It’s time to bring MFP into the digital age

Nov 15, 2024 • 5 min

Traditional Merchandise Financial Planning (MFP) processes are desperate for modernization. MFP is surprisingly outdated for such a strategic process that sits between high-level business objectives and on-the-ground operations. I want those of you who entered the general merchandise industry two decades ago to really ask yourselves: has the job become any easier?

MFP is often bogged down by time-consuming manual processes that lead to a stalemate between high-level strategy and day-to-day execution. This leaves the process feeling neither truly forward-looking nor fully actionable. Planners are often stuck balancing a realistic forecast and a high-level target, grappling with excessive complexity on one side and a lack of meaningful detail on the other.

Today’s retail environment demands more than these outdated, manual processes. Limited by monthly planning cycles, planners lack the agility to adjust to changing market dynamics. Modern platforms offer robust data collection, short-horizon demand sensing, and predictive alerts, turning MFP from a guessing game into an actionable data-driven process.

So, the question is: What’s needed to bring your MFP into the digital age?

The new tools for Merchandise Financial Planning (MFP)

Let’s look at some of these common issues with outdated MFP processes and see how modern tech can step in to help solve these “old school” problems.

Let machines manage data; let planners add strategy

Old school:

Planners or central teams often face the challenge of gathering data from multiple sources to present historical information in one cohesive format. When planning for the upcoming season, the typical process involves copying last year’s data and making adjustments.

While this approach isn’t entirely unreasonable, planners must then manually account for sales peaks due to known calendar events—such as Easter, Chinese New Year, etc. They also spend significant time identifying and cleansing outliers in last year’s data, often reviewing multiple years of history at various intersections.

Only after these tasks are completed can planners begin incorporating human insight, which is crucial for strategically investing and growing based on market, customer, and product insights.

New tool:

Machine learning models help preserve and highlight planners’ insights by analyzing historical data and trends to help forecast achievable targets. These tools empower planners by incorporating their expertise into data-driven projections, closing the gap between what is realistic and what is expected executively.

Machine learning models can provide a seeded plan that automatically adjusts sales patterns for known calendar events and outliers and can even use external macroeconomic data to take the heavy data manipulation away from planners. These tools give planners an accelerated starting position, empower them with explainable models, and allow them to have more time to incorporate their expertise

Add clarity to sales numbers with dontext and rationale

Old school:

In traditional MFP, the why behind the plan and adjustments are rarely documented, often living solely in the planner’s mind. What are the assumptions and components behind the 40% year-on-year growth? This lack of transparency makes it hard for team members to understand the context of growth assumptions, slowing decision-making and hindering the ability to explain performance gaps in-season.

New tool:

Collaborative planning platforms allow planners to capture the what and the why behind the growth plan as structured and unstructured data.

The what: Develop the growth plan by breaking it into structured components, such as channel expansion or closures, volume growth, market inflation, pricing strategy, and other strategic initiatives.

The why: Document the context, rationale, and key assumptions and examine them alongside the plan’s numbers. This transparency gives teams the visibility they need to make quicker, data-driven decisions and adjust strategies as necessary, promoting greater alignment and accountability across the organization.

Moving beyond surface-level, reactive planning

Old school:

Having a financial plan is a great foundation, but what’s the next step? Does your inventory and ordering actually match up, or will you find yourself scrambling at the last minute?

Plans are often made at such a high level that they can’t really consider how things will be executed on the ground. This can lead to frantic adjustments in inventory orders that can cause inefficiencies and stock problems.

The manual nature of planning also limits this to a monthly cycle. A lot can happen within a month, and without foresight, planning becomes reactive.

New tool:

During the season, leverage demand sensing and actual performance data to proactively monitor and address gaps in sales, margin targets, and inventory management. Using real data instead of manual or optimistic projections gives you a clearer picture of potential shortfalls or overspending. That way, you can take timely and informed action.

If targets still need to be met, collaborate with your inventory, pricing, or promotions teams to make necessary adjustments. This could include optimizing stock levels, adjusting pricing strategies, or launching targeted promotions to drive sales. These data-driven, in-season adjustments help align your operations with financial goals, allowing for a more responsive and agile approach to managing the season.

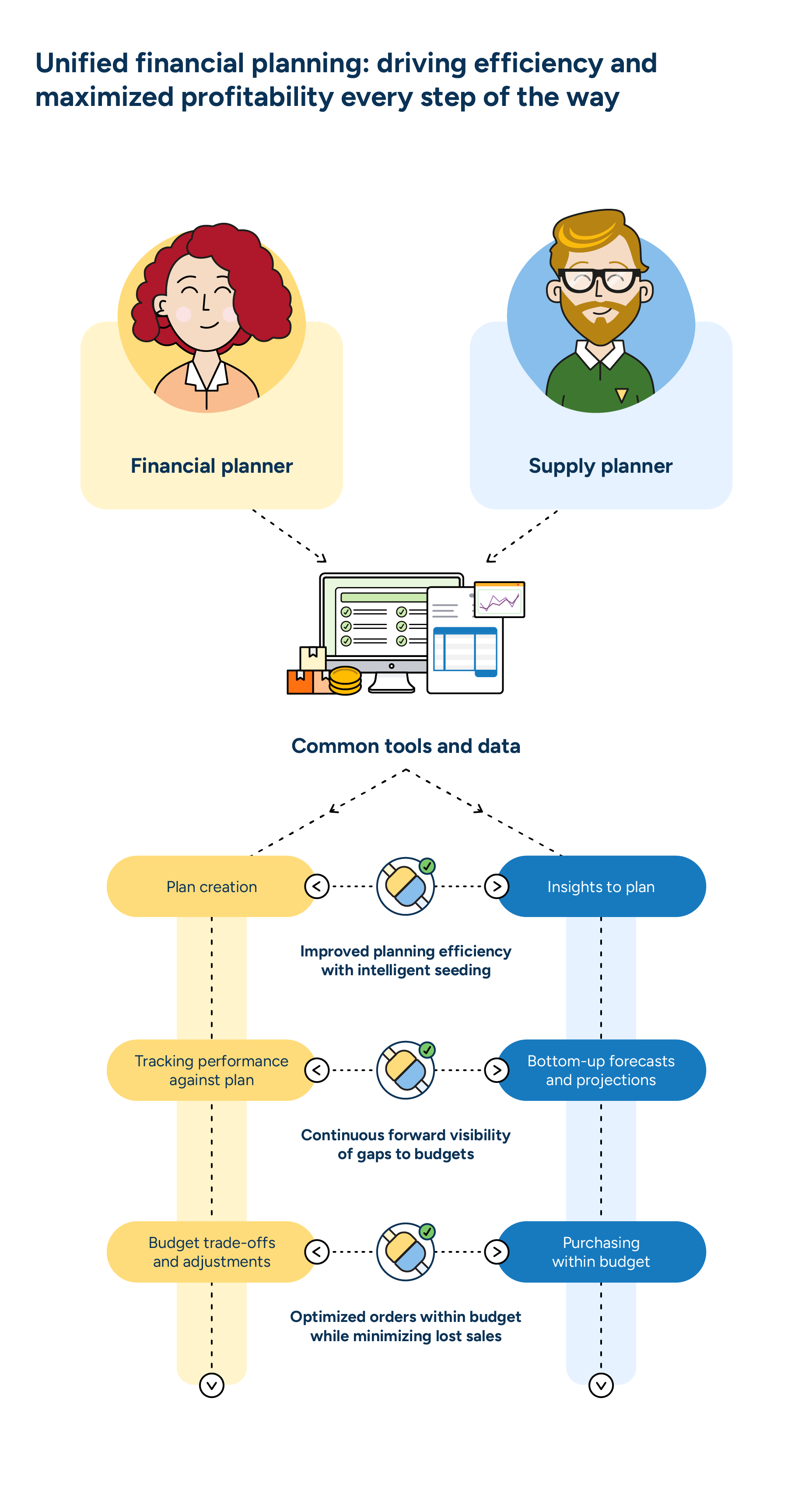

Integrated planning tools align high-level strategies with ground-level execution. These tools can then help manage orders and inventory by considering supply, capacity, and financial limits, reducing last-minute changes and inefficiencies.

From hesitation to implementation…

Honestly, the MFP process hasn’t changed much over the past couple of decades. Isn’t it time for a refresh? Relying on old-school top-down planning that ignores modern data analytics and real-time insights just doesn’t work anymore. And if you don’t adopt it, your competitors will.

It’s time to finally allow yourself an upgrade to make your planning easier and keep you ahead of your competition. Updating MFP methods to include advanced forecasting tools, machine learning, and more dynamic adjustments will lead to more accurate and flexible planning with actual actionable steps.

Embrace the change, enhance your forecasting, and let data help you create a more accurate and collaborative future with far fewer headaches.