Why channel-specific wholesale forecasting is the future

Mar 25, 2024 • 8 min

Newsflash to wholesalers: your customers don’t have the same needs.

The statement seems obvious. Clearly a grocery wholesaler knows that a C-store will order differently than a supercenter. Pharma distributors know a local drugstore will have wildly different needs than a regional hospital.

Yet, for too many companies, wholesale forecasting still revolves around creating a single demand forecast for an entire range of customers. Relying on a single forecast for everyone can result in forecasting inaccuracies for specific customers or failure to identify trends and patterns accurately. This can cause supply and demand misalignments that erode a wholesaler’s razor-thin margins.

Wholesalers must prioritize accuracy within their forecasts to address unique customer needs and preserve healthy profit margins. Channel-specific forecasts consider unique customer behaviors and needs to provide segmentation and accuracy that broad demand forecasts can’t. Wholesalers should use these accurate forecasts to reduce operational inefficiencies, improve service levels, and save money in the long term.

What is channel-specific wholesale forecasting?

Channel-specific forecasting (commonly channel forecasting) is the process of creating separate demand forecasts for different customer segments to increase forecasting accuracy. Each segment (or channel) comprises customers who share similar behaviors or qualities that cause them to order alike. And each forecast offers wholesalers the ability to cater to these unique behaviors specifically instead of grouping them with dissimilar customers.

Wholesalers can customize channels to fit their needs. A single channel could include:

- A single high-volume customer

- Similarly behaving customers, like a band of mom-and-pop C-stores

- Customers with unique ordering and delivery stipulations

- Retailers located in the same physical area

- A specific sales channel, like ecommerce

Many wholesalers have historically focused on how many products are ordered instead of where these products end up going. But zeroing in on specific customer segments allows wholesalers to anticipate demand shifts more accurately and better manage their inventory. An auto parts wholesaler, for example, could create a segment for a group of discount tire companies, enabling them to stock up on the appropriate amount of winter tires ahead of cold weather months without experiencing delivery peaks.

Zeroing in on specific customer segments allows wholesalers to anticipate demand shifts more accurately and better manage their inventories.

Why channel forecasting is superior to traditional wholesale forecasting

Accurately forecasting customer demand isn’t easy on the best days, so suggesting wholesalers create multiple forecasts for unique segments might seem like a doozy — a fundamental change to supply chain planning processes. But those wholesalers who do make the upgrade to channel forecasting often point out three big ways it outperforms traditional wholesale forecasting processes:

1. Multiple channel forecasts are more accurate than a single traditional one

Broad forecasts don’t consider the nuances of individual accounts or businesses, whereas channel forecasting allows you to optimize inventory per individual customer segment.

Imagine your biggest customer suddenly takes a product out of assortment in some or even all their stores. Their demand for the product would drop to zero, but the rest of your customers would still order it. A broad forecast couldn’t anticipate this change for that specific customer—but a channel-specific forecast comprising your biggest customer could.

The use of granular data like assortment and promotional decisions increases forecasting accuracy, greatly improving inventory optimization efforts. It’s a welcome alternative to understocking or overstocking, which is more likely to occur with broader forecasts. An understocked warehouse means missed sales opportunities and even contractual penalties, but an overstocked one can result in spoilage and costly markdowns. These costs hurt wholesale margins even in the best of economic circumstances, let alone the current state of disruption and high inflation.

The use of granular data like assortment and promotional decisions increases forecasting accuracy, greatly improving inventory optimization efforts.

2. Channel forecasting encourages retail partners to collaborate

Wholesale distributors are almost always a degree removed from the end consumer, often forcing them to react to changes instead of properly anticipating them. Poor collaboration with retail partners often thwarts efforts to gain insight into consumer demand. Limited collaboration also reduces visibility into retailer strategies like planned promotions or range changes.

The promise of optimal availability provides wholesalers with extra leverage when asking for pertinent planning data, like POS data. High-volume customers with stringent contractual obligations will appreciate a wholesaler’s ability to prioritize product quality and delivery for their channels — and wholesalers won’t mind avoiding potential fines from OTIF violations.

These efficiency improvements will improve overall customer satisfaction — and leave them more willing to put effort into sharing that all-important retail data to improve forecasting for their wholesale partners.

3. Channel forecasting allows wholesalers to modernize supply chain planning

We get it: the ol’ spreadsheet-and-clipboard approach to forecasting worked well enough for a long time, especially considering the technological limitations of the past.

But wholesale supply chain management has become immensely more complex since the analog glory days. Economic hard times and shortages in both labor and materials have impacted both customer and consumer behaviors. Demand shifts in a heartbeat, often rendering manually created forecasts obsolete when it comes time to actually order new inventory. And embracing ecommerce channels has only added extra layers of complications to the proceedings.

This issue is especially troublesome for wholesalers, who must consider an entire range of customers that don’t always behave the same. Any given demand planning team can struggle to create a single unified forecast for its entire portfolio of customers. It would be impossible for that same overtaxed team to manually create multiple unique forecasts for various segments of customers — let alone forecasts that are accurate and easily adjustable.

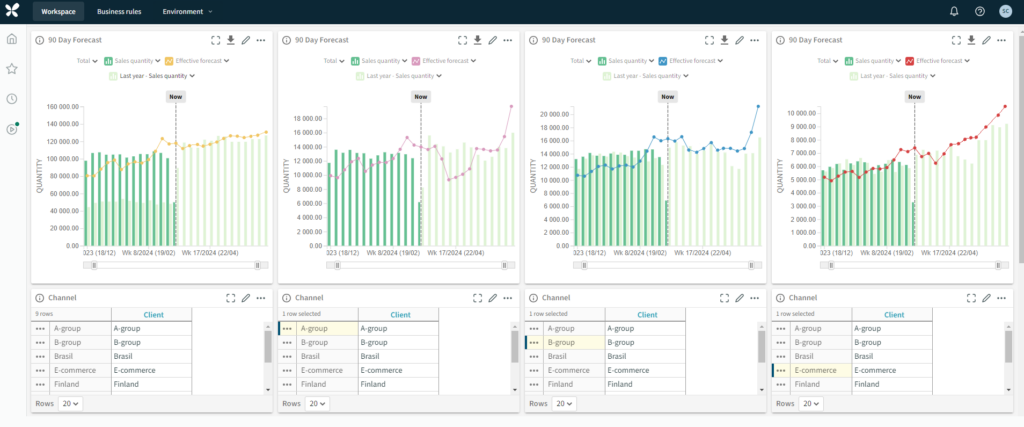

Wholesalers wanting to take advantage of channel forecasting need a digital solution capable of performing the task. Smart planning platforms automate channel forecast creation and adjustment, freeing up planners to focus on value-adding tasks that only humans can do. Meanwhile, forecasts are updated daily with the most recent data from various relevant sources to ensure the highest possible accuracy.

Smart planning platforms automate channel forecast creation and adjustment, freeing up planners to focus on value-adding tasks that only humans can do.

3 keys to creating smarter, more accurate channel forecasts

The benefits of channel forecasting are exciting enough that wholesalers may want to dive in head-first. But there are a few topics companies must wrangle first to ensure that their channel forecasting efforts get off on the right foot:

1. Know your customers

Wholesalers must understand their customers’ needs, behaviors, and strategies if they hope to properly segment them. And even then, they must consider an approach to segmentation that best aligns with your goals. Is geographic proximity their most significant concern when forecasting, or does it make more sense to forecast by niche?

Knowing their customers also means understanding their contracts through and through. Heavyweight customers likely have stipulations in their contracts concerning on-time delivery and availability that may make them unsuitable for segmentation with other, less stringent businesses. These companies may need to be a segment unto themselves to ensure their forecasting meets their particular needs.

A wholesaler’s data model can be the primary driver for choosing which channels make sense. Channel forecasting is a difficult task for a company lacking the ability to identify unique customer attributes in their sales data. On the other hand, companies with established collaborative processes can base their decision on their customers’ promotional and assortment data.

WATCH: Wholesale Supply Chain Pain: Data, Demand, and Disconnection

2. Identify the appropriate number of channels

Granularity in channel forecasting is what makes it so exciting, but it is possible to go overboard. A wholesaler with 300 customers doesn’t need to create a unique channel for each customer and then create 300 separate channel forecasts.

Wholesalers should instead look at their existing customer base and find the optimal number of channels — the inflection point between increased optimization and increased complexity. The correct number of channels will differ between businesses. Wholesalers new to channel forecasting may want to start with broad strokes and fewer channels before experimenting with more selective and granular segmentation.

3. Get the right software

Whether a wholesaler forecasts for four channels or 14, they need a planning solution that actually allows them to build channel forecasts in the first place. Channel forecasting isn’t a standard feature across the board, with some platforms incapable of performing channel forecasts and others only able to forecast for a limited set of channels. Interested parties should do their research to find a planning platform capable of meeting their channel forecasting needs.

How more accurate forecasting enhances supply-side efficiency for wholesalers

Not all benefits of accurate forecasting specifically relate to a wholesaler’s relationship with retailers. Retail customer satisfaction is integral to a wholesale company’s long-term success, but the business’s supply side directly impacts its ability to maintain customer service levels.

When forecast accuracy is improved, wholesalers can optimize procurement and inventory management. They can time orders to align with channel forecasts, reducing excess inventory and associated holding costs. This precision supports a leaner, more responsive supply chain.

Wholesalers can order the right quantities of products at the right time when channel forecasts closely match actual demand, reducing excess inventory and associated holding costs.

Achieving this accuracy requires the incorporation of lead times into the planning process. Wholesalers who understand the time required to procure goods from suppliers can plan orders so that products arrive exactly when needed. This minimizes the risk of stockouts or overstocking, ensuring companies don’t tie capital up in unnecessary inventory. Aligning order cycles with lead times also enables wholesalers to improve their cash flow as well as their responsiveness to market changes.

Wholesalers can also translate accurate forecasting into better supplier relationships and negotiation leverage. Businesses with a clear view of future demand can communicate their needs more effectively to suppliers, potentially securing better terms or prioritization. This collaborative approach can lead to more reliable supply chains, further enhancing a wholesaler’s ability to meet customer demand promptly and efficiently.

READ MORE: Supply Chain Collaboration Report 2023

Improve wholesale forecasting accuracy with a robust planning platform

Demand forecasting forms the foundation of supply chain success for any wholesaler, and any change to that foundation can seem daunting. It’s unrealistic to expect companies to shed their existing systems and processes in favor of a complete adoption of channel forecasting, especially without proof that channel forecasting works for their particular business case.

So start small. Identify essential customer segments that would benefit most from channel-specific forecasting and create separate forecasts for those channels. Once the benefits of this pilot program become apparent, it will justify additional investments in resources and personnel to facilitate full-fledged channel forecasting.

Most importantly, look for a robust digital planning solution capable of producing accurate channel-specific forecasts. The best planning platforms go even further than demand forecasting, helping wholesalers facilitate better collaboration with suppliers and customers, optimize end-to-end inventory planning, and even manage their workforce.

The thought of adopting new digital solutions or processes may give cost-conscious companies pause. But with prices climbing and competition stiffer than ever, wholesalers can’t afford not to embrace every cost-saving tool at their disposal.