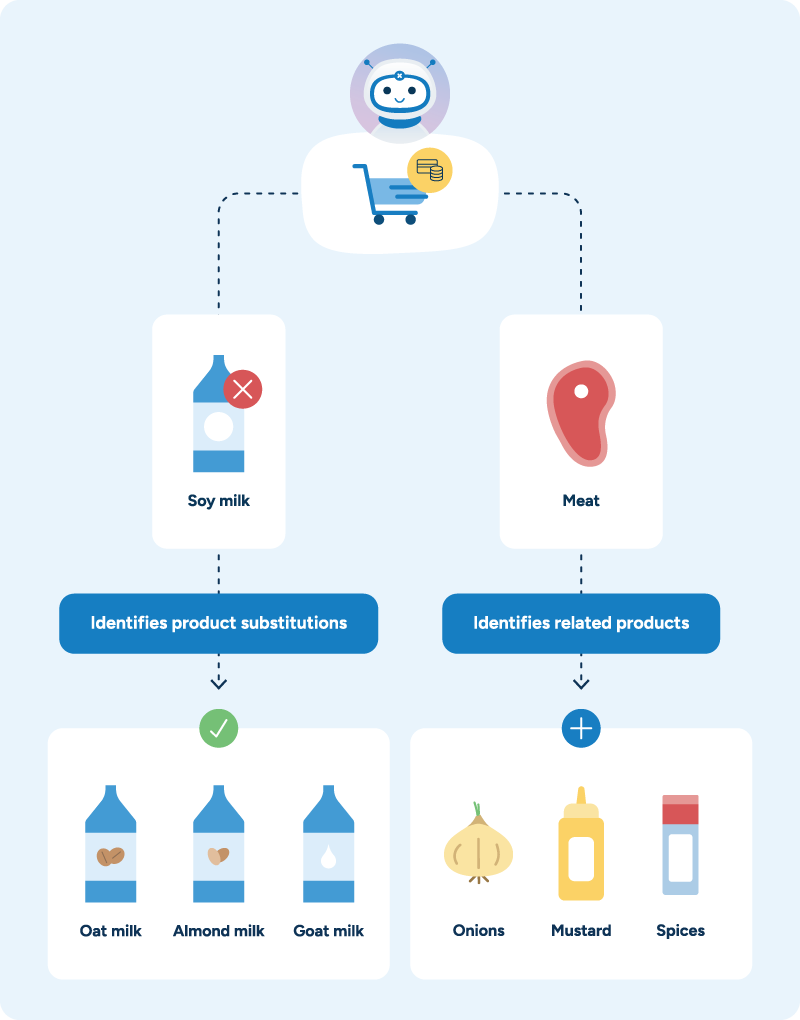

The RELEX data science team tackled demand transference by developing a new capability called “market basket analysis.”

Market basket analysis uses AI models that look through transactional data, learning from customer baskets and identifying which products are complementary and which are substitutes for each other.

From this volume of data, the model can estimate the percentage of demand likely to transfer to other products if you remove a particular item, giving companies much greater confidence as they prune their assortments, remove duplicates, and fill those spaces with better-performing options.

Upcoming advancements: The RELEX team is looking at the same data but from the other side of the coin. Instead of modeling demand transference, the model will capture information on lost sales. For instance, if a product generates $100 of truly unique incremental sales out of a total of $1,000, the model would determine that the remaining $900 is duplicative. It’s the same model and the same information, just with a different focus.

3. Integrating with other planning teams through a unified platform

SKU rationalization shouldn’t be done in a vacuum, especially if you want responsive assortments that adapt to changing customer demand.

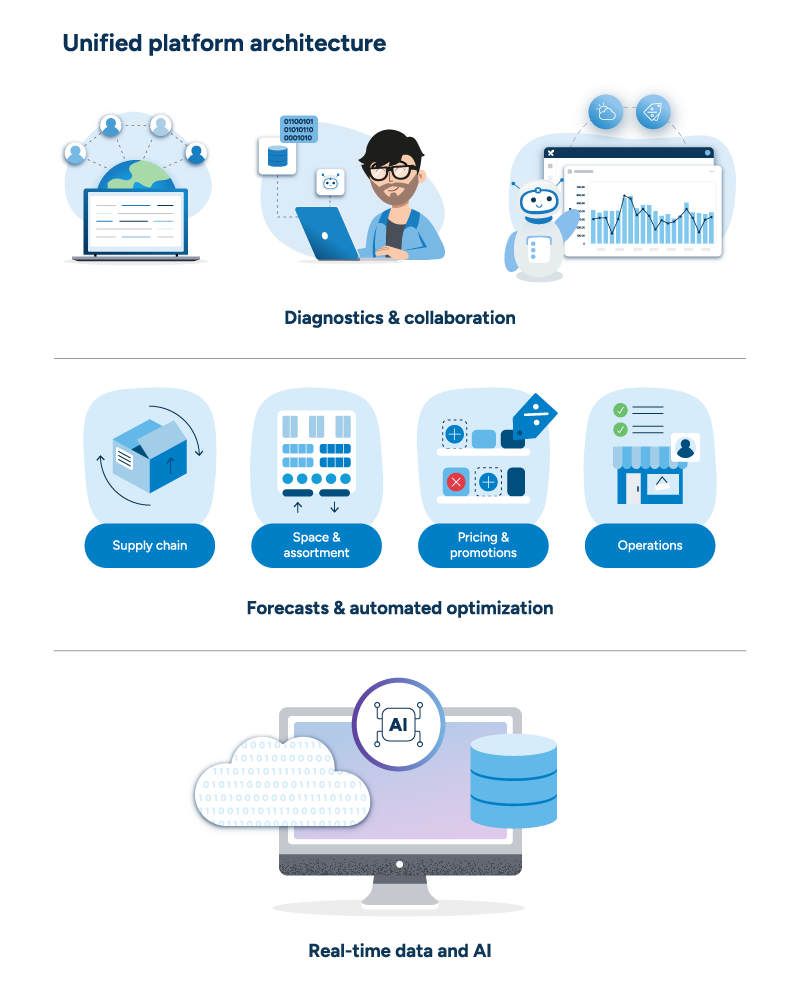

The RELEX unified platform brings all your supply chain and retail planning teams into one solution with a shared data core, AI capabilities, diagnostics, and collaboration tools.

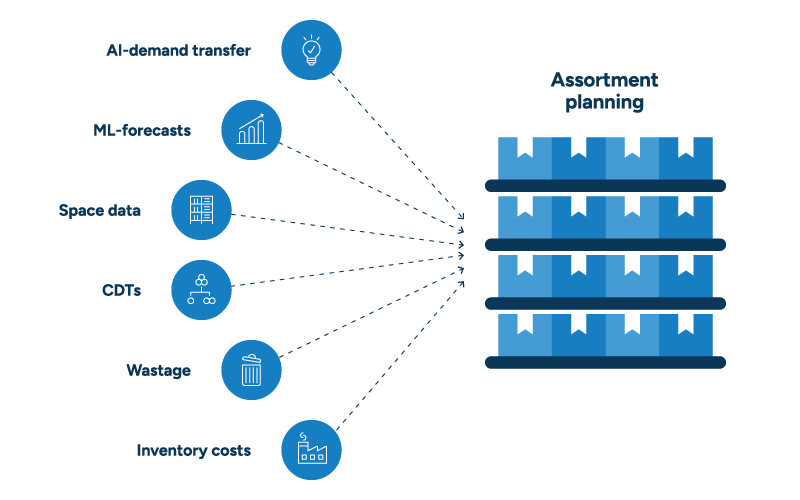

This integration makes SKU rationalization part of the wider business ecosystem, enabling the assortment planning module to pull all the up-to-date information it needs from other systems on the platform.

For instance, it’s linked to the AI model that performs market basket analysis, examining transactions and determining substitutability. The solution can also access supply chain data like consumer decision trees, waste and spoilage rates, and inventory costs.

RELEX Assortment Planning also has access to machine learning-based forecasts that account for local needs and adapt assortments to changing demand by leveraging historical sales information as well as store- and channel-specific forecasts.

This flow of information continues once the SKU rationalization process is complete. If a product has joined or remained part of the assortment, it continues to space planning so the team can design a planogram and push it to stores. If the product has been delisted, it’s sent to clearance optimization to be sold out to zero stock.

By linking all these capabilities, the unified platform enables users to make data-informed decisions that ensure an optimal assortment mix, balancing customer preferences and profitability.

Plus, thanks to its shared data core and collaboration tools, it helps every team keep an eye on and account for those three major KPIs – sales, stock, and profit – so every decision supports business growth.

The benefits of SKU rationalization

Smaller assortments punch above their weight when it comes to overall business benefits. Through strategic SKU rationalization, companies can:

- Drive sales and profit through customer-tailored assortments and waste reduction.

- Reduce stockouts and overstocks by concentrating on customer preferences and improving inventory management.

- Increase operational efficiency by reducing complexity, lowering handling costs, and improving shelf utilization.

- Enhance customer satisfaction by increasing the availability of customer-preferred products.

- Invest in new market opportunities and business expansions.

SKU rationalization as a growth strategy

Wider assortments are not safety nets. They just provide bigger holes for market opportunities, margins, and customer satisfaction to fall through, leaving companies vulnerable to inefficiencies and disruptions and taking up space that could be used for innovative new product lines.

SKU rationalization helps companies work smarter, not harder. With a holistic view of end-to-end costs and product profitability, companies can engineer assortments that free up and focus resources on the products customers love most.

Companies with the right technology and a “less is more” strategy can balance sales, stock, and profit and put those cost savings and increased sales to good use, seizing market and growth opportunities.